The external factor has faded significantly, and the domestic market today witnessed a strong recovery in liquidity, even as FPT saw reduced trading. The breadth of stocks, index gains, and liquidity were well-aligned, indicating a consensus.

The earnings effect is becoming more apparent, creating differentiation and separation from peripheral information. Foreign investors continued to sell strongly but with little impact, confirming that yesterday’s negative movement was merely a “catch-up” reaction after the two-week Lunar New Year holiday.

FPT and bank stocks were the two main stimulants in today’s session. Domestic money continued to hold high expectations for FPT, buying back the volume sold by foreign investors and stabilizing the price. Even if FPT remains unstable, the positive sign is that other stocks are detached from this movement.

The banking group’s strong and fairly even recovery today also significantly supported the index, with 8 out of 10 codes being the best VNI pullers. Many bank codes recovered more than yesterday’s decline, showing a counter-reaction.

In terms of breadth, VNI’s rise was supported by a large number of stocks, confirming that the index’s gain was not limited to the pillar group. The spread of widespread price increases is always a sign of high consensus. In terms of liquidity, FPT’s trading decreased by more than 1k billion compared to yesterday, but the total matching value of HSX still slightly increased by 2% to over 13k billion. In fact, the rest of the market’s trading, excluding FPT, increased by more than 12% compared to yesterday.

About 27% of the number of stocks (traded today) in VNI rose by more than 2%, concentrating 33% of HSX floor trading value, which is the clearest evidence of proactive demand and impressive price efficiency.

Thus, the market is returning to its pre-holiday uptrend smoothly. Although global stock markets remain unstable, and the US policies are still unclear, the improved domestic sentiment will likely overshadow these external influences. There are no macro changes from day to day or week to week; only sentiment “reverses.”

Currently, money is flowing into the market, with an average of 13k billion/day in matching orders on the two exchanges, which is not a large number but still much better than in December last year.

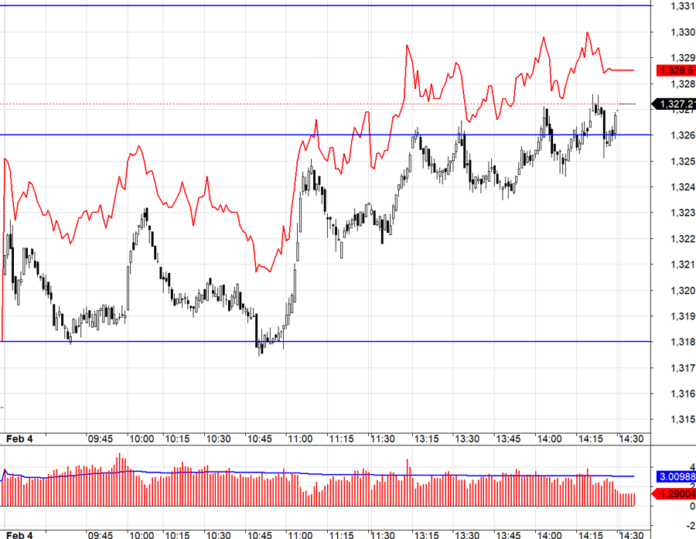

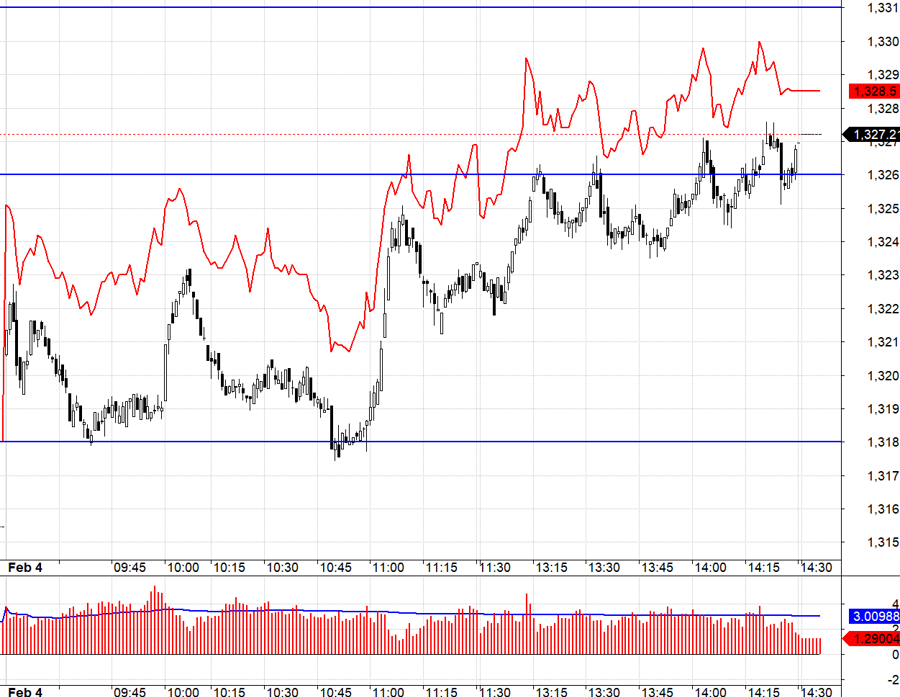

Today, the basis of the futures market remained relatively narrow for F1, which is advantageous for Long as it reduces the loss in case of a price increase. VN30 reacted very well to the 1318.xx mark, testing this level twice in the morning, and the basis of the second test was narrower, creating a standard Long setup. The subsequent upward momentum of the index was quite challenging, failing to surpass 1326.xx several times but continuously hugging this threshold and closing at any time.

With the return of bullish sentiment, the domestic market is likely to move against global trends as external influences wane. A further increase in money flow will be a robust signal. Currently, earnings results will create room for specific stocks to outperform the index. The strategy is to hold stocks and go Long in the futures market.

VN30 closed today at 1327.21. Tomorrow’s nearest resistances are 1331; 1338; 1348; 1357; 1362. Supports are at 1326; 1318; 1313; 1306; 1301.

“Blog chứng khoán” reflects the personal perspective of the investor and does not represent the views of VnEconomy. VnEconomy respects the author’s perspective and writing style and does not hold responsibility for issues related to the published evaluation and investment perspective.

The First Month of 2025: VN-Index Slips, Liquidity Hits 3-Year Low, Foreigners Keep Selling

The first month of the year witnessed a significant 23.4% decline in average trading values, bringing the figure to a meager 11.406 trillion VND. This places the monthly liquidity at a three-year low, a concerning development for the market.

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.

The Market Outlook: A Cautious Tone for the Short Term?

The VN-Index rebounded after testing the middle Bollinger Band, with trading volumes remaining below the 20-day average. This indicates a continued lack of liquidity in the market. Currently, the Stochastic Oscillator indicates a sell signal, and if the MACD follows suit in upcoming sessions, the risk of a correction will increase.