I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 01/16/2025

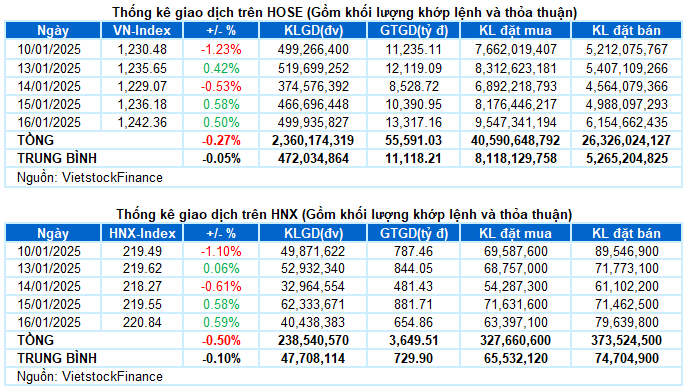

– The main indices continued to recover in the trading session on January 16, with the VN-Index closing up 0.5% to 1,242.36 points; HNX-Index increased by 0.59% to reach 220.84 points.

– The matching volume on HOSE reached nearly 402 million units, a slight increase of 2.4% compared to the previous session. Meanwhile, the matching volume on HNX slightly decreased by 7.8%, reaching nearly 40 million units.

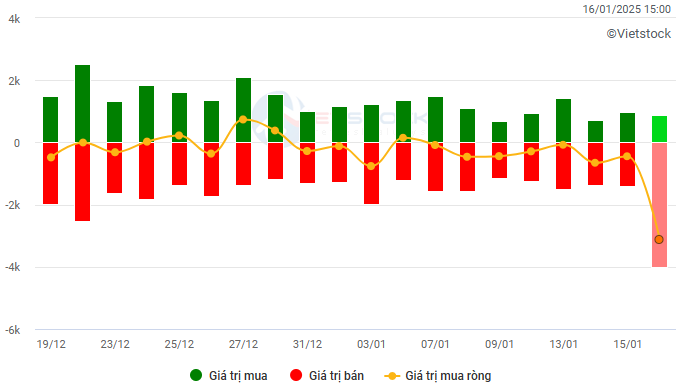

– Foreign investors net sold strongly on the HOSE with a value of nearly VND 3,120 billion and net bought more than VND 6 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

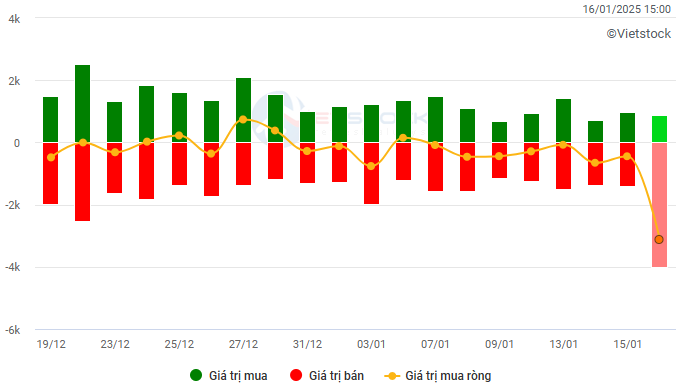

Net trading value by stock code. Unit: VND billion

– The Vietnamese stock market started the session on January 16 with a positive gap after optimistic signals from international markets overnight. Strong buying pressure helped the VN-Index surge nearly 9 points after about 30 minutes of trading, especially the impressive breakthrough of securities stocks. However, the excitement did not last long, the VN-Index gradually lowered its altitude with strong selling pressure from foreign investors. Nevertheless, the pull of the pillar in the last minutes on the futures expiration day still helped the VN-Index close with an increase of more than 6 points, reaching 1,242.36 points.

– In terms of impact, VCB was the main pillar that helped the VN-Index avoid a losing session at the end of the day, contributing nearly 2 points to the increase in the total of more than 4 points brought about by the top 10 most positive stocks. On the contrary, the 10 most negative stocks were not enough to take away 1 point from the VN-Index.

– VN30-Index closed up 0.43%, reaching 1,303.25 points. The breadth was tilted to the upside with 22 gainers, 3 losers, and 5 unchanged. Of which, VCB, SSI, and STB led with gains of more than 1%. On the opposite side, the 3 remaining stocks had to close in red, which were SAB, POW, and ACB.

In terms of sectors, telecommunications led the table with a gain of 2.89%, thanks to the outstanding performance of VGI (+3.61%), CTR (+2.22%), MFS (+2.4%), and TTN (+3.39%). Following was the industry group, which increased by 1.11%, with the most notable highlight in this sector being VTP with a purple color.

