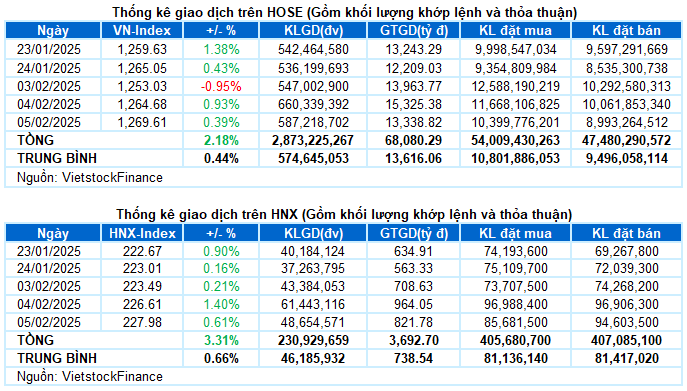

I. MARKET ANALYSIS OF STOCKS ON 02/05/2025

– The main indices continued to gain points during the trading session on February 5th. The VN-Index closed up 0.39%, reaching 1,269.61 points; HNX-Index increased by 0.61%, hitting 227.98 points.

– The matching volume on HOSE reached nearly 534 million units, an 8.7% decrease compared to the previous session. On the HNX floor, the matching volume decreased by 20.2%, reaching more than 48 million units.

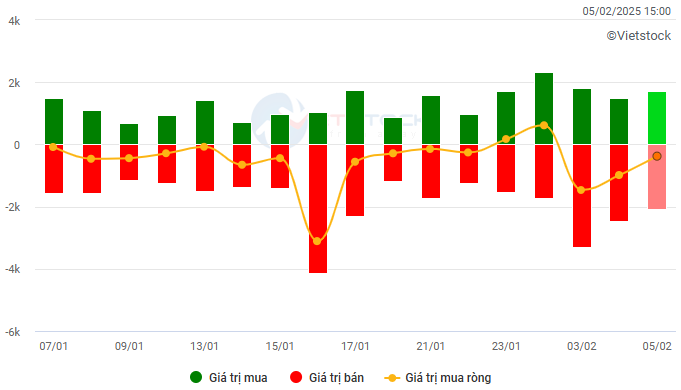

– Foreign investors maintained net selling on the HOSE with a value of more than 331 billion VND and net sold nearly 14 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

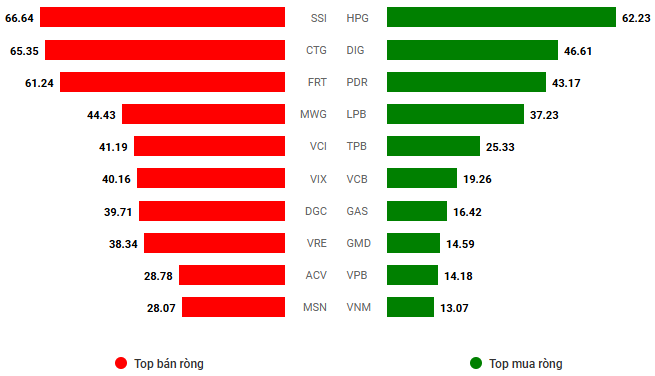

Net trading value by stock code. Unit: Billion VND

– The positive effect continued to spread during the trading session on February 5th. A vibrant start with the explosion of real estate stocks, the VN-Index soared nearly 7 points in the first half of the morning session. Although the momentum slowed down significantly towards the end of the morning session and the beginning of the afternoon session, the green color was still well maintained until the end of the day. The VN-Index closed at the 1,269.61 mark, up nearly 5 points from the previous session.

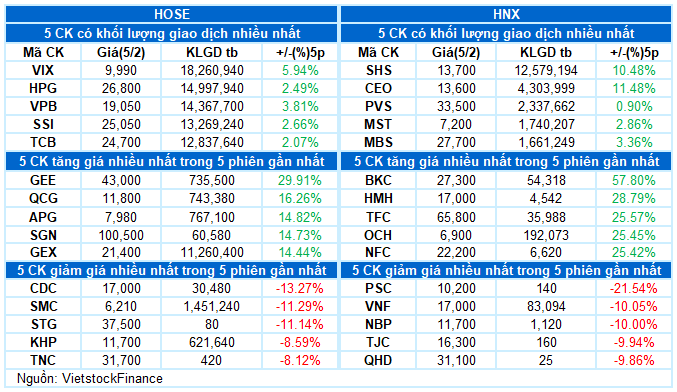

– In terms of impact, VCB, VNM, and LPB were the main pillars that contributed the most, helping the VN-Index increase by about 2 points. On the other hand, MSN was the most notable name on the negative side, taking away 0.4 points from the overall index, with the rest having a minor impact.

– VN30-Index continued to inch up by 0.31%, reaching the 1,331.35 mark. Stocks in the basket were divided into 15 codes increasing, 14 codes decreasing, and 1 code standing at the reference price. Among them, VRE led the gainers, breaking out impressively by 3.4%. Following were LPB, VNM, and BCM, also rising by more than 2%. On the opposite side, MSN and SSI came last with a decrease of 1.6% and 1%, respectively.

The green color was maintained in most industry groups. Telecommunications and industry were the two leading groups with a 1.7% increase. Many codes had a breakout in price accompanied by typical liquidity such as VGI (+2.13%), CTR (+1.1%), ELC (+4.47%), MFS (+6.19%); HAH (+4.83%), CTD (+4.04%), VTP (+2.52%), and VOS (+2.52%).

