After years of stagnant charter capital, to meet the demand for implementing the Golden City social housing project and investing in owning shares of Golden City Joint Stock Company, at the beginning of 2024, Hoang Quan Trading Consulting Services Real Estate Joint Stock Company (HOSE: HQC) re-established a plan to issue 100 million private placement shares at VND 10,000/share, while the market price was only around VND 4,000-5,000/share.

Golden City Project. Photo: HQC

|

Two mysterious female tycoons spent hundreds of billions of dong to own HQC shares

Raising a large amount of capital with a price higher than the market is not easy. The plan has been there since 2022, but the Company had to extend the implementation time several times to 2023 and then to 2024.

In just the first quarter of 2024, attracting VND 1,000 billion from private placement shareholders was quickly completed. According to the Enterprise’s report, HQC did not incur any expenses related to the issuance. Thus, the net proceeds from the offering were VND 1,000 billion. However, the list and ownership ratio of the investors buying the shares were not disclosed – something that many listed companies are willing to disclose before the offering results are announced.

| HQC’s privately placed shares are restricted from being transferred within 1 year from the end of the offering period (04/03/2024) |

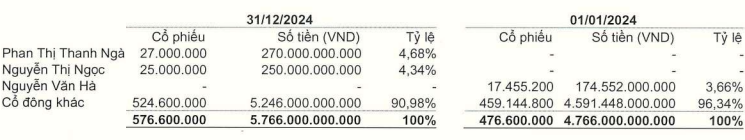

According to HQC’s consolidated financial statements for the fourth quarter of 2024, the owners’ equity capital was VND 5,766 billion; at the same time, two individuals, Phan Thi Thanh Nga and Nguyen Thi Ngoc, held 27 and 25 million shares, respectively, holding a stake of 4.68% and 4.34% according to the new charter capital. Just these two mysterious female tycoons contributed VND 520 billion to HQC. In the opposite direction, Mr. Nguyen Van Ha divested nearly 17.5 million shares, or 3.66% of HQC’s capital (before the capital increase).

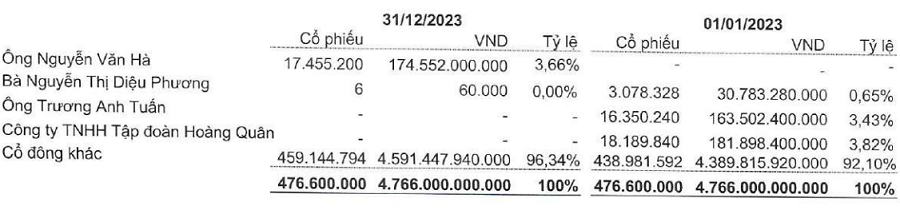

Mr. Nguyen Van Ha first appeared on HQC’s financial statements at the end of 2023, holding 3.66% of the capital. At that time, HQC’s Chairman, Truong Anh Tuan, along with his wife, Nguyen Thi Dieu Phuong, and Hoang Quan Group Joint Stock Company – a company related to the Chairman – all divested their capital.

Thus, after just one year of holding a large amount of HQC shares, Mr. Nguyen Van Ha has fully divested his capital.

|

Details of owners’ equity capital at the end of 2023 of HQC

|

|

Details of owners’ equity capital as of the end of 2024 of HQC

Source: HQC’s Financial Statements

|

As of the end of 2024, HQC did not have any major shareholders. Chairman Truong Anh Tuan and his family also held only about 3.3 million shares, accounting for more than 0.57% of the circulating shares.

Changes in the accounting balance sheet after issuance

Owners’ equity increased by VND 1,000 billion, but on the other side of the balance sheet of HQC showed that: debt also increased by a commensurate amount, and the loans arose in the first quarter of 2024, i.e. during the period when the Enterprise implemented the private placement of shares.

Specifically, the bank credit contracts dated January 25, 2024, February 6, 2024, and March 5, 2024, with 3 loans of VND 130 billion (interest rate of 11%/year, 24 months), VND 155 billion (interest rate of 12%/year, 24 months), and VND 30.7 billion (interest rate of 11%/year, 48 months). HQC said that the purpose of the loan is to contribute capital for business cooperation with Bao Linh Housing Development and Investment Joint Stock Company. The Company uses some real estate as collateral for this loan.

