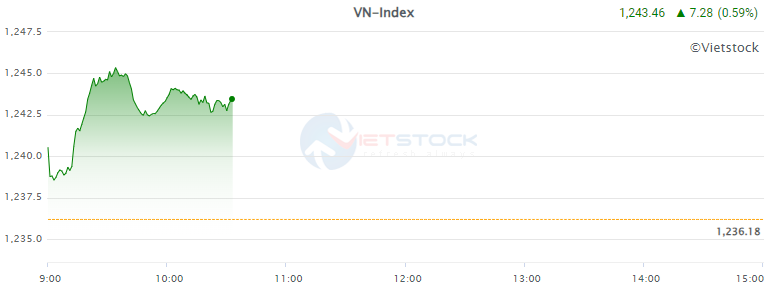

VN-Index closed up 6.18 points to 1,242.36, HNX-Index gained 1.3 points to 220.84, while UPCoM rose 0.15 points to 92.42. The market’s liquidity reached 14,390 billion VND, a significant increase compared to the previous session and slightly higher than the 10-session average.

|

Source: VietstockFinance

|

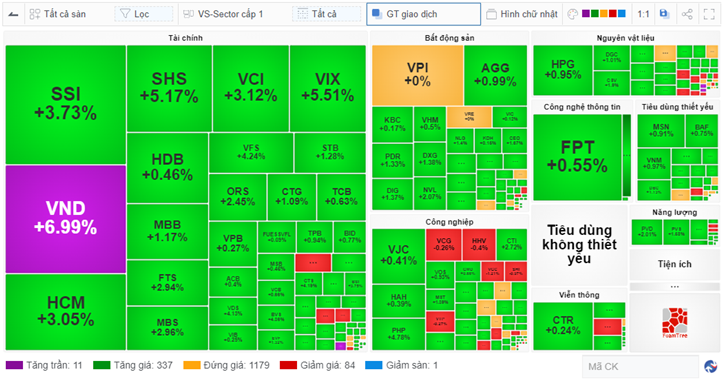

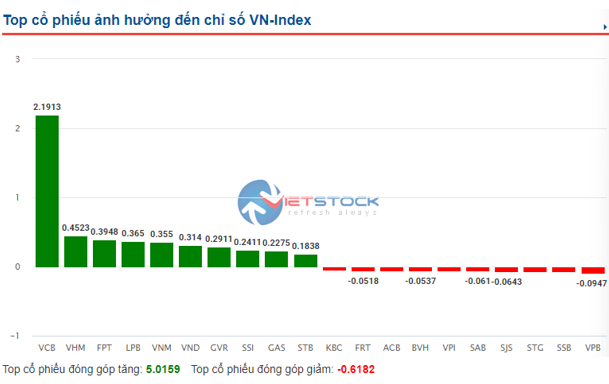

Considering the VN-Index, VCB contributed the most to today’s gain with nearly 1.8 points, followed by a series of “big guys” such as VND, VNM, VTP, LPB, etc. In total, the top 10 most positively impacting stocks brought in nearly 4.3 points. On the opposite side, the top 10 stocks with the most negative impact took away nearly 0.8 points, led by STB with 0.3 points.

In terms of sectors, the number of 19 rising sectors overwhelmingly outnumbered the 3 declining sectors and 1 unchanged sector. Among them, the telecommunications sector witnessed the strongest growth, up 3.04%, driven by VGI‘s 3.49% increase and CTR‘s 2.22% gain. Next was the specialized services and trading sector, which climbed 2.75%, thanks mainly to VEF‘s 3.47% rise and TTT‘s nearly 10% surge.

Additionally, the market observed two other well-performing sectors: financial services, which rose 1.65% due to a series of securities companies, and transportation, which advanced 1.45%, led by VTP‘s ceiling price and MVN‘s 6.48% jump.

In the remaining group, sectors like software, credit institutions, and real estate, despite rising by less than 1%, also left their marks on the overall market due to their considerable market capitalization.

On the downside, the entertainment and media sector led the decline with a 0.28% drop due to the pressure from YEG‘s 2.04% fall, DST‘s 7.02% plunge, and SBD‘s 4.82% slip, overshadowing the gains made by EID and ADG.

