The bonds issued by CTCP Investment and Development of Real Estate Century (Cen Invest) with the code CIVCB2124001 were released in October 2021, offering a fixed interest rate of 10.5% per annum. Initially, these bonds had a three-year term and were set to mature on October 13, 2024. However, a second agreement with the bondholders in late October of last year extended the maturity date to October 13, 2025.

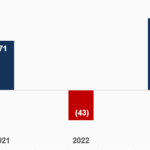

In addition to the previous bond collateral, which included 50 million shares of CTCP Real Estate Century (Cen Land, HOSE: CRE) from Cen Group, the bond is also backed by property rights from a collaboration agreement between Galaxy Land and CRE in the Hoang Van Thu urban project in Ha Noi’s Hoang Mai district. Each CRE share was once valued at over VND 25,000 (post-adjustment) in early 2022 but has since declined, now trading below the VND 7,000 mark, implying a loss of over 70% in value, prompting the company to supplement the bond’s collateral.

| The number of pledged CRE shares has significantly decreased in value |

According to a document sent to the Hanoi Stock Exchange (HNX) on February 11, 2025, Cen Invest has pledged an additional 20.7 million shares of CTCP Investment Thanh Dat VN (Thanh Dat VN), equivalent to 67.87% of its charter capital. Thanh Dat VN is currently the investor in the Khe Cat residential project in Quang Yen, Quang Ninh. Along with the shares, the project’s property rights have also been added to the bond’s collateral list.

Thanh Dat VN not only serves as the collateral provider but also undertakes to guarantee Cen Invest’s bond payment obligations and refrains from incurring new loans or using its assets to secure other obligations.

Cen Invest has proposed a plan in case it needs to sell all its shares in Thanh Dat VN to repay the bond debt. The company commits to a minimum price of VND 373 billion, subject to bondholder approval. The transaction will be finalized by May 31, 2025, at the latest, and the proceeds, after deducting expenses, will be transferred to the bond repayment account.

Regarding its financial performance, Cen Invest reported a post-tax profit of over VND 1.6 billion in the first half of 2024, a significant improvement from a loss of VND 31 billion in the same period last year. As of June 30, 2024, its owner’s equity stood at over VND 2,720 billion, while total liabilities exceeded VND 3,734 billion.

Khe Cat residential project in Quang Ninh – Illustration

|

It’s not just Cen Invest that has sought an extension; CRE – where Shark Hung serves as Vice Chairman of the Board of Directors – has also received bondholder approval to extend the CRE202001 bond by almost nine months. The VND 450 billion bond, issued in late 2020 with an initial term of 36 months, has now been adjusted twice, extending the maturity by a total of 22 months. By the end of 2024, CRE had repurchased a portion of the principal debt, reducing the outstanding balance to approximately VND 354 billion.

Similarly, the previous bond collateral, which included nearly 59 million CRE shares, has also decreased significantly in value since it was first pledged. Additionally, the collateral included 50 million Cen Invest shares, property rights from Galaxy Land, and some other assets.

According to a document CRE sent to HNX on January 24, 2025, the company supplemented its commitment regarding cash flow, stating that all proceeds from the collaