Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 505 million shares, equivalent to a value of more than 12.8 trillion VND; HNX-Index reached over 42.8 million shares, equivalent to a value of more than 698 billion VND.

VN-Index continued its tug-of-war state, although buying demand reappeared, selling pressure still dominated, causing the index to continue to weaken and close in the red. In terms of impact, FPT, VCB, BID, and TCB were the most negative-impact stocks, taking away more than 5.8 points from the index. On the other hand, GVR, HVN, BSR, and GEE were the most positive-impact stocks, contributing more than 1.3 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on February 3, 2025 |

In contrast, the HNX-Index had a rather optimistic performance, with the index positively impacted by stocks such as KSV (+1.94%), VGS (+10%), NVB (+1.12%), and PVI (+0.79%)…

|

Source: VietstockFinance

|

The information technology sector recorded the largest decline with a drop of 5.12%, mainly due to the performance of FPT (-5.15%), CMG (-4.88%), CMT (-4.91%), and ITD (-5.21%). This was followed by the telecommunications and financial sectors, which decreased by 3.43% and 1.11%, respectively. On the other hand, the energy sector witnessed the strongest recovery in the market, gaining 0.91% with green signals from CLM (+0.14%). The consumer discretionary sector also rebounded with a 0.39% increase, driven by buying interest in stocks like GEX (+3.96%), TCM (+0.24%), PNJ (+0.51%), and MSH (+0.58%)…

In terms of foreign trading activities, foreign investors returned to net sell on the HOSE with a value of more than 1,500 billion VND, focusing on stocks such as FPT (508.02 billion VND), VNM (315.23 billion VND), MWG (87.57 billion VND), and VND (76.75 billion VND). On the HNX exchange, foreign investors net bought slightly over 10 billion VND, mainly in SHS (37.91 billion VND), CEO (1.83 billion VND), LAS (700 million VND), and PLC (420 million VND).

| Foreign Trading Activities – Net Buy/Sell |

Morning Session: VN-Index Turns Red on the First Trading Day of the Year

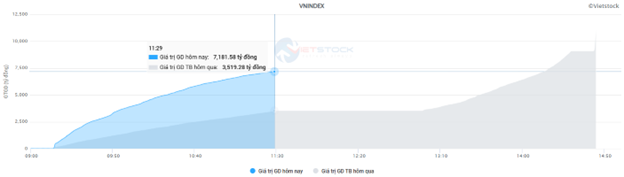

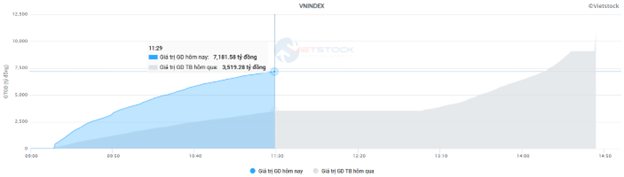

VN-Index remained weak amid significant pressure from large-cap stocks during the first trading session of the year. At the end of the morning session, the VN-Index decreased by 9.57 points, or 0.76%, to 1,255.48 points. Meanwhile, the HNX-Index slightly increased by 0.24% to 223.54 points. The positive sign was that the market breadth remained relatively balanced, with 327 declining stocks and 332 advancing stocks.

The strong selling pressure in large-cap stocks pushed the market’s liquidity higher in the morning session. The matching volume of the VN-Index reached over 287 million units, equivalent to a value of nearly 7.2 trillion VND, double the volume of the previous session. The HNX-Index recorded a matching volume of nearly 28 million units, with a value of nearly 425 billion VND.

Source: VietstockFinance

|

Red dominated most industry groups, with information technology and telecommunications recording the sharpest declines of 4.01% and 2.45%, respectively. This was mainly influenced by large-cap stocks in these sectors, such as FPT (-4.04%), CMG (-3.72%); VGI (-1.65%), FOX (-7.15%), and CTR (-3.72%).

The “king” stock group exerted considerable pressure on the overall market due to their large market capitalization, with stocks like ACB, STB, TCB, MBB, HDB, VIB, TPB, VPB, BID, LPB, and EIB falling by more than 1%. A few bright spots that went against the overall trend included SHB (+1.46%), BVB (+8%), NVB (+1.12%), and ABB (+1.41%).

