|

Source: VietstockFinance

|

After a tumultuous trading session on February 6th, the VN-Index closed at 1,271.48, a gain of 1.87 points. Unlike the HOSE index, the two indices on the HNX witnessed more positive developments, with the HNX-Index climbing 1.15 points to reach 229.13, maintaining most of its morning gains, while the UPCoM index continued its upward trajectory, ending the day at 96.74, up by 0.84 points (nearly 1%).

On the VN-Index, the stock that contributed the most points was TCB, with nearly 0.9 points, slightly lower than its contribution of over 1 point during the morning session. This was followed by a string of other bank stocks such as LPB, VCB, BID, HDB, CTG, and MBB.

In terms of growth rate, the automotive and components sector witnessed the strongest performance, achieving a 3.53% yield. This was driven by the “giant” tire manufacturer, CSM, which soared by 7%, along with a 3.21% increase for DRC, a 1.06% rise for the rubber stock BRC, and a 7% jump for the automobile stock TMT. Following closely was the household and personal goods sector, which climbed by 3.5%, propelled by LIX‘s 4.6% gain, NET‘s 2.72% increase, and PGN‘s 4.48% surge.

The market also observed five sectors that rose by more than 1%, including insurance (up 1.73%), hardware (up 1.46%), pharmaceuticals and biotechnology (up 1.31%), consumer services (up 1.28%), and consumer and decorative goods (up 1.03%).

On the flip side, only four sectors witnessed declines, with specialized services and commerce experiencing the steepest drop in the market, albeit a modest 0.71% fall. However, the real estate sector appeared on the decline list, exerting a tad more pressure on the market despite a mere 0.09% slip.

The real estate sector displayed a mixed performance, with a range of stocks dipping in price, such as VHM falling by 0.13%, VRE dropping by 0.89%, DXG declining by 1.62%, NLG slipping by 1.29%, and CEO decreasing by 2.21%… Conversely, VIC rose by 1%, while SNZ climbed by 1.79%…

Today’s market liquidity was recorded at nearly VND 14,529 billion, not differing significantly from recent levels.

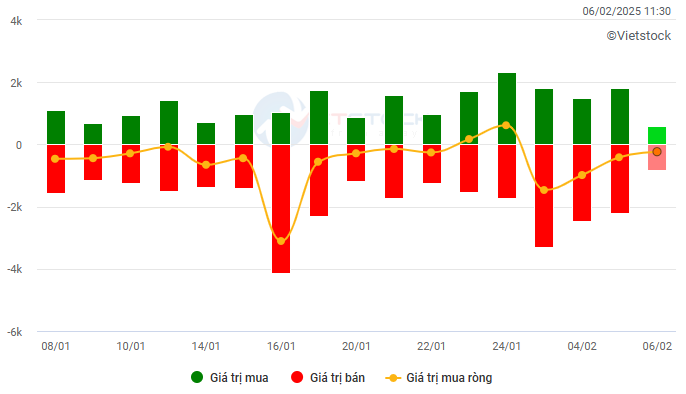

Foreign investors continued their net selling streak for the fourth consecutive session, offloading over VND 405 billion worth of shares. This also marked their persistent net selling trend over the past several months.

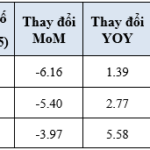

| Foreign Investors’ Net Buying/Selling Activity |

The stock that witnessed the heaviest net sell-off today was VNM, with a net outflow of over VND 73 billion, followed by FRT at nearly VND 60 billion, and MWG at over VND 50 billion. On the buying side, CTG topped the market with net purchases of over VND 60 billion, followed by PC1 at more than VND 46 billion.

According to several experts’ assessments, foreign investors’ net selling trend may persist, and a return to balance or net buying is not expected until the second or third quarter at the earliest.

Morning Session: VN-Index Recovers Slightly After Touching Reference Level

Facing substantial pressure and even dipping close to the reference level at 11:00 AM, the VN-Index demonstrated resilience by staging a mild recovery to close the morning session at 1,272.15 points, a gain of 2.54 points. Overall, the upward momentum was significantly curbed compared to the early morning session, with the index even surpassing the 1,275-point level at one point.

