Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 356 million shares, equivalent to a value of more than 8.2 trillion VND; HNX-Index reached over 40 million shares, equivalent to a value of more than 626 billion VND.

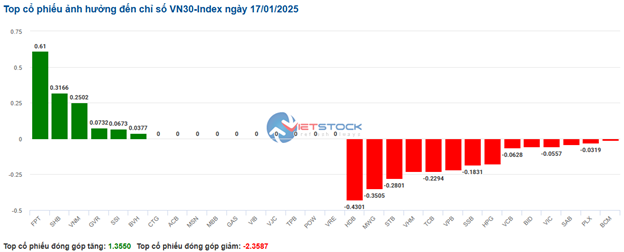

| Top 10 stocks with the strongest impact on the VN-Index on January 17, 2024 |

The VN-Index opened the afternoon session on a positive note, with continuous buying pressure causing the index to quickly break free from the tug-of-war and surge towards the end of the session. In terms of impact, TCB, FPT, HDB, and CTG were the most positive influences on the VN-Index, contributing over 3 points to the rise. On the other hand, VCB, SAB, MSN, and SJS faced strong selling pressure, but their impact on the index was not significant.

Similarly, the HNX-Index also witnessed a positive performance, driven by gains in KSV (+5.13%), PVS (+2.52%), CEO (+4.13%), and SHS (+2.52%)…

|

Source: VietstockFinance

|

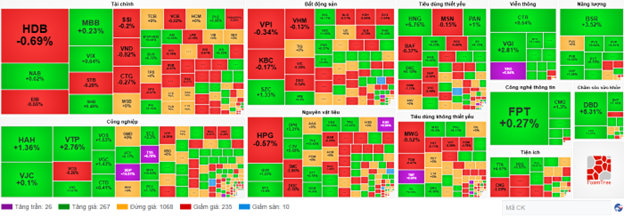

The telecommunications sector was the top-performing group in the market, surging 3.21%, led by ELC (+6.91%), MFS (+14.98%), YEG (+6.84%), and VGI (+3.28%). Following the recovery were the industrial and information technology sectors, rising 2.72% and 1.76%, respectively.

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, offloading stocks mainly in FPT (140.74 billion VND), STB (64.77 billion VND), VCB (57.65 billion VND), and CTG (35.73 billion VND). On the HNX exchange, foreign investors net sold over 6 billion VND, focusing on IDC (6.38 billion VND), CEO (2.12 billion VND), VCS (2.04 billion VND), and VTZ (1.62 billion VND).

| Foreign investors’ net buying/selling activities |

Morning Session: Market fluctuates as foreign investors continue net selling

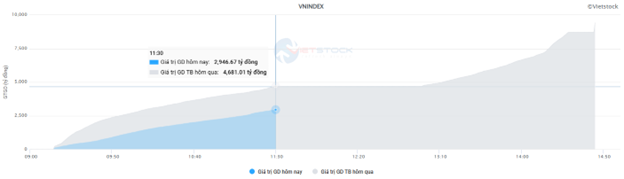

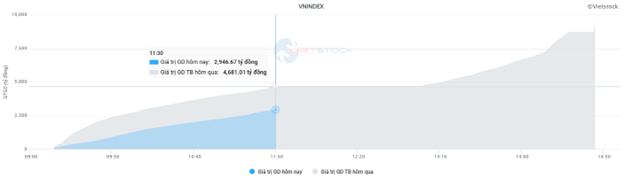

The market continued to fluctuate within a narrow range with low liquidity until the end of the morning session. At the midday break, the VN-Index hovered near the reference level, closing at 1,242.78 points. Meanwhile, the HNX-Index recorded a more positive performance, climbing 0.49% to 221.92 points. The number of gainers increased towards the end of the morning session, with 313 stocks rising and 253 stocks falling.

Market liquidity remained subdued, with the VN-Index‘s matching volume in the morning session reaching just over 126 million units, equivalent to a value of nearly 3 trillion VND, a 37% decrease compared to the previous morning. Liquidity on the HNX exchange also decreased by more than 20%, with a matching volume of over 20 million units and a value of nearly 290 billion VND.

Source: VietstockFinance

|

In the first morning session after switching to listing on the HOSE exchange, BSR was the stock that contributed the most positively to the VN-Index, adding about half a point to the index. This was followed by FPT, GVR, and BVH, which also contributed nearly 1 point to the index. On the other hand, the most negative impacts came from BID, HPG, and SAB, although the impact was not significant.

The green dominated the sector performance, with three groups recording outstanding gains of over 2%, including energy, telecommunications, and industry. Many stocks in these sectors attracted strong buying interest, such as PVS (+2.2%), PVD (+2.44%), PVB (+1.49%); VGI (+2.7%), FOX (+2.94%), ELC (+2.5%), and YEG (+6.84%); ACV (+1.93%), VTP (+2.76%), PVT (+1.33%), and HAH (+0.97%).

On the other hand, the remaining two groups, non-essential consumer goods and financials, were slightly in the red. This was influenced by stocks that were sold off with notable volumes, including MWG (-0.87%), PLX (-0.63%); HDB (-0.69%), EIB (-0.55%), BID (-0.51%), and VND (-0.41%), among others.

