I. VIETNAMESE STOCK MARKET WEEKLY REVIEW: JANUARY 20-24, 2025

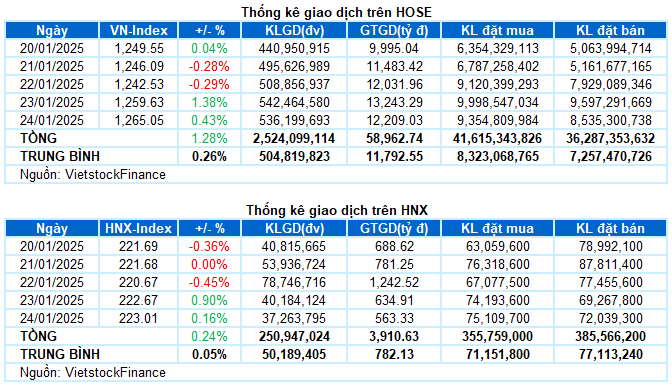

Trading: The main indices gained during the last trading day of the Year of the Dragon. At the close on January 24th, the VN-Index was up 0.43% from the previous session, reaching 1,265.05 points; the HNX-Index rose 0.16% to 223.01 points. For the week, the VN-Index climbed a total of 15.94 points (+1.28%), while the HNX-Index edged up 0.53 points (+0.24%).

The Vietnamese stock market continued its recovery trend during the final trading week of the year, despite low liquidity as investors prepared for the upcoming holidays. However, not all sectors benefited, as money flow remained polarized. With the Q4 2024 earnings picture of companies gradually taking shape, this is expected to be the main factor influencing market psychology and investment strategies in the first trading weeks of the new year.

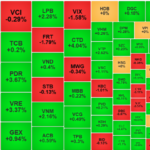

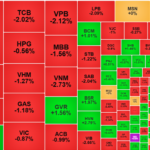

In terms of impact, MSN, GAS, and LPB were the stocks that contributed most positively to the VN-Index in the last session, adding nearly 2 points. In contrast, the top 10 stocks with the most negative influence took away just over 1 point, led by FPT with a 0.3-point drop.

Most sectors ended the year in the green. The most notable gains were in utilities and consumer staples, with many stocks making impressive breakthroughs, such as GAS (+1.34%), MSN (+3.98%), MCH (+1.69%), HNG (+5.33%), FRT (+3.78%), MWG (+1.52%), DGW (+1.2%), TLG (+5.18%), GIL (+3.17%), and GEX and GEE, which hit the ceiling price.

On the other hand, the remaining three sectors that ended in the red were energy, information technology, and telecommunications, mainly due to strong selling pressure from large-cap stocks in these industries, including BSR (-0.98%), PVS (-1.2%); FPT (-0.58%), CMG (-0.84%); and CTR (-1.35%), FOX (-2.01%), and YEG (-6.43%).

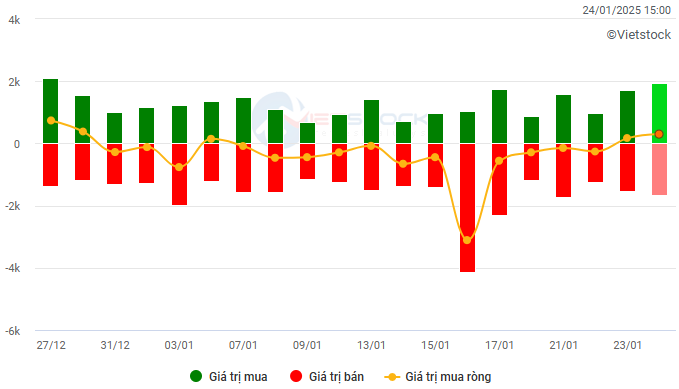

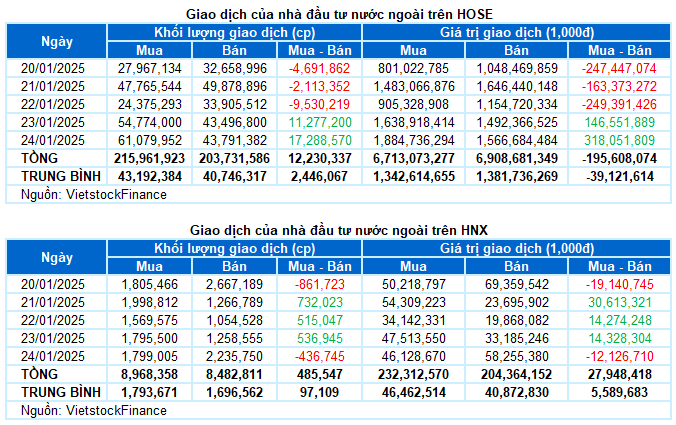

Foreign investors significantly reduced their selling activity, with net selling value falling to nearly VND 168 billion on both exchanges last week. Specifically, they net sold nearly VND 196 billion on the HOSE and net bought nearly VND 28 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