The securities group was also a typical highlight in today’s session as most of the stocks in the industry attracted outstanding buying power from the early stages, typically VND hitting the ceiling, SSI (+1.04%), HCM (+1.25%), VCI (+1.09%), MBS (+1.11%), VIX (+1.84%), SHS (+2.59%), BVS (+1.74%),…

Essential consumer goods were the only group left dominated by red, mainly affected by the decline of the 2 large-cap stocks MCH (-1.2%) and SAB (-1.82%). However, many stocks in the industry still maintained a good recovery such as MSN (+0.76%), BAF (+2.64%), HNG (+2.74%), VHC (+0.75%), SLS (+1.31%),…

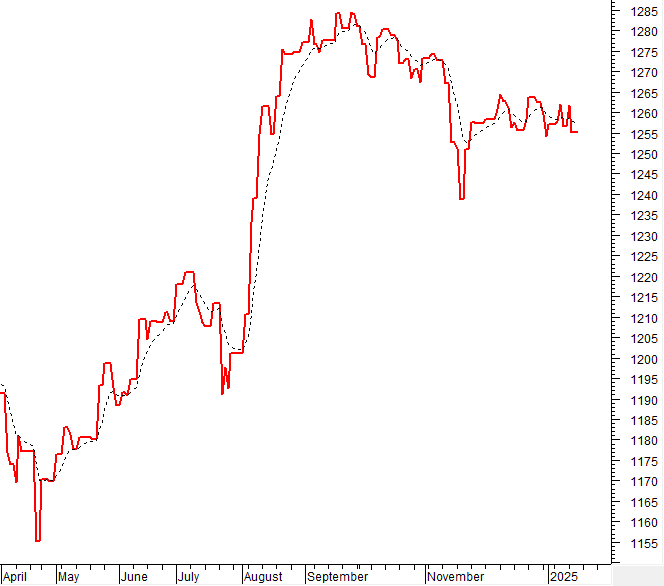

The VN-Index has been rising continuously with trading volume below the 20-day average, reflecting investors’ cautious sentiment. This needs to be improved in the coming sessions if the uptrend is to be sustained. Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If the buy signal continues and exits this region, the short-term outlook will become more positive.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume remains low

The VN-Index has been rising continuously with trading volume below the 20-day average. This needs to be improved in the coming sessions if the uptrend is to be sustained.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If the buy signal continues and exits this region, the short-term outlook will become more positive.

HNX-Index – Re-testing November 2024 low

The HNX-Index continued to rise and re-test the November 2024 low (corresponding to the 218-221 point region). In the next sessions, if the index breaks above this threshold along with the trading volume above the 20-day average, the uptrend will be reinforced.

Currently, the Stochastic Oscillator indicator is still maintaining a buy signal in the oversold region. If the MACD indicator also gives a similar signal in the future, the short-term outlook will become more optimistic.

Analysis of Capital Flows

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index cut down below the EMA 20 day line. If this state continues in the next session, the risk of a sudden drop (thrust down) will increase.

Fluctuations in foreign capital flow: Foreign investors continued to net sell in the trading session on January 16, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

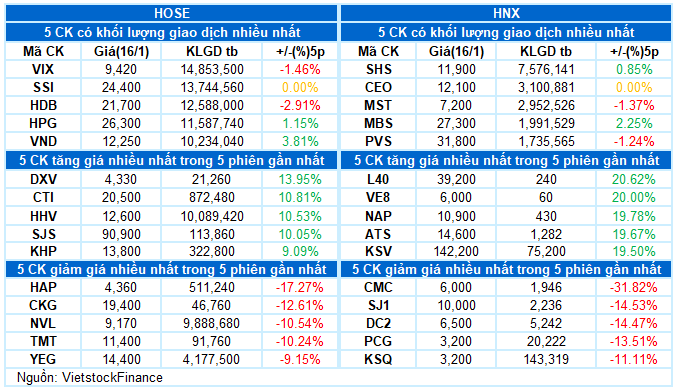

III. MARKET STATISTICS ON 01/16/2025

Department of Economic Analysis & Market Strategy, Vietstock Consulting

– 17:02 01/16/2025

The Cash Flow Comeback Before the Holidays

The VN-Index surged by over 17 points, crossing above the 200-day SMA. This significant jump was accompanied by a trading volume that exceeded the 20-day average, indicating a resurgence of active participation by investors. The Stochastic Oscillator and MACD both provide bullish signals, with the latter crossing above the Signal Line. Should this momentum be sustained, the outlook for the market is exceedingly positive.

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.

Market Beat: VN-Index Surges Over 6 Points in Late Recovery

The market was volatile during the afternoon session, with the VN-Index dipping into negative territory at one point. At the close of trading on January 16th, all three major indices managed to recover, but the gains were narrower compared to the morning’s enthusiasm.

The Market Beat: Foreigners Buy for Two Straight Sessions, VN-Index Responds Positively

The market ended the session on a positive note, with the VN-Index climbing 5.42 points (+0.43%) to reach 1,265.05, while the HNX-Index gained 0.34 points (+0.15%), closing at 223.01. The market breadth tilted in favor of advancers, with 432 tickers in the green and 301 in the red. The large-cap sector mirrored the broader market’s sentiment, as evidenced by the VN30 basket, which saw 20 constituents advance, 5 decline, and 5 remain unchanged, resulting in a sea of green.

The Power of Positive Thinking

The VN-Index surged after a period of consolidation around the 200-day SMA. Accompanied by a solid trading volume above the 20-day average, this indicates a positive shift in market sentiment. The Stochastic Oscillator and MACD are both generating buy signals, with the latter crossing above zero, suggesting a further boost to the already optimistic short-term outlook.