left Intent:

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 535 million shares, equivalent to a value of more than 12.8 trillion VND. The HNX-Index reached over 40 million shares, equivalent to a value of more than 652 billion VND.

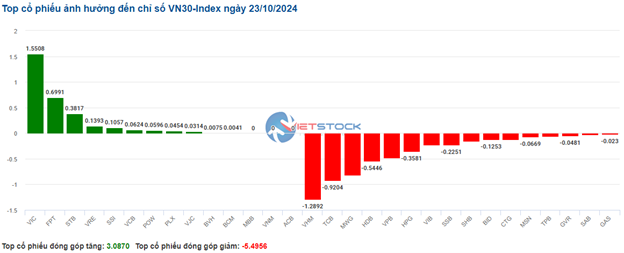

At the start of the afternoon session, the VN-Index continued to fluctuate around the reference level with fairly balanced buying and selling forces, but buyers succeeded in helping the index maintain its positive momentum until the end of the session. In terms of impact, VIC, FPT, STB, and TPB were the codes with the most positive impact on the VN-Index, with an increase of more than 1.9 points.

On the other hand, VHM, BID, HPG, and VPB were the codes with the most negative impact, taking away 2.3 points from the overall index.

Similarly, the HNX-Index also showed a fairly positive development, with the index being positively influenced by the DNP (+6.6%), IDC (+0.93%), MBS (+1.04%), and PVS (+0.79%) codes…

|

Source: VietstockFinance

|

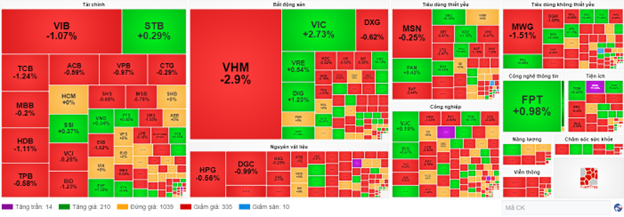

The information technology industry was the group with the strongest increase, up 0.76%, mainly driven by the FPT (+0.83%), POT (+6.75%), and ITD (+0.37%) codes. This was followed by the consumer staples and industrial sectors, which rose 0.5% and 0.41%, respectively. On the other hand, the materials sector saw the largest decline in the market, falling by -0.21%, mainly due to the HPG (-0.75%), DGC (-0.09%), GVR (-0.74%), and DPM (-0.15%) codes.

In terms of foreign trading, they continued to sell a net amount of more than 4 billion VND on the HOSE exchange, focusing on the VHM (86.98 billion), HPG (53.1 billion), KBC (27.95 billion), and BID (25.5 billion) codes. On the HNX exchange, foreigners sold a net amount of more than 67 billion VND, focusing on the SHS (46.58 billion), PVS (21.76 billion), LAS (1.53 billion), and BVS (1.25 billion) codes.

| Foreigners’ Buying and Selling Session on October 23, 2024 |

Morning Session: Continued Fluctuation

In the context of a lack of supportive information and large capital inflows, the market this morning continued to fluctuate around the reference level. At the mid-session break, the VN-Index fell 0.12%, settling at 1,268.38 points; the HNX-Index fell 0.04%, to 225.41 points. In terms of market breadth, the number of declining codes still outnumbered advancing ones, with 327 codes falling and 265 codes rising.

Market liquidity was somewhat subdued despite a slight increase from the previous morning’s lows, with the VN-Index trading volume reaching nearly 282 million units in the morning session, equivalent to a value of more than 6.8 trillion VND. Meanwhile, the HNX-Index recorded a trading volume of over 20 million units, with a value of nearly 333 billion VND.

VHM, BID, and VPB were the stocks that put the most pressure on the VN-Index, taking away nearly 2.5 points from the index. On the other hand, VIC, FPT, and MSN tried to curb the decline, contributing more than 1.5 points to the VN-Index, with VIC alone contributing more than 1 point.

At the end of the morning session, most sectors were dominated by red, but the declines were not significant, indicating a gradually differentiating market. The materials sector was down the most, falling by 0.55%. This was mainly driven by the decline of HPG (-0.75%), GVR (-1.19%), DGC (-0.81%), BMP (-0.77%), MSR (-1.6%), and KSV (-1%). This was followed by the telecommunications and industrial sectors, which fell by 0.49% and 0.41%, respectively. While the telecommunications stocks were mostly in the red, the industrial sector showed a more mixed performance.

On the other hand, FPT (+0.83%) was the main driver that helped the information technology group temporarily lead the market at the end of the morning session. The two sectors that maintained their gains were real estate and energy, notably VIC (+2.73%), KDH (+2.75%), PDR (+2.87%), NLG (+2.75%), DIG (+3.95%), CEO (+2.65%), NVL (+1.97%), DXG (+1.85%); BSR (+0.46%), PVD (+0.78%), and CLM (+9.39%).

Foreigners continued their selling trend, recording a net sell value of nearly 16 billion VND on the HOSE exchange in the morning session, with selling pressure concentrated mainly in the VHM stock (56 billion VND). On the HNX exchange, foreigners also net sold nearly 37 billion VND at the end of the morning session, with strong selling appearing in the SHS stock (27 billion).

10:30 a.m.: Selling Pressure Continues

Buyers and sellers in the market struggled quite fiercely after the previous losing session, causing the main indices to fluctuate around the reference level and unable to break out. As of 10:35 a.m., the VN-Index fell 3.99 points, trading around 1,265 points. The HNX-Index fell 0.54 points, trading around 224 points.

The stocks in the VN30 basket were quite mixed, and the red color slightly outnumbered the green. Specifically, VHM, TCB, MWG, and HDB respectively took away 1.29 points, 0.92 points, 0.82 points, and 0.54 points from the index. In contrast, VIC, FPT, STBVRE maintained good buying interest and contributed more than 2.7 points to the VN30-Index.

Source: VietstockFinance

|

Financial stocks continued to be the focus in the context of a mixed performance and a slightly higher proportion of red stocks. Selling pressure mainly came from banking codes such as VIB (-1.07%), TCB (-0.83%), HDB (-0.93%), TPB (-0.58%)… Conversely, the green color was quite modest in codes such as STB (+0.29%), SSI (+0.37%), EVF (+1.38%), CTS (+0.67%)… Additionally, there were more than 40 codes that were at the reference level.

Following the weakness was the materials sector, which also fluctuated quite strongly with a bias towards the sell side. DGC (-1.08%), HPG (-0.56%), GVR (-1.63%), DCM (-0.41%)… While there were still codes in the green, such as ECO (+4.94%), TNT (+0.25%), PHR (+0.72%), ALV (+13.11%)… their impact was not significant.

Compared to the opening, buyers and sellers struggled quite fiercely, with more than 1,000 codes standing at the reference level and the sell side slightly outperforming. There were 335 codes declining (10 codes hitting the floor) while there were 210 advancing codes (14 codes hitting the ceiling).

, <a>TNT</a> (+0.25%), <a>PHR</a> (+0.72%), <a>ALV</a> (+13.11%)… but their impact was not significant.</p><div class='code-block code-block-7' style='margin: 8px 0; clear: both;'>

<script type=)

Compared to the opening, buyers and sellers struggled quite fiercely, with more than 1,000 codes standing at the reference level and the sell side slightly outperforming. There were 335 codes declining (10 codes hitting the floor) while there were 210 advancing codes (14 codes hitting the ceiling).

Opening: Cautious Start As of 9:40 a.m., the VN-Index fluctuated around the reference level and edged lower to 1,267.28 points. Meanwhile, the HNX-Index also dipped slightly to 225.21 points. Buyers were struggling, with nearly 180 codes advancing and more than 220 codes declining, indicating that selling pressure was prevailing. The red color temporarily outnumbered the green in the VN30 basket, with 18 codes declining, 7 codes advancing, and 5 codes standing at the reference level. Among them, GVR, SSB, and VIB were the most negatively impacted stocks. On the other hand, VIC, VRE, and BCM were the stocks with the strongest gains. Real estate stocks were one of the most notable sectors in the market. Specifically, codes such as VIC rose 4.03%, VRE rose 1.08%, HDG rose 0.56%, DIG rose 0.49%, NLG rose 0.79%,… In contrast, telecommunications services stocks were in the red, with most codes such as VGI, CTR, YEG, ELC, FOC, SGT,… all declining. You may also like

The Cash Flow Comeback Before the Holiday Break

|

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[On the Hot Seat] Haval Vietnam: Missteps and All](https://xe.today/wp-content/uploads/2024/08/quote-temp-1-100x70.jpg)