I. MARKET ANALYSIS OF STOCKS ON JANUARY 22, 2025

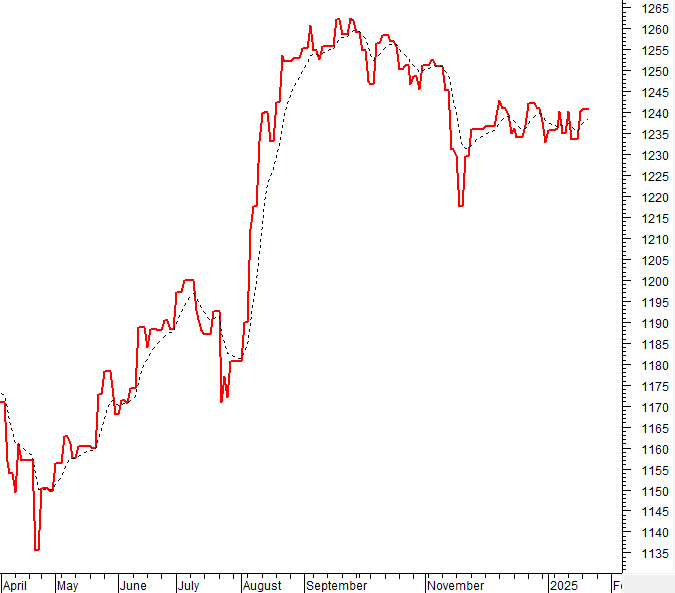

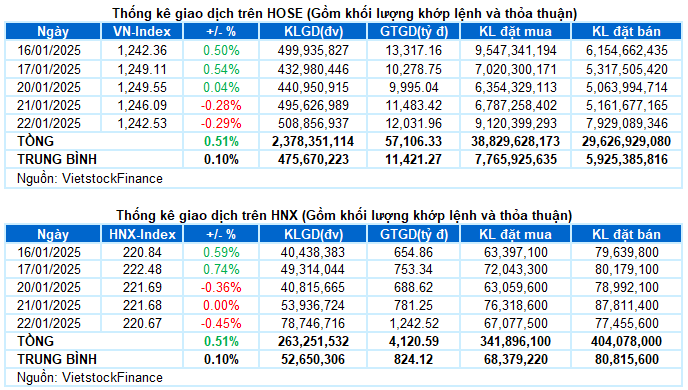

– The main indices continued to fall during the trading session on January 22, with the VN-Index closing 0.29% lower at 1,242.53 points, and the HNX-Index dropping by 0.45% to 220.67 points.

– The trading volume on the HOSE exceeded 400 million units, a slight increase of 5.5% compared to the previous session. In contrast, the trading volume on the HNX decreased by 13.5%, reaching over 39 million units.

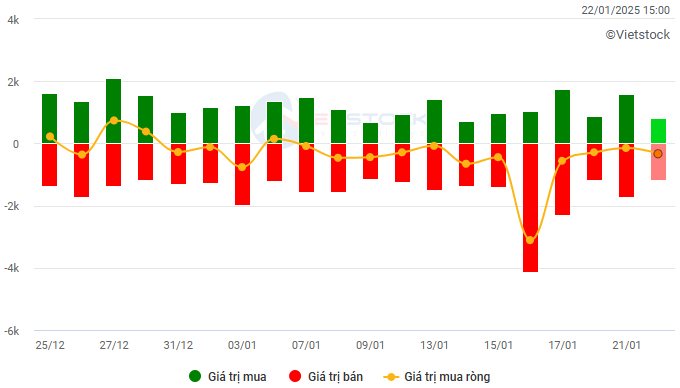

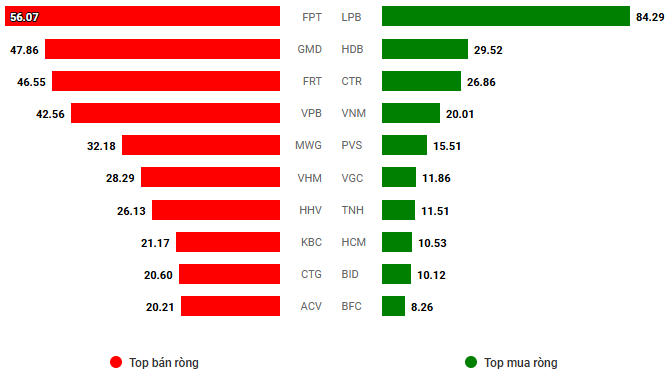

– Foreign investors continued to sell off on the HOSE, with a net sell value of nearly VND 325 billion, while they net bought over VND 14 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market fluctuated within a narrow range on low liquidity throughout the session on January 22. The momentum for the market to break through in the last trading days of the year was almost non-existent, while large funds stayed on the sidelines and the demand for restructuring portfolios before the Tet holiday was slightly higher. Stronger selling pressure towards the end of the day caused the VN-Index to lose 3.56 points, closing at the 1,242.53 level.

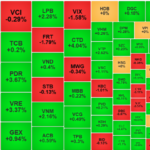

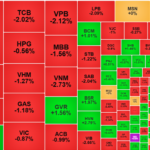

– In terms of impact, HDB, BID, and VHM were the biggest drags on the market today, taking away 1.5 points from the VN-Index. Meanwhile, the standout performance of LPB, despite contributing over 1 point to the gain, was not enough to counter the pressure from the rest of the market.

– The VN30-Index retreated to 1,309.72 points, a drop of more than 5 points from the previous day. The sellers dominated with 24 declining stocks, 3 advancing stocks, and 3 stocks unchanged. Among them, HDB and BVH had a challenging trading day, ranking at the bottom with decreases of 2.9% and 2.5%, respectively. On the other hand, 3 stocks managed to stay in the green, including SSB, STB, and SAB.

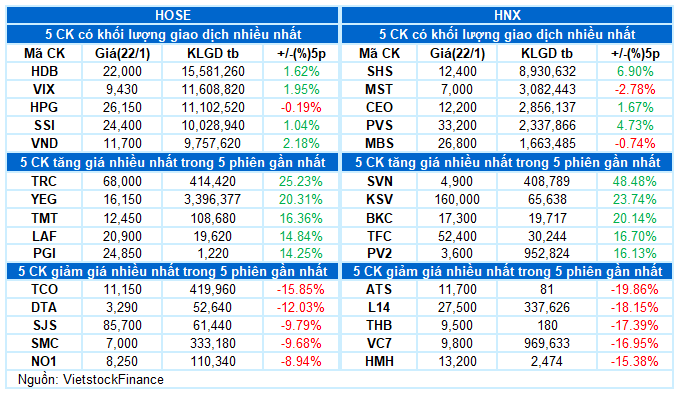

Most sectors showed mixed performances, with both increases and decreases. The most notable highlight today was the telecommunications group, especially the strong breakthrough of VGI (+3.48%), CTR (+4.21%), FOX (+2.44%), FOC (+2.86%), and YEG, which hit the daily limit-up.

In the financial group, apart from the outstanding performance of LPB (+4.87%) and SSB (+1.63%), the remaining stocks were mostly dragged down by the red color, plunging significantly with notable liquidity, including HDB (-2.87%), EIB (-1.38%), VND (-2.09%), BVH (-2.5%), and VIX (-1.57%).

The materials sector recorded the most negative performance today, with many stocks falling by more than 1%, such as HSG, NKG, DPM, DCM, GVR, PTB, PLC, KSB, etc.

The VN-Index fell and continued to drop below the Middle line of the Bollinger Bands. Additionally, the trading volume remained below the 20-day average, reflecting investors’ cautious sentiment. At present, the MACD indicator is likely to give a buy signal again as it gradually narrows the gap with the Signal Line. If this happens in the coming sessions, the risk of short-term corrections will be reduced.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Fell Below the Middle Line of the Bollinger Bands

The VN-Index fell and continued to drop below the Middle line of the Bollinger Bands. Additionally, the trading volume remained below the 20-day average, reflecting investors’ cautious sentiment.

At present, the MACD indicator is likely to give a buy signal again as it gradually narrows the gap with the Signal Line. If this happens in the coming sessions, the risk of short-term corrections will be reduced.

HNX-Index – Stochastic Oscillator Still Maintains a Buy Signal

The HNX-Index declined for three consecutive sessions recently, with trading volume fluctuating around the 20-day average, indicating investors’ unstable sentiment.

Currently, the Stochastic Oscillator indicator still maintains a buy signal. If, in the coming period, the MACD indicator also gives a similar signal, the risk of corrections will be reduced.

Analysis of Money Flow

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of the VN-Index cut above the EMA 20 line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of Foreign Capital Flow: Foreign investors continued to sell off during the trading session on January 22, 2025. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

III. MARKET STATISTICS ON JANUARY 22, 2025

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 17:25 22/01/2025

“Banking Stocks Rebound: Foreign Investors Still Dumping FPT and VNM”

Liquidity weakened this morning, but demand for high-priced stocks remained robust. The banking sector played a pivotal role in the VN-Index’s impressive recovery, surging past the 1260-point mark. Most of the blue-chips that experienced heavy selling yesterday staged a strong rebound, paving the way for a more vigorous rally in the mid and small-cap segments. Notably, foreign investors persisted in their net selling activities, focusing their attention on FPT and VNM.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.

The Foreign Sell-Off: A $1.4 Billion Rout Sends Blue-Chip Stocks Tumbling

The VN-Index remained lackluster in the afternoon session, but many resilient stocks gained strength. The index was heavily impacted by the drag of large-cap stocks, with the VN30-Index plunging to a 16-session low as foreign selling pressure weighed down on these stocks. FPT took a significant hit, evaporating 5.15% in value.

The Red-Hot Market: FPT in the Eye of the Storm, Foreign Outflows Galore

The investor community reacted rather negatively on the first trading session of the Year of the Wood Snake, as Vietnamese markets reopened after a two-week Lunar New Year holiday amidst a volatile international backdrop. The tech-heavy NASDAQ composite index fell sharply, and this was reflected in the performance of FPT Corporation, which faced the brunt of the selling pressure. The stock tumbled as global tech stocks experienced a broad-based decline, with the impact of this trend finally catching up to the Vietnamese market.