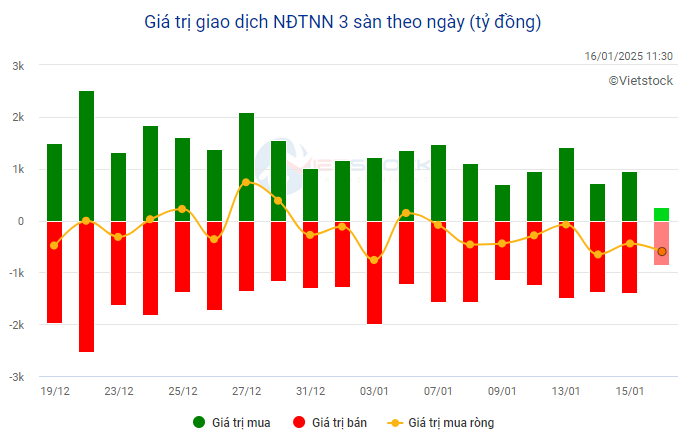

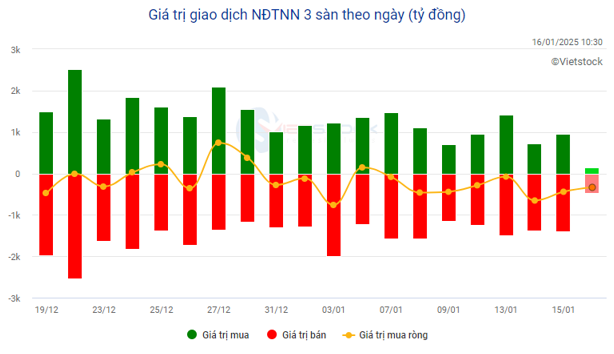

Foreign investors net sold over 1,220 billion VND, with 5 stocks experiencing net selling of hundreds of billions of VND, including FPT with nearly 187 billion VND, VIC with more than 131 billion VND, STB with over 131 billion VND, SSI with nearly 118 billion VND, and CTG with almost 111 billion VND. On the buying side, VHM topped the list, but the scale was only about 53 billion VND.

| Foreign Investors’ Net Buying and Selling Activities |

The strong net selling by foreign investors could have been one of the factors influencing the market’s challenging performance for most of today’s session.

Morning Session: Continued Narrowing of Gains, Foreign Investors Net Sold Nearly 600 Billion VND

VN-Index experienced a similar pattern as it did yesterday, starting the morning session with a strong surge, then entering a period of consolidation and correction before closing the morning session at 1,239.52. HNX-Index and UPCoM-Index also narrowed their gains and ended the morning at 221.11 and 92.49, respectively.

Thus, although still up 3.34 points compared to the previous session, VN-Index fell below today’s opening price of 1,241.49.

Source: VietstockFinance

|

Liquidity improved significantly, with over 6,190 billion VND in value traded during the morning session, much higher than yesterday’s session and the 5-session average.

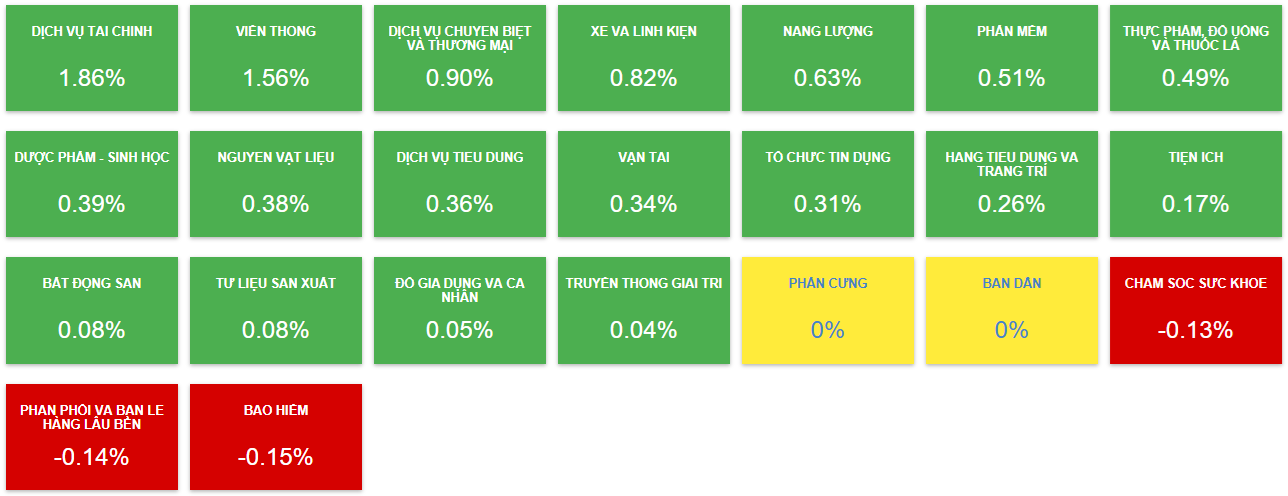

The number of rising sectors outnumbered the declining ones, with 18 sectors in the green, led by financial services, up 1.86%, and telecommunications, up 1.56%.