Foreign investors continued net selling amid weak buying interest, with no stock recording net buying of over 10 billion VND in the morning session. Net selling value in the morning session exceeded 400 billion VND on the HOSE exchange, concentrated mainly in FPT (51.76 billion VND) and HPG (48.64 billion VND). On the HNX exchange, foreign investors net sold nearly 9 billion VND by the end of the morning session, with the strongest selling pressure on IDC (4.25 billion VND).

10:40 am: Financials and real estate sectors witness mixed performance amid low liquidity

Investor caution led to a decline in trading volume, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index edged up 0.12 points, hovering around 1,242 points. The HNX-Index gained 0.46 points, trading around 221 points.

Stocks in the VN30 basket were mostly in the red due to selling pressure, with notable losers including HDB, down 0.43 points, MWG, down 0.35 points, STB, down 0.28 points, and VHM, down 0.23 points. Conversely, FPT, SHB, VNM, and GVR were among the few stocks that maintained a positive performance, contributing over 1 point to the overall index.

Source: VietstockFinance

|

The financial sector exhibited mixed performance, with both gainers and losers. Specifically, on the downside, HDB fell 0.92%, STB declined 0.42%, VND dropped 0.82%, and CTG decreased 0.27%… Conversely, VIX rose 0.85%, SHB climbed 0.99%, MBB advanced 0.23%, and BVH gained 1.17%…

The real estate sector also witnessed a mixed performance, with gainers including SZC, up 1.45%, TIG, up 0.78%, HDG, up 0.92%, and VRE, up 0.3%. Meanwhile, losers included VPI, down 1.7%, VHM, down 0.25%, VIC, down 0.12%, and DXG, down 0.34%.

A more optimistic performance was observed in the telecommunications sector, which recorded its second consecutive day of gains, with a positive increase of over 3%. Buying interest was concentrated mainly in CTR, up 0.54%, YEG, up 6.84%, VGI, up 2.93%, and MFS, up 11.34%…

Compared to the opening, the number of stocks trading at the reference level continued to dominate, with over 1,000 stocks, and buyers slightly outnumbering sellers. There were 267 gainers and 235 decliners.

Source: VietstockFinance

|

Opening: Caution prevails at the start of the session

At the opening of the January 17 session, as of 9:30 am, the VN-Index edged lower and fluctuated around the reference level, hovering near 1,240 points. In contrast, the HNX-Index recorded a slight increase, maintaining the 221.38-point level.

The S&P 500 index declined on Thursday (January 16), snapping a three-day winning streak, as large technology stocks retreated. At the close of the January 16 session, the S&P 500 index fell 0.21% to 5,937.34 points. The Nasdaq Composite lost 0.89% to 19,338.29 points. The Dow Jones index dropped 68.42 points (equivalent to 0.16%) to 43,153.13 points.

The red dominated the VN30 basket, with 21 decliners, 5 gainers, and 4 stocks trading at the reference level. Among them, PLX, HDB, and MSN were the top losers. Conversely, SHB, VNM, and GVR were the top gainers.

As of 9:30 am, the energy sector was the top contributor to the market’s performance. Notable gainers in this sector included PVB, up 3.28%, PVS, up 0.63%, and PSB, up 1.64%…

– 09:38 17/01/2025

Stock Market Week of January 20-24, 2025: The Return of Optimism

The VN-Index witnessed a robust increase, staying above the 200-day SMA, with trading volume indicating a recovery. This reflects an improvement in investor sentiment, suggesting a shift towards optimism. However, continued foreign selling may dampen the index’s growth prospects in the near future.

The Stock Market Week of February 3-7, 2025: Foreigners Continue to Sell

The VN-Index sustained a positive upward trajectory with consecutive sessions in the green last week. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating a resurgence in investor activity. However, the index faces a challenge as foreign investors have been net sellers for a prolonged period, with relatively large transaction values. Should this trend persist, it could significantly impact the index’s growth prospects in the near future.

Market Beat 22/01: Stuck in a Tug-of-War, VN-Index Hovers Around 1,245 Points

The market closed with the VN-Index down 3.56 points (-0.29%) to 1,242.53, while the HNX-Index fell 1.01 points (-0.46%) to 220.67. The market breadth tilted towards decliners with 422 losers and 286 gainers. Notably, the large-cap stocks in the VN30-Index witnessed a dominant red hue, recording 24 decliners, 3 advancers, and 3 stocks unchanged.

“Vietstock Weekly: A Cautious Short-Term Outlook”

The VN-Index rallied and recovered after a steep decline in previous weeks. The index also rose above the 200-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of positive momentum in market participation. At the moment, the MACD indicator is signaling a sell-off and has crossed below the zero threshold, suggesting that the short-term outlook remains bearish.

The Caution Quotient Rises

The VN-Index declined, slipping further below the Middle Bollinger Band. This downward movement, coupled with trading volumes remaining below the 20-day average, indicates a cautious sentiment among investors. However, the MACD indicator offers a glimmer of hope as it narrows its gap with the Signal Line, suggesting a potential buy signal in upcoming sessions. Should this materialize, it would alleviate concerns of an immediate short-term correction.