In addition, HQC has a bank loan contract of VND 449 billion (interest rate of 11.5%, 48 months) to invest in the Golden City social housing project (secured by the project itself) and a loan of VND 500 billion (interest rate of 10%/year, 24 months) to contribute capital for business cooperation with Hoang Quan Mekong Trading-Services-Real Estate Joint Stock Company (HQM).

| As of the end of 2024, HQC’s loan balance exceeded VND 1,744 billion, while the figure at the beginning of the year was less than VND 62 billion. |

In addition, as of the end of the first quarter of 2024, short-term prepayments to suppliers also increased by about VND 1,200 billion. The largest increase was VND 600 billion that HQC prepaid to Bao Linh, bringing the total to more than VND 1,000 billion; prepayments to other suppliers increased by nearly VND 540 billion.

In addition to Mr. Nguyen Van Ha’s divestment, after the issuance, Nam Quan Investment Joint Stock Company – an enterprise related to HQC’s Vice President, Truong Nguyen Song Van (daughter of HQC’s Chairman) – also fully divested 2 million shares for the reason of portfolio restructuring from March 29 to April 27, 2024, and the transaction was made through order matching.

|

HQC shares have been trading below par value for many years

Source: VietstockFinance

|

The Chairman’s promises

Closing 2024, HQC recorded its highest profit after tax in 4 years, reaching nearly VND 33 billion, but only completed one-third of the annual target. Revenue of VND 512 billion reached 26% of the set target; not to mention that revenue was significantly reduced, causing net revenue to be just over VND 100 billion. Thus, this period marks the 9th consecutive year that the social housing giant has repeated the refrain of failing to complete the annual plan, since 2016.

It is worth remembering that at the 2024 Annual General Meeting of Shareholders, Mr. Truong Anh Tuan emphasized the need to achieve VND 2,000 billion in revenue for the year. In nearly 10 years, he has realized that HQC has always set high business plans but has not completed them, and he believes that, in addition to difficulties from the macro economy and the world market, there are also mistakes in the judgment of the Board of Directors, who are too optimistic about the market and the ability of HQC to complete the plan. That is a big lesson for HQC.

“This year, HQC is expected to complete 5 projects to hand over 3,000 social housing units, and in the following years, it will ensure a minimum of 5,000 units. HQC also sets a profit target from 2024 of 5% on revenue. The figure of VND 2,000 billion in revenue this year is not an effort but a must,” said Mr. Tuan at the 2024 Annual General Meeting of Shareholders.

HQC’s failure to complete its annual plan is no longer strange to HQC shareholders. Source: Compiled by the author

At the 2023 Annual General Meeting, the Chairman of HQC confidently stated that the Company has many partners who are willing to buy HQC’s additional shares at VND 10,000/share because they see “other benefits.”

“The price of HQC shares is currently lower than the book value. HQC’s capital is long-term investment in projects. With the VND 120,000 billion package (the social housing credit package – PV), HQC will have strong cash flow to help the Company recover its investment. Therefore, next year, the book value will definitely increase. I am confident that the price of HQC shares will return to VND 10,000/share in the period from now to 2024,” Mr. Tuan answered a shareholder’s question about when the price of HQC shares will return to par value at the 2023 Annual General Meeting of Shareholders.

– 08:00 11/02/2025

The Capital’s Vision: Hanoi Plans to Build Two Social Housing Projects in Long Bien by 2025

On January 3rd, the People’s Committee of Hanoi approved the 2025 land use plan for Long Bien district, comprising 152 projects spanning over 651 hectares. Notably, this includes two social housing projects slated for launch this year.

Is the Social Housing Project Series Launch Cooling the Condo Market?

The final months of 2024 brought a wave of good news for Hanoi’s real estate market, with multiple social housing projects being inaugurated and granted construction permits. This surge in social housing supply is a welcome development, bringing the dream of home ownership within reach for low and middle-income earners.

Affordable Housing Development: Falling Short of the 130,000 Unit Target for 2024

As of December 14, 2024, only 36 out of 63 provincial People’s Committees have published documents on their electronic portals, announcing projects that meet the eligibility criteria for preferential loans from the 120,000 billion VND program.