Source: VietstockFinance

|

In contrast, the HNX-Index and UPCoM indices displayed unwavering strength, with the HNX-Index ending the morning session up 1.04 points at 229.02, while UPCoM climbed 0.45 points to 96.35.

The market witnessed 372 advancing stocks, including 32 stocks that hit the ceiling price, such as MSR, KSV, KCB, MTA, and HGM from the materials sector; TCL, TCW, ICN, DFF, and SAC from the industrial sector; and OCH and TFC from the essential consumer goods sector…

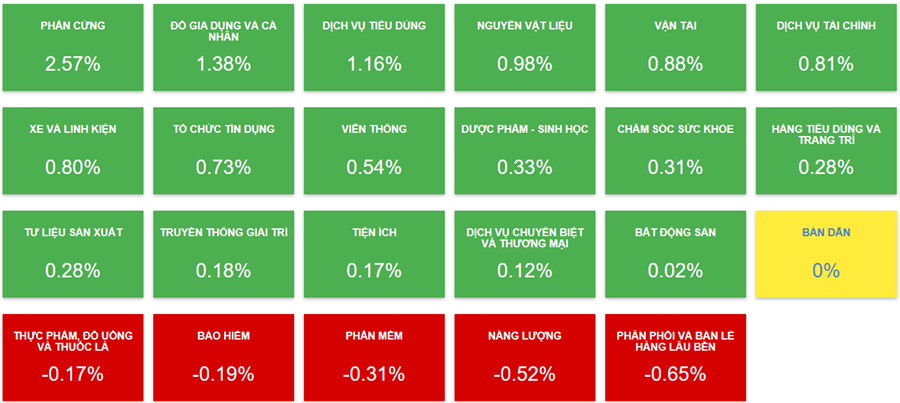

In terms of sectors, hardware, household and personal goods, and consumer services were the top three performers in the morning session, rising by 2.57%, 1.38%, and 1.16%, respectively. However, these sectors hold relatively smaller capitalization weights.

In reality, the large-cap sectors are witnessing decent gains, including banks, which climbed by 0.73%, and securities, which rose by 0.81%, while real estate inched up by 0.02%.

|

The Number of Advancing Sectors Outnumbered the Declining Ones

Source: VietstockFinance

|

Market liquidity improved compared to recent sessions, recording nearly 363 million shares traded, equivalent to a value of nearly VND 7.8 trillion.

In this context, foreign investors adopted a cautious stance, buying nearly VND 581 billion worth of shares and selling over VND 815 billion, resulting in a net sell-off of nearly VND 235 billion. The stocks that witnessed the heaviest net selling pressure were MWG, with over VND 34 billion, FRT, with nearly VND 33 billion, and DGC, with almost VND 29 billion. On the buying side, CTG led the market with net purchases of over VND 39 billion, outpacing the stocks that followed. Prior to today’s trading session, foreign investors had net sold for three consecutive sessions.

|

Foreign Investors Displayed Caution During the Morning Session

Source: VietstockFinance

|

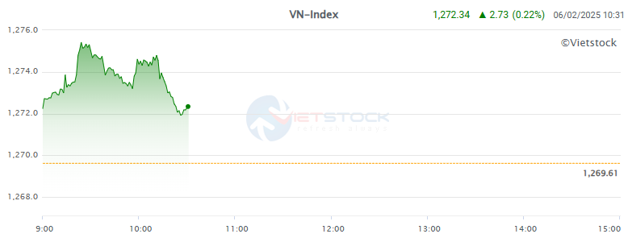

10:30 AM: Entering a Correction Phase After Initial Euphoria

Following an initial euphoric phase, the VN-Index started encountering headwinds and corrected to the 1,272.34-point level, marking a gain of 2.73 points as of 10:30 AM.

Source: VietstockFinance

|

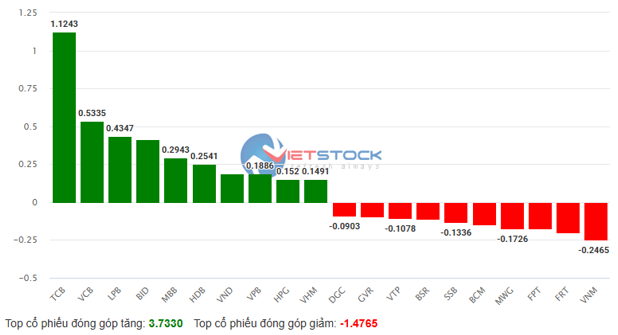

The banking group continued to dominate the market, with seven stocks out of the top ten positively impacting the VN-Index. Leading the pack was TCB, contributing more than 1.1 points, followed by VCB, LPB, BID, MBB, HDB, and VPB. Collectively, these top ten stocks added over 3.7 points to the index.

