Recent policies by US President Donald Trump on tariffs have caused concern for global trade and the economy. In a new report, experts at HSBC suggest that “ASEAN is expected to benefit significantly from these trends. The region has surpassed the US and the European Union (EU) to become China’s largest export market.”

ASEAN HAS MANY OPPORTUNITIES

Recently, President Trump announced a delay in imposing 25% tariffs on Mexico and Canada for 30 days, while maintaining 10% tariffs on China, prompting retaliatory measures, including focused tariff implementation and restricted exports to the US.

According to HSBC experts, considering Japan’s similar experience in the 1980s, this is a case of particular interest to Chinese policymakers.

“We believe China will substitute some direct exports to the US with more foreign investment, increased trade with emerging economies, and solidify its central position in the global supply chain through exports of components and high-tech manufacturing, avoiding major exchange rate adjustments. Simultaneously, they will seize the best opportunities to implement robust economic stimulus measures and structural reforms,” said Frederic Neumann, Co-Head of Asian Economic Research at HSBC.

Hence, HSBC experts suggest that the ASEAN region is expected to benefit significantly from these trends. The region has surpassed the US and the EU to become China’s largest export market. Along with this, there has been an improvement in production capabilities across various industries, from electric vehicles to consumer electronics, aided by Chinese investments.

Additionally, Frederic Neumann suggests that Trump’s import-reducing policies could inadvertently motivate Asia to shift its growth model, which previously relied heavily on exports to the US. “Decoupling” does not mean withdrawing from trade or turning away from the US, an important trading partner, but rather an opportunity for Asia to foster new growth drivers.

TWO PILLARS OF GROWTH

According to Frederic Neumann, there are two main pillars in Asia’s inward-focused growth strategy.

“Firstly, the region needs to address the imbalance between savings and investment. While saving is a virtue, excessive capital accumulation without efficient investment channels will hinder growth,” Frederic Neumann stated.

“Asia can also strengthen intra-regional trade and investment by leveraging and expanding existing agreements. Including South Asia in this equation would mark a significant step forward, contributing to building a more resilient region.”

On the other hand, increased investment can help balance excess savings, but it will be inefficient if profitable investment opportunities are scarce. More investment also means producing more goods that will eventually need to find consumption outlets.

Economist Frederic Neumann suggests that the solution lies in boosting domestic consumption. As intra-regional demand increases, Asia will not only reduce its dependence on foreign markets but also contribute to improving household living standards.

“However, Asian households, known for their high savings rates, will need encouragement to spend more. Policymakers can support this process by increasing incomes and enhancing social welfare for all,” Frederic Neumann recommended.

Additionally, even if immediate reduction in excess savings in some regions is not feasible, Asia can efficiently reallocate capital from high-saving economies like mainland China, South Korea, Malaysia, Singapore, and Japan to more investment-needy markets, such as India, Indonesia, the Philippines, and Bangladesh. “This is where the second pillar of Asia’s ‘decoupling’ strategy comes into play,” Frederic Neumann stated.

While investment flows and supply chains have already been cross-formed within the region, they are largely focused on serving Western markets. Instead of continuing to export to the US or Europe, where trade barriers are rising, Asia can expand its intra-regional market through enhanced regional integration.

At the same time, the Head of HSBC’s Asia Economic Research suggested that Asia can also strengthen intra-regional trade and investment by leveraging existing trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) with ASEAN and Northeast Asian members, or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), involving 11 economies from Asia and the Americas.

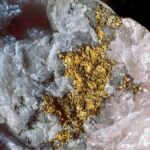

The Neighboring Country of Vietnam Strikes Gold Again: A Super-Massive Treasure Trove of Hundreds of Tons of Gold Discovered, Potentially Shaking Up the Global Gold Market

A glittering discovery has been made in China, with the unearthing of a new gold mine estimated to hold over 168 tons of the precious metal.

Trump’s Tough Talk Leaves EU in a Bind: “Buy More American Energy or Face Higher Tariffs”

Former US President Donald Trump has threatened to impose tariffs on the European Union if its member states do not increase their purchases of American oil and natural gas. In a characteristic display of his aggressive trade policy approach, Trump is demanding that the EU boost its imports of US energy resources or face economic consequences. This bold ultimatum underscores Trump’s unwavering commitment to protecting and promoting American economic interests on the global stage.