The highlight of today’s session was the real estate group as buying demand returned after a long period of silence. Many codes soared impressively right from the beginning of the session, such as DIG (+6.78%), CEO (+4.62%), VRE (+3.37%), PDR (+3.67%), DXG (+1.31%), NTL (+3.22%), BCM (+2.13%),…

Healthcare was the only group that closed in the red due to the main impact of the strong selling of DCL (-4.05%), DBD (-1.02%), IMP (-0.44%), DMC (-2.17%), and PMC (-3.31%).

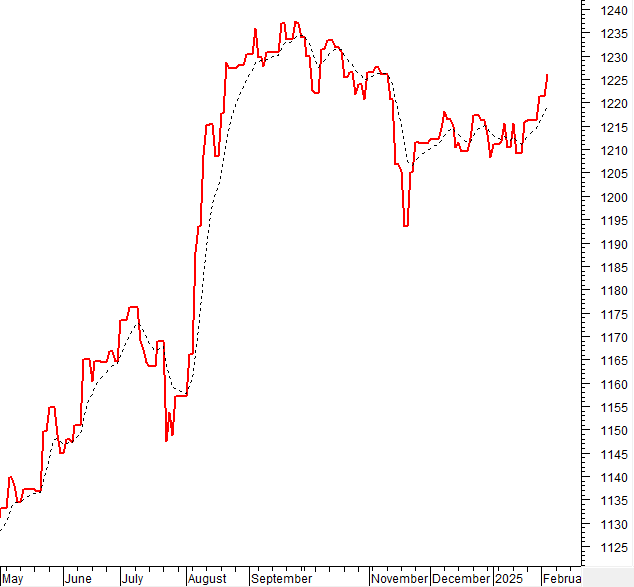

The VN-Index continued to rise compared to the previous session, with trading volume above the 20-day average. If, in the coming sessions, money flows in more strongly, the index will have the opportunity to head towards the old peak of December 2024 (equivalent to the 1,270-1,280-point range). Currently, the Stochastic Oscillator and MACD indicators are still maintaining buy signals, indicating that the short-term outlook will remain optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Heading towards the old peak of December 2024

The VN-Index continued to rise compared to the previous session, with trading volume above the 20-day average. If, in the coming sessions, money flows in more strongly, the index will have a chance to reach the old peak of December 2024 (equivalent to the 1,270-1,280-point range).

Currently, the Stochastic Oscillator and MACD indicators are still maintaining buy signals, indicating a continued optimistic short-term outlook.

HNX-Index – Surpassing the SMA 100-day

The HNX-Index maintained its upward momentum with five consecutive gaining sessions, simultaneously surpassing the SMA 100-day, indicating a very optimistic investor sentiment.

At the moment, the Stochastic Oscillator indicator is still maintaining a buy signal, and MACD is also giving a similar signal, and it is even likely to surpass the 0 threshold. If this happens, the short-term outlook will become even more positive.

Money Flow Analysis

Movement of smart money flow: The Negative Volume Index indicator of the VN-Index cut above the EMA 20-day. If this state continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow movement: Foreign investors continued to net sell during the trading session on February 5, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS ON 02/05/2025

Economic and Market Strategy Division, Vietstock Consulting Department

– 17:19 02/05/2025

Market Beat: Afternoon Recovery Efforts See VN-Index Gain Almost 2 Points

The market rallied strongly in the first half of the morning session, with green dominating the screens. However, the momentum stalled, and a correction set in, allowing red to creep in. By the end of the session, despite a significant 461 gainers, including 51 stocks hitting the ceiling, there were also 304 decliners, of which 4 touched the floor.

Market Beat: Foreigners Sell-Off, VN-Index Struggles in the First Trading Session of the Year of the Black Tiger

The market closed with the VN-Index down 12.02 points (-0.95%) to 1,253.03, while the HNX-Index climbed 0.48 points (+0.22%) to 223.49. The market breadth tilted in favor of gainers with 380 advancing stocks against 343 declining ones. Meanwhile, the large-cap VN30-Index painted a red picture, with 25 stocks declining, 4 advancing, and 1 stock closing flat.

“Vietstock Weekly: Sustaining the Uptrend”

The VN-Index extended its upward momentum, surpassing the 50-week SMA. However, trading volume remained below the 20-week average, indicating investors’ cautious sentiment. In the upcoming sessions, the index needs to firmly hold above this threshold with improved liquidity to sustain the upward trajectory.

Market Beat on Feb 7th: Hesitation Lingers, VN-Index Wobbles Around 1,275 Points

The market closed with positive gains, seeing the VN-Index rise by 3.72 points (+0.29%) to 1,275.2, while the HNX-Index climbed 0.36 points (+0.16%) to 229.49. The market breadth tilted in favor of bulls with 463 gainers and 310 losers. The large-cap basket, VN30, witnessed a similar trend with 17 gainers, 11 losers, and 2 stocks closing flat, ending the day on a greener note.

Stock Market Update for Jan 13-17, 2025: A Murky Road to Recovery

The VN-Index posted gains in 4 out of 5 trading sessions last week, indicating a strong recovery. However, trading volume remained below the 20-day average, reflecting a persistent cautious sentiment among investors. Moreover, net foreign selling in recent times has also been a less-than-favorable factor for the index.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)