Liquidity decreased this morning, but demand for high-priced goods improved. The banking stock group helped VN-Index recover strongly, surpassing the 1260 mark. The blue-chips that were heavily sold off yesterday mostly recovered positively, allowing mid-cap and small-cap groups to surge. Only foreign investors remained persistent in their net selling, focusing on FPT and VNM.

VN-Index rose early and closed the morning session near its highest level, reaching 1260.98 points, up 7.95 points (+0.63%) from the reference level. The breadth was quite impressive, with 287 gainers and 130 losers, including 110 stocks rising more than 1%.

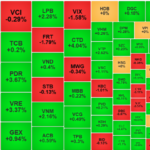

The VN30 basket contributed 11 stocks to the top gainers in the aforementioned market, but these were blue-chips capable of pulling the index higher. Especially in the banking group, except for LBP, which fell slightly by 0.14%, and SSB, which remained unchanged, the rest recorded gains. In terms of magnitude, the five strongest stocks in the VN30 basket were all banks: CTG rose 3.68%, STB increased by 2.05%, TPB gained 1.86%, VIB climbed 1.74%, and MBB advanced by 1.59%.

Unfortunately, among these banking stocks, only CTG belongs to the top 10 capitalization group. Nevertheless, TCB also performed well, rising by 1.24%, while VPB and BID increased by 1.08% and 1.14%, respectively. The impact of the banking group was notable for the VN-Index, as out of the 10 stocks leading the index, eight were from the banking sector. The remaining two were HPG, which climbed by 1.33%, and MSN, which rose by 1.03%.

The VN30-Index closed the morning session with a 0.6% gain, comprising 19 gainers and seven losers. FPT, the stock in focus during yesterday’s trading session, rebounded slightly. However, selling pressure remained strong, pushing FPT down by 0.14% at times. Moreover, the recovery effort was hindered, as the stock’s best performance of 0.89% slipped, and it eventually closed just 0.07% higher. Foreign investors sold nearly 1.19 million FPT shares, accounting for approximately 40% of the total trading volume of this stock. The net selling value reached VND115.5 billion.

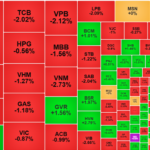

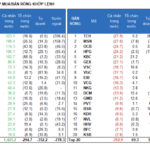

Thanks to the recovery efforts of the blue-chip group, led by banking stocks, the mid-cap and small-cap groups benefited significantly. Out of the 110 stocks on the HoSE that rose more than 1%, the VN30 basket contributed only 11. Of course, banking stocks outperformed in terms of liquidity within this group, but several mid-cap and small-cap stocks also made a strong impression. Notable mentions include VCG, which rose 2.74% with a matching volume of VND145.3 billion; HHV, which climbed 2.8% with a volume of VND139 billion; PAN, which increased by 5.69% with a volume of VND112.8 billion; CTD, which gained 6.96% with a volume of VND105.4 billion; CSV, which rose 3.6% with a volume of VND91.1 billion; and DBC, which advanced by 2.33% with a volume of VND82.6 billion…

If we focus solely on price, there are numerous strong mid-cap and small-cap stocks. APG, VPG, OGC, and QCG hit the ceiling price. KSB, DLG, GEE, BFC, TEG, EVF, AGG, CSM, and TCD rose more than 3%. Both the Midcap and Smallcap indices outperformed the VN30-Index, climbing 0.69% and 0.79%, respectively.

The recovery of blue-chip stocks this morning was not surprising, as the market’s first trading session after the holiday break typically reflects a temporal response to international developments. Yesterday’s differentiation remained relatively positive, and mid-cap and small-cap stocks were largely unaffected, with many even moving against the broader market trend. This morning, as the overall market “warmed up,” mid-cap and small-cap stocks continued their upward momentum.

Thus, market sentiment has stabilized rather quickly. In reality, international influences have not shown any direct negative impact on Vietnam so far, and the USD-Index is currently undergoing a downward adjustment. The technology stock sector, which was most affected, has gradually regained balance. The positive fourth-quarter earnings reports from many businesses, showcasing impressive figures, are providing substantial support.

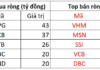

Foreign investors remain the sole negative factor, as they continue to sell off aggressively. However, the primary stocks being sold are still limited to a few, including FPT. Additionally, VNM also experienced substantial selling for the second consecutive session, with VND139.6 billion worth of shares sold in the morning session. Some other notable stocks on the selling side were SSI (-VND33.4 billion), FRT (-VND30.2 billion), VPB (-VND29.2 billion), DGC (-VND27.8 billion), VHM (-VND23.9 billion), and TCB (-VND20.5 billion). On the buying side, notable stocks included CTG (+VND54.7 billion), HPG (+VND33.9 billion), and MSN (+VND30.1 billion).

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.

The Foreign Sell-Off: A $1.4 Billion Rout Sends Blue-Chip Stocks Tumbling

The VN-Index remained lackluster in the afternoon session, but many resilient stocks gained strength. The index was heavily impacted by the drag of large-cap stocks, with the VN30-Index plunging to a 16-session low as foreign selling pressure weighed down on these stocks. FPT took a significant hit, evaporating 5.15% in value.

The Red-Hot Market: FPT in the Eye of the Storm, Foreign Outflows Galore

The investor community reacted rather negatively on the first trading session of the Year of the Wood Snake, as Vietnamese markets reopened after a two-week Lunar New Year holiday amidst a volatile international backdrop. The tech-heavy NASDAQ composite index fell sharply, and this was reflected in the performance of FPT Corporation, which faced the brunt of the selling pressure. The stock tumbled as global tech stocks experienced a broad-based decline, with the impact of this trend finally catching up to the Vietnamese market.

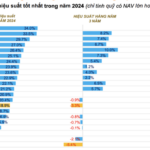

The Great Capital Exodus of 2024: Outperforming Equity Funds Still Double, Triple VN-Index Returns

Many stock funds recorded returns of up to over 30% in the past trading year, an impressive performance that outpaced the broader market.