2024 saw an unprecedented growth in apartment prices in Vietnam, particularly in major cities such as Hanoi, Ho Chi Minh City, and Da Nang. The average increase ranged from 15-30%, with some areas even recording a record-breaking 50% surge compared to the same period last year, sparking a real estate market frenzy.

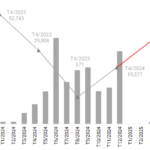

In Hanoi, apartment prices are reaching all-time highs. In the third quarter of 2024, the average price of a newly opened apartment in Hanoi reached VND 70 million per square meter (excluding VAT and maintenance fees), a whopping 75% increase compared to the first quarter of 2022. And this upward trend is predicted to continue into 2025.

Apartments priced below VND 50 million per square meter have almost entirely disappeared from the market, and projects below VND 60 million per square meter have become a rarity.

A report by the Vietnam Real Estate Brokers Association (VARS) highlighted the shock among the population as real estate prices keep soaring, likening it to waves, with each wave higher than the last.

“Many people with a genuine need for housing are missing out on opportunities to acquire property. Many young people have not even had the chance to commit to the goal of buying a home, already considering it a far-fetched dream,” VARS pointed out the existing reality.

“Set realistic goals and have a clear financial plan. If you want to buy a house, start saving early,”

Regarding this situation, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared his opinion that it is a fact that young people have always found it challenging to buy a house, not just the youth of today.

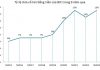

“In 2004, an individual from the 7X generation would have needed about 31.3 years of income to purchase a 60-square-meter apartment worth VND 600 million, with a deposit interest rate of 7.4%. Ten years later, an individual from the 8X generation would have needed 22.7 years of income to buy the same apartment. The apartment price had increased to VND 1.5 billion, while the deposit interest rate dropped to 6%.

By 2024, a 9X individual would require 25.8 years of income to purchase the same apartment (now worth VND 3 billion) with a deposit interest rate of 4.5%. Although the number of years of income and interest rates have gradually decreased over time, young people from these generations still need to work hard for an extended period to achieve homeownership,” Mr. Nguyen Quoc Anh assessed.

On the reason why the keyword “young people struggle to buy a house” has gained widespread attention from the public recently, the Deputy General Director of Batdongsan.com.vn attributed it to GenZ being born and raised in the digital age. There are now countless means to share information and stories.

In contrast, it was incredibly challenging to create such a massive wave of public opinion in previous eras. This is the primary reason why the issue of young people struggling to buy homes in big cities has become a widely discussed topic.

Additionally, the mindset and expectations of young people regarding early homeownership have also contributed to the heated discussions around this topic.

Mr. Quoc Anh shared: “Many young people aspire to own a home in the city center immediately, even though their income may not be high enough, or they may not have saved enough capital. On the other hand, it is understandable if they feel that their dream is ‘out of reach’ if they only consider apartments in the city center or extremely expensive areas.

However, there are actually many affordable housing options if they are willing to look beyond the city center and explore developing projects, which offer lower prices compared to completed properties,” he added.

So, what can young people do to turn their dream of owning a home in a big city into a reality? According to Mr. Nguyen Quoc Anh, they first need to change their mindset and instead of complaining about not being able to buy a house, they should focus on increasing their income.

“Set realistic goals and have a clear financial plan. If you want to buy a house, start saving early, and look for ways to increase your income and optimize your spending. Utilizing financial tools such as mortgage loans can be a solution, but make sure to carefully consider your debt repayment ability to avoid financial strain.

Third, take advantage of government support policies or special loan programs for young homebuyers. Currently, home loan interest rates have dropped to 4.5-6% in some periods, making it easier for young people to access financing,” shared Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn.