Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 495 million shares, equivalent to a value of more than 11.1 trillion VND; HNX-Index reached nearly 36.8 million shares, equivalent to a value of more than 547 billion VND.

VN-Index opened the afternoon session on a positive note as buying power continued to appear, helping the index recover and maintain its optimistic green color until the end of the session. In terms of impact, MSN, GAS, LPB, and GVR were the codes with the most positive impact on the VN-Index, with an increase of over 2.1 points. On the contrary, FPT, HPG, BSR, and HVN were still under selling pressure, but the impact was not significant.

| Top 10 stocks with the strongest impact on the VN-Index on January 24th |

HNX-Index followed a similar trend, with the index positively impacted by the codes VNR (+5%), BAB (+1.69%), CDN (+3.26%), NTP (+1.33%), etc.

|

Source: VietstockFinance

|

The utilities sector was the group with the strongest increase, up 1.32%, mainly driven by the codes GAS (+1.34%), POW (+0.44%), TTA (+0.73%), and CNG (+0.32%). This was followed by the non-essential consumer and essential consumer sectors, with increases of 1.2% and 0.97%, respectively. On the other hand, the energy sector saw the largest decrease in the market, down -0.79%, mainly due to the codes PVS (-1.2%), PVB (-1.24%), NBC (-2.88%), and VTD (-2.63%).

In terms of foreign trading, they continued to net buy nearly 318 billion VND on the HOSE exchange, focusing on the codes MSN (143.38 billion), PC1 (70.71 billion), GMD (51.87 billion), and HDB (50.63 billion). On the HNX exchange, foreigners net sold more than 12 billion VND, focusing on the code PVS (16.34 billion), PVI (2.75 billion), HUT (1.63 billion), and MST (940 million).

| Foreigners’ buying and selling dynamics |

Morning session: Slow trading before the Tet holiday

The last trading session of the Year of the Dragon was rather slow as the Tet holiday mood prevailed. The slight green in a few pillar stocks was not enough to create momentum for a breakthrough, while sporadic profit-taking pressure remained present. The market only fluctuated slightly around the reference level on thin liquidity. At the midday break, the VN-Index paused slightly above the reference level at 1,259.26 points; HNX-Index also remained unchanged at 222.63 points.

The matching volume of the VN-Index this morning reached over 156 million units, equivalent to a value of 3.5 trillion VND, a decrease of 25% compared to the previous morning. The HNX-Index recorded a matching volume of over 15 million units, with a value of nearly 220 billion VND.

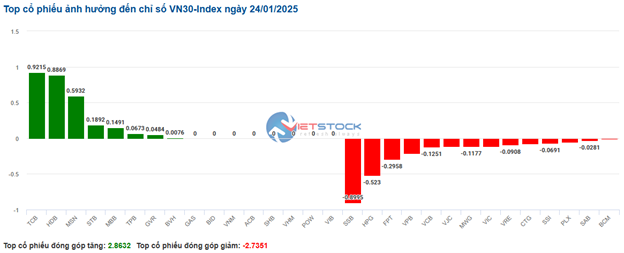

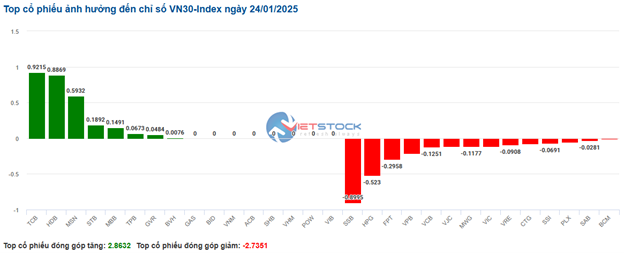

The influence between the buying and selling sides remained relatively balanced during the morning session. The top 10 positive and negative stocks all hovered around an impact of about 2 points on the VN-Index. Among them, MSN and LPB were the two leading buying codes, contributing nearly 1 point increase to the overall index. On the contrary, CTG, VCB, and SSB were the names that exerted significant pressure.

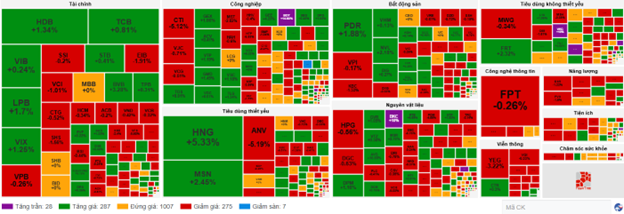

The most positive momentum was seen in the essential consumer industry group. Although the number of declining and reference stocks was somewhat higher, the green of the high-capitalization stocks in the industry, such as MSN (+2.29%), MCH (+1.88%), HNG (+5.33%), MML (+3.92%), and VNM (+0.32%), helped the sector index rise nearly 1% at the end of the morning session.

In addition, a few stocks attracted notable buying interest during the morning session in other industry groups, including PDR (+2.42%), NVL (+2.29%), LPB (+1.42%), BVB (+2.46%), VIX (+1.57%), VSC (+1.76%), GEX (+2.65%), GMD (+2.42%), and FRT (+1.76%), among others.

On the other hand, telecommunications continued to be the “laggard” group as red dominated the sector, with many large-cap stocks in the industry, such as VGI, FOX, VNZ, ELC, YEG, and FOC, falling between 1-4%.

Foreigners returned to net sell more than 113 billion VND on the HOSE exchange this morning, with FPT being the stock that foreigners net sold the most. On the HNX exchange, foreigners net sold more than 18 billion VND, focusing on selling the PVS stock.

10:40 am: Hesitant sentiment emerges, energy sector performs poorly

Investors were quite hesitant, causing the main indices to fluctuate around the reference level. As of 10:30 am, the VN-Index decreased slightly by 0.61 points, trading around 1,259 points. The HNX-Index also decreased slightly by 0.14 points, trading around 222 points.

The breadth of the VN30-Index basket showed a slight dominance of red. Specifically, on the negative side, SSB decreased by 0.89 points, HPG by 0.52 points, FPT by 0.29 points, and VPB by 0.21 points. Conversely, only a few codes still received optimistic buying support, such as TCB, HDB, MSN, and STB, contributing more than 2.5 points to the overall index.

Source: VietstockFinance

|

The group of industrial stocks, although showing mixed performance, still had a majority of codes maintaining their green color. On the buying side, TOS (+8.23%), ACV (+0.41%), and VTP (+1.49%) were leading the industry group. Meanwhile, some codes faced selling pressure, including CTI (-5.81%), VJC (-0.61%), VCG (-1.01%), MST (-2.82%), etc.

Following this was the materials sector, which maintained a good increase, led by stocks such as DPM (+1.16%), VGC (+0.81%), GVR (+0.88%), and DCM (+0.75%)…

On the contrary, the energy sector performed poorly, with the leading oil and gas codes facing selling pressure, such as PVS (-1.2%), PVD (-1.06%), PVB (-0.31%), and coal mining codes like TVD (-1.75%) and NBC (-3.85%).

Compared to the opening, the buying side still had a slight advantage, despite the breadth being dominated by codes standing at their reference prices (over 1,000 codes). There were 287 rising codes (28 hitting the ceiling) and 275 falling codes (7 hitting the floor).

Source: VietstockFinance

|

Opening: Positive start to the session

At the start of the January 24 session, as of 9:30 am, the VN-Index slightly increased to 1,260 points. Similarly, the HNX-Index also edged higher above the reference level, trading around 222 points.

The S&P 500 index climbed to a record high on Thursday (January 23) after US President Donald Trump called for lower interest rates and oil prices. Specifically, at the close of the January 23 session, the S&P 500 index advanced 0.53% to 6,118.71 points, surpassing its previous all-time high closing level of 6,090.27 points reached in early December 2024, while also hitting an intraday record high for the second consecutive session.

Red temporarily dominated the VN30 basket, with 15 declining codes, 11 increasing codes, and 4 unchanged codes. Among them, SSB, PLX, and HPG were the most negative stocks. Conversely, GVR, HDB, and TCB were the stocks with the strongest gains.

The industrial sector led the market’s growth, with most codes maintaining their green color. Notably, codes such as ACV (+0.49%), VTP (+0.66%), DPG (+1.24%), and GMD (+0.16%) recorded gains…

– 09:38 24/01/2025

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in the upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the situation could turn more negative. However, the Stochastic Oscillator remains in bullish territory, and the MACD is echoing a similar signal, even hinting at a potential rise above the zero threshold. Should this transpire, the risks of a short-term correction would be mitigated.

The Power of Positive Thinking

The VN-Index surged after a period of consolidation around the 200-day SMA. Accompanied by a solid trading volume above the 20-day average, this indicates a positive shift in market sentiment. The Stochastic Oscillator and MACD are both generating buy signals, with the latter crossing above zero, suggesting a further boost to the already optimistic short-term outlook.

The Ultimate Trader’s Journal: Aiming for the December 2024 Peak

The VN-Index extended its upward momentum from the previous session, with trading volume surpassing the 20-day average. A more robust participation of funds in the upcoming sessions could propel the index towards its old peak of December 2024 (1,270-1,280 points). The Stochastic Oscillator and MACD indicators remain bullish, suggesting continued optimism in the short term.

Market Beat: Afternoon Recovery Efforts See VN-Index Gain Almost 2 Points

The market rallied strongly in the first half of the morning session, with green dominating the screens. However, the momentum stalled, and a correction set in, allowing red to creep in. By the end of the session, despite a significant 461 gainers, including 51 stocks hitting the ceiling, there were also 304 decliners, of which 4 touched the floor.

Market Beat: Foreigners Sell-Off, VN-Index Struggles in the First Trading Session of the Year of the Black Tiger

The market closed with the VN-Index down 12.02 points (-0.95%) to 1,253.03, while the HNX-Index climbed 0.48 points (+0.22%) to 223.49. The market breadth tilted in favor of gainers with 380 advancing stocks against 343 declining ones. Meanwhile, the large-cap VN30-Index painted a red picture, with 25 stocks declining, 4 advancing, and 1 stock closing flat.