The financial services sector’s growth was positively supported by a series of securities stocks such as VND hitting the ceiling price, SSI rising 1.24%, VCI climbing 1.25%, HCM gaining 1.79%, VIX increasing 2.49%, MBS up 1.48%, and SHS surging 3.45%… As for the telecommunications group, the main growth driver was VGI‘s 2.04% advance.

Among the remaining sectors that rose by less than 1%, notable mentions include software, up 0.48%; credit institutions, up 0.31%; and real estate, up 0.08%.

On the flip side, only three sectors declined, and they did so very slightly: insurance fell 0.15%, distribution and durable goods retail dropped 0.14%, and healthcare decreased by 0.13%. Meanwhile, the hardware and semiconductor sectors remained unchanged.

|

Most Industry Groups Traded in Positive Territory in the Morning Session of January 16

Source: VietstockFinance

|

The market also felt the pressure from foreign investors, who net sold nearly 600 billion VND, a strong figure compared to recent days. The main contributors to this net selling were FPT, which was net sold for nearly 110 billion VND, SSI for over 70 billion VND, and the banking duo of STB and CTG for around 60 billion VND each.

Source: VietstockFinance

|

The performance of Vietnam’s stock market was not surprising, as a similar narrowing of gains was observed in other Asian markets, including Hang Seng, Shanghai Composite, and Nikkei 225…

10:30 am: Stabilizing After an Initial Euphoria

After an initial euphoria, the market began to stabilize, with the VN-Index trading sideways and consolidating around the 1,243 – 1,245-point range.

Source: VietstockFinance

|

At 10:30 am, VCB was the stock contributing the most points to the VN-Index, with nearly 2.2 points, outperforming other stocks such as VHM, which contributed about 0.5 points, and FPT, with almost 0.4 points…

Source: VietstockFinance

|

In the overall positive market, the financial services sector was the top performer, rising 2.35%, driven by well-known securities stocks such as SSI, which climbed 1.66%; VCI, up 1.72%; HCM, advancing 2.15%; and even VND, which hit the ceiling price early in the day.

Meanwhile, foreign investors net sold more than 330 billion VND, mainly in FPT, with about 74 billion VND; SSI, with nearly 45 billion VND; STB, with over 28 billion VND; and CTG, with almost 23 billion VND… On the buying side, VHM led, but the scale was only over 20 billion VND.

Source: VietstockFinance

|

Market Open: Global Markets Surge, Vietnam Follows Suit

Echoing the positive sentiment from the US and Asian markets, Vietnam’s major stock indices accelerated from the start of the trading session on January 16. The VN-Index even opened at 1,241.49, creating a “gap” compared to yesterday’s close of 1,236.18.

After the first 25 minutes of trading, the VN-Index climbed 8.19 points to 1,244.37, the HNX-Index rose 2.3 points to 221.84, and the UPCoM-Index gained 0.17 points to 92.44. Liquidity also improved compared to the opening period of the previous session, recording more than 61 million shares traded, equivalent to a value of nearly 1,248 billion VND.

The number of rising stocks far exceeded the declining ones, with 348 stocks in the green. Stocks in the large-cap sectors, such as banking, securities, and real estate, rose sharply, with the leading securities stock VND hitting the ceiling price.

|

Market Trades in Positive Territory in the Early Session of January 16

Source: VietstockFinance

|

Overall, the market has been witnessing consecutive recovery sessions after the sharp drop to the 1,220-point level, accompanied by slightly improved liquidity.

According to Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities (VPBankS), if the downward trend stabilizes this week (January 13-17) and starts to recover next week (January 20-24), investors can consider buying again.

The expert expressed optimism about February, expecting a positive scenario that would create more optimism. Conversely, he warned that a continued bearish trend would be very dangerous. Mr. Duc also anticipated a return of liquidity after the Tet holiday.

Turning to Asian markets, the opening performance was also positive, with notable gains in Hang Seng (+1.42%) and All Ordinaries (+1.25%).

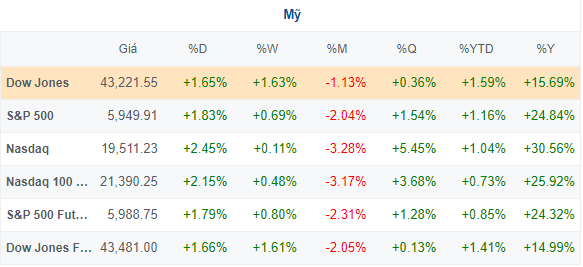

Last night, US stock markets rallied after the report showed that the core consumer price index (CPI) unexpectedly slowed in December 2024, and major US banks kicked off the earnings season with explosive results.

At the close, the Dow Jones rose 703.27 points to 43,221.55, the S&P 500 advanced to 5,949.91, and the Nasdaq Composite climbed to 19,511.23. This was the best session for all three major indices since November 06, 2024.

Source: VietstockFinance

|

– 09:43 16/01/2025