Additionally, several stocks outside the top ten also recorded impressive gains and attracted significant attention, such as MSR, which soared by 15%, and TCL, which surged by 7%…

On the opposite end, the top ten stocks with negative impacts subtracted nearly 1.5 points from the index, led by VNM, FRT, FPT, and MWG…

|

Top Stocks Influencing the VN-Index

Source: VietstockFinance

|

In terms of sector performance, banking, despite a modest 0.67% gain, exerted significant influence due to its massive capitalization. Another large-cap sector, securities, climbed by 0.95%.

The sector that witnessed the strongest performance as of 10:30 AM was hardware, surging by 2.57%, driven by POT‘s 5.33% jump. Household and personal goods came in second, with a 1.39% increase, propelled by LIX‘s 0.32% rise and NET‘s 2.84% ascent.

Overall, the number of advancing sectors outnumbered the declining ones, with 16 sectors in the green and only six in the red, while one sector remained unchanged (semiconductors).

Opening: Green Dominance Across the Board

Echoing the positive sentiment in global stock markets, Vietnam’s stock market commenced the trading session on February 6th with a sea of green.

|

Green Predominated at the Opening Bell

Source: VietstockFinance

|

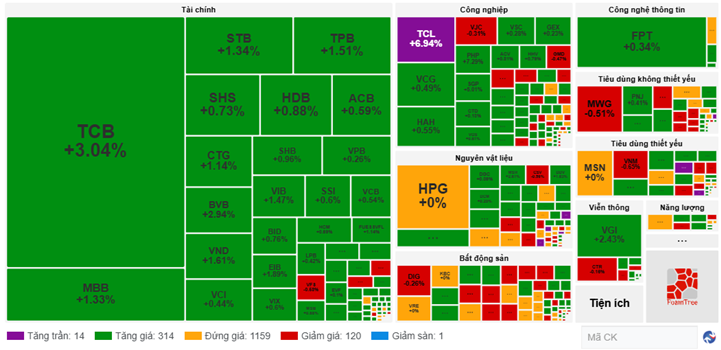

As of 9:30 AM, the VN-Index climbed 5.66 points to 1,275.27, the HNX-Index rose 1.13 points to 229.11, and the UPCoM-Index advanced 0.49 points to 96.39. Market liquidity reached over 69 million shares, equivalent to a value of more than VND 1.5 trillion.

Green dominated the market, with the banking group standing out as TCB jumped by 3.04%, MBB climbed by 1.33%, STB rose by 1.34%, TPB gained 1.51%, CTG increased by 1.14%, and BVB surged by 2.94%… Within the financial group, securities stocks also joined the rally, including VND, which rose by 1.61%, VCI, which climbed by 0.44%, and SSI, which advanced by 0.6%…

The market witnessed 328 advancing stocks, including 14 stocks that hit the ceiling price, notably TCL, which soared by 7%, and KSV, which spiked by 10%. Conversely, only 121 stocks declined, including one stock that plummeted to the floor price.

Vietnam’s stock market mirrored the upbeat sentiment in global markets. In Asia, major indices like the Nikkei 225, Shanghai Composite, and Singapore Straits Times posted solid gains.

Last night, US stocks also advanced, even as notable technology stocks like Alphabet and AMD tumbled following their earnings reports.

At the close of the trading session on February 5th, the Dow Jones index climbed 317.24 points (equivalent to 0.71%) to 44,873.28 points, led by the strong performance of Nvidia shares. The S&P 500 index added 0.39% to reach 6,061.48 points, while the Nasdaq Composite index inched up 0.19% to 19,692.33 points.

Thus, US stocks extended their gains for the second consecutive session as investors shrugged off the trade-related tensions that had weighed on the market earlier in the week.

– 09:46 06/02/2025