I. MARKET ANALYSIS OF STOCKS ON 06/02/2025

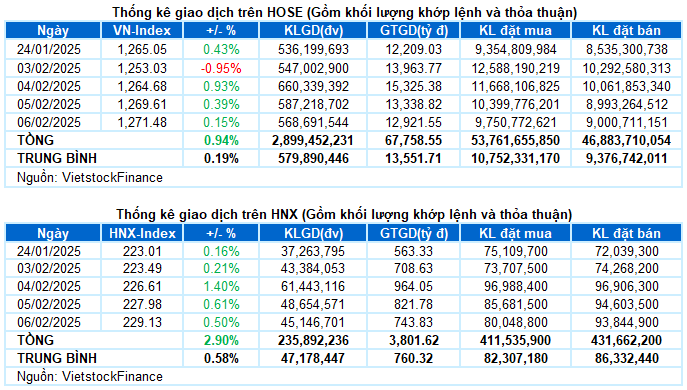

– The main indices increased during the trading session on 06/02. VN-Index closed up 0.15%, reaching 1,271.48 points; HNX-Index increased by 0.5%, reaching 229.13 points.

– The matching volume on HOSE exceeded 537 million units, approximately the same as the previous trading session. Meanwhile, the matching volume on the HNX floor decreased slightly by 7.2%, reaching nearly 45 million units.

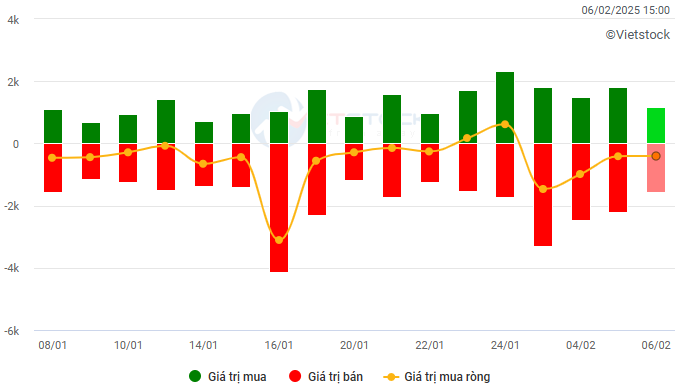

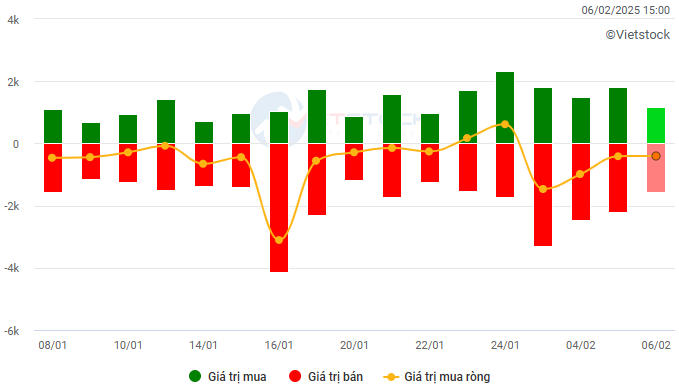

– Foreign investors continued to sell a net on the HOSE floor with a value of more than 399 billion VND and bought a net of nearly 9 billion VND on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

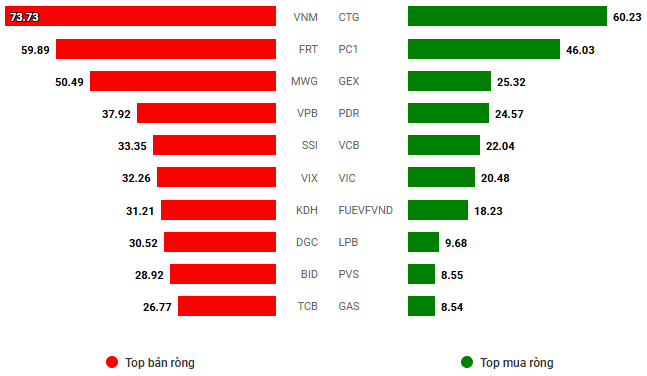

Net trading value by stock code. Unit: Billion VND

– The uptrend was maintained, but the market started to differentiate during the session on 06/02. The excitement of the stock group pushed VN-Index up more than 5 points from the beginning of the morning session. However, profit-taking pressure increased after the index approached the old peak of around 1,275 points. Buying power slowed significantly, causing the rising range to narrow later. At the end of the session, VN-Index edged up 0.15%, closing at 1,271.48 points.

– In terms of impact, TCB, LPB, and VCB led with a contribution of more than 1.5 points to VN-Index. Meanwhile, VNM, FRT, and BCM were dominated by selling pressure, taking away nearly 1 point from the overall index.

– VN30-Index increased by 0.39%, reaching 1,336.59 points. The basket width was balanced with 14 codes increasing, 11 codes decreasing, and 5 codes standing at the reference price. Among them, the “king stocks” occupied most of the top positions such as TCB, LPB, and HDB, increasing by 1.5% or more. On the opposite side, BCM and VNM were at the bottom with a decrease of more than 1%.

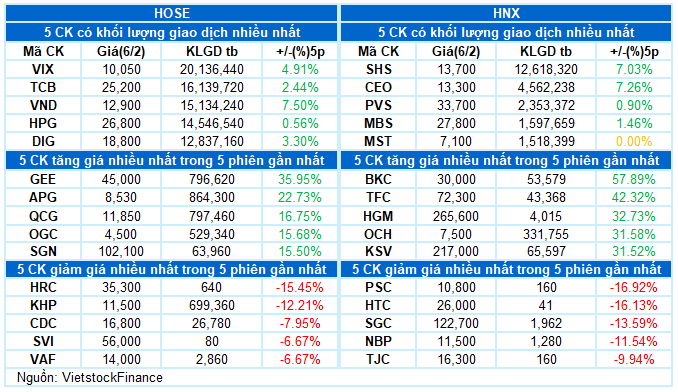

The green color still dominated, but most industry groups only fluctuated within a narrow range. The most positive momentum today was the healthcare group with the breakthrough of large-cap stocks such as DHG (+1.38%), IMP (+4.44%), DCL (+4.63%), and DBD (+1.03%).

Following are the materials and industrial groups with an increase of nearly 1%. The most prominent were the purple colors of MSR, KSV, BMC, KVC, and HGM; TCL, TCW, and ICN. However, many codes also made significant adjustments after a good previous increase, such as VTP (-3.35%), VCG (-1.21%), FCN (-3.27%), HBC (-1.49%), TV2 (-1.26%),…

The real estate group decreased slightly after a quick increase yesterday. In fact, many codes were sold back quite strongly, such as CEO (-2.21%), DXG (-1.62%), CKG (-3.88%), SGR (-2.07%), L14 (-1.99%), TCH (-1.28%), NLG (-1.29%), BCM (-1.39%),… Among the large-cap stocks, the light green color was only left in a few codes such as VIC (+1%), SNZ (+1.79%), IDC (+0.55%), PDR (+0.25%), HDG (+0.37%),…

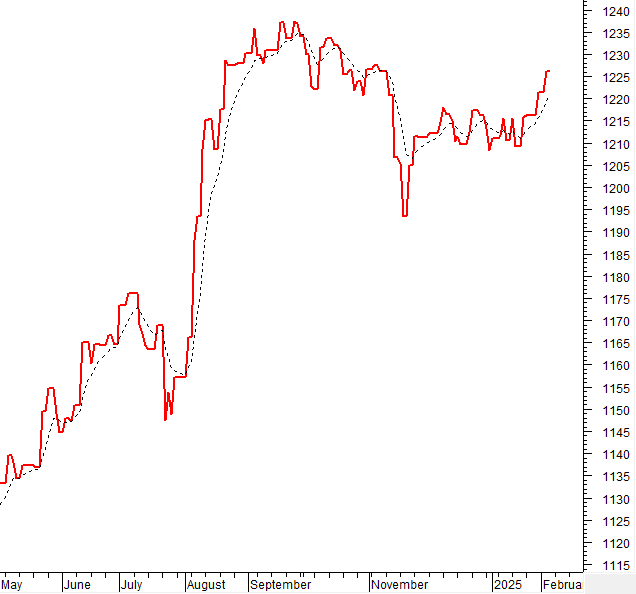

VN-Index increased slightly and formed a Doji candlestick pattern. This reflects investors’ hesitation when the index retested the old peak of December 2024 (equivalent to the 1,270-1,280-point range). However, the trading volume maintained above the 20-day average, reflecting the positive participation of money flow in the market. Currently, the Stochastic Oscillator and MACD indicators continue to rise after giving buy signals. If this state is maintained in the coming period, the situation will become more optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Doji Candlestick Pattern Appears

VN-Index increased slightly and formed a Doji candlestick pattern. This reflects investors’ hesitation when the index retested the old peak of December 2024 (equivalent to the 1,270-1,280-point range). However, the trading volume maintained above the 20-day average, reflecting the positive participation of money flow in the market.

Currently, the Stochastic Oscillator and MACD indicators continue to rise after giving buy signals. If this state is maintained in the coming period, the situation will become more optimistic.

HNX-Index – Breaks Above the SMA 100-day Moving Average

HNX-Index extended its uptrend with trading volume maintained above the 20-day average. At the same time, the index is retesting the old peak of December 2024 (equivalent to the 228-231-point range). If, in the coming sessions, the index breaks above this range, the outlook will become even more positive.

Currently, the Stochastic Oscillator indicator maintains a buy signal, and MACD is also giving a similar signal, while breaking above the 0 threshold. This indicates that the short-term outlook will become more optimistic.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index indicator of VN-Index cut above the EMA 20-day moving average. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Changes in Foreign Money Flow: Foreign investors continued to sell a net during the trading session on 06/02/2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS ON 06/02/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:13 06/02/2025

The Power of Positive Thinking

The VN-Index surged after a period of consolidation around the 200-day SMA. Accompanied by a solid trading volume above the 20-day average, this indicates a positive shift in market sentiment. The Stochastic Oscillator and MACD are both generating buy signals, with the latter crossing above zero, suggesting a further boost to the already optimistic short-term outlook.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.

The Stock Market: Capital Flows Unbound

The external factor has significantly faded, and the domestic market today witnessed a robust recovery with surging liquidity, despite FPT’s trading decrease. The breadth of stocks, index gains, and liquidity all aligned, indicating a consensus and a positive shift in market sentiment.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.