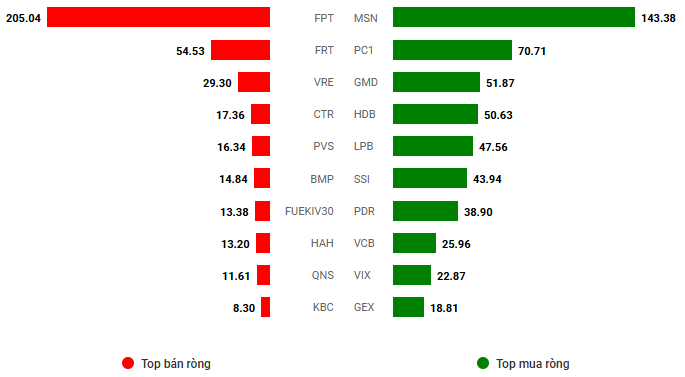

Net trading value by stock code. Unit: VND billion

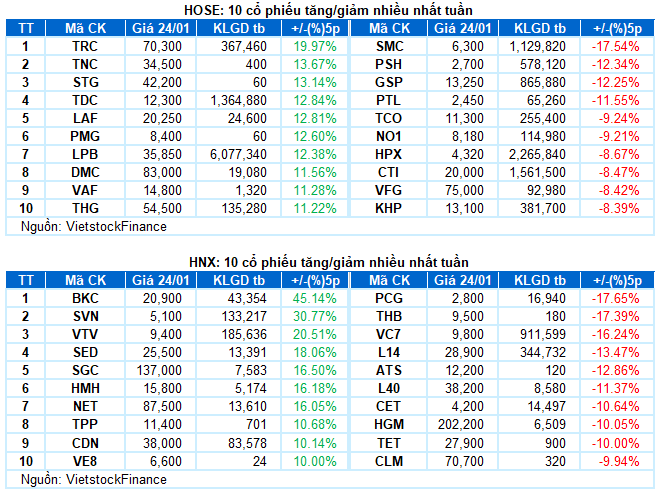

Stocks that increased significantly last week: TRC

TRC rose 19.97%: TRC had a brilliant trading week, surging 19.97%. The stock continuously soared while closely following the upper band of the expanding Bollinger Bands, indicating a very optimistic outlook. However, trading volume showed signs of declining and even fell below the 20-day average in the last session of the week, suggesting that investors are becoming cautious again.

Currently, the Stochastic Oscillator indicator has given a sell signal in the overbought zone. This suggests that the risk of a correction will increase if the indicator falls out of this zone.

Stocks that decreased significantly last week: SMC

SMC fell 17.54%: SMC experienced a rather negative trading week, continuously dropping with a sharp increase in trading volume in the last two sessions. This reflects strong selling pressure on this stock.

At present, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This indicates that the risk of short-term adjustments remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic and Market Strategy Division, Vietstock Consulting

– 17:15 24/01/2025

The Stock Market Week of February 3-7, 2025: Foreigners Continue to Sell

The VN-Index sustained a positive upward trajectory with consecutive sessions in the green last week. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating a resurgence in investor activity. However, the index faces a challenge as foreign investors have been net sellers for a prolonged period, with relatively large transaction values. Should this trend persist, it could significantly impact the index’s growth prospects in the near future.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.

The Foreign Sell-Off: A $1.4 Billion Rout Sends Blue-Chip Stocks Tumbling

The VN-Index remained lackluster in the afternoon session, but many resilient stocks gained strength. The index was heavily impacted by the drag of large-cap stocks, with the VN30-Index plunging to a 16-session low as foreign selling pressure weighed down on these stocks. FPT took a significant hit, evaporating 5.15% in value.

The Red-Hot Market: FPT in the Eye of the Storm, Foreign Outflows Galore

The investor community reacted rather negatively on the first trading session of the Year of the Wood Snake, as Vietnamese markets reopened after a two-week Lunar New Year holiday amidst a volatile international backdrop. The tech-heavy NASDAQ composite index fell sharply, and this was reflected in the performance of FPT Corporation, which faced the brunt of the selling pressure. The stock tumbled as global tech stocks experienced a broad-based decline, with the impact of this trend finally catching up to the Vietnamese market.

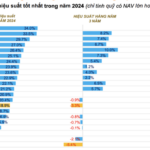

The Great Capital Exodus of 2024: Outperforming Equity Funds Still Double, Triple VN-Index Returns

Many stock funds recorded returns of up to over 30% in the past trading year, an impressive performance that outpaced the broader market.