On the other hand, the materials sector was the only group that managed to stay in the green, recording a modest gain of 0.77%. The positive performance was driven by chemical and construction material stocks, such as GVR (+2.95%), DCM (+1.79%), DPM (+1.45%), PHR (+1.54%), CSV (+2.13%), DDV (+2.26%), DPR (+1.33%); VGC (+1.61%), KSB (+1.58%), and BCC (+2.86%).

Foreign investors net sold strongly in the morning session, with a net selling value of over 856 billion VND across all three exchanges. FPT was the focus of selling pressure, witnessing net outflows of more than 315 billion VND, double the net selling value of the second-largest stock, VNM (154.66 billion VND). Meanwhile, no notable names emerged on the buying side, with SHS leading the net buying with a meager value of 30 billion VND.

10:45 am: Strong Selling Pressure in Large-Cap Stocks Influences the Market

Selling pressure continued to intensify, causing the major indices to weaken and exhibit mixed performances. As of 10:40 am, the VN-Index dropped by more than 10 points, hovering around 1,255 points. In contrast, the HNX-Index gained 0.34 points, trading around 223 points.

Most stocks in the VN30 basket faced strong selling pressure. Specifically, FPT, ACB, MWG, and TCB took away 7.37 points, 1.33 points, 1.33 points, and 1.31 points from the index, respectively. Conversely, SHB, HPG, GVR, and CTG were among the few stocks that managed to stay in positive territory, although their gains were not significant.

The information technology sector was the worst-performing group in the market, recording a decline of 4.3%. This was mainly due to selling pressure in two large-cap stocks, FPT and CMG, which fell by 4.37% and 4.46%, respectively.

The banking sector also witnessed a notable decline, with BID falling by 1.25%, VCB decreasing by 0.97%, TCB dropping by 1.21%, and VPB slipping by 1.59%…

Additionally, the industrial sector failed to maintain its early gains and turned red as selling pressure intensified. Specifically, selling pressure was observed in stocks like PVT (-1.34%), VTP (-3.76%), VJC (-1.8%), and GMD (-1.88%). On the other hand, a few stocks managed to stay in the green, including VCG (+2.03%), HHV (+1.63%), and ACV (+0.33%)…

Notably, the stock HAH witnessed a strong surge from the beginning of the trading session on February 3, 2025, accompanied by a trading volume exceeding its 20-session average, indicating the presence of optimistic investor sentiment. Currently, the stock continues its long-term uptrend and has reached a new 52-week high at the Fibonacci Projection 61.8% level (corresponding to the 51,400-53,000 range). If the uptrend is sustained and the stock successfully surpasses this level, the potential price target in the upcoming period is expected to be in the range of 55,500-56,000.

Source: https://stockchart.vietstock.vn/

|

In contrast, the materials sector was the only group that recorded a modest gain of 0.39%, along with strong divergence among its constituent stocks. Buying interest was observed in stocks like GVR (+1.74%), KSV (+3.13%), VGC (+1.61%), and DCM (+1.04%) … Meanwhile, selling pressure persisted in stocks such as HPG (-0.38%), DGC (-0.9%), VCS (-1.17%), and NTP (-1.64%) …

Compared to the opening, the selling side gained the upper hand. There were 337 declining stocks (including 4 stocks hitting the floor price) and 289 advancing stocks (including 18 stocks reaching the ceiling price).

Source: VietstockFinance

|

Opening: Information Technology Sector Unexpectedly Declines

The market opened on a negative note, with most industry groups trading in the red. In particular, the VN30 index had the most negative impact, as most of its constituent stocks fell.

Red dominated the VN30 basket, with 26 declining stocks, 3 advancing stocks, and 1 stock trading unchanged. Notably, SSB, FPT, and VIB were the worst-performing stocks in the group. On the other hand, GVR, SHB, and CTG were the top gainers.

As of 9:30 am, the information technology sector had the most negative impact on the market, recording a decline of 3.41%. This was mainly due to the poor performance of stocks like FPT (-3.32%), CMG (-4.88%), ITD (-2.43%),…

The telecommunications services sector also witnessed a sea of red, with most of its constituent stocks falling. Notable losers included VGI (-1.98%), CTR (-2.05%), ELC (-1.97%), TTN (-6.02%), FOX (-7.8%), and VNZ (-1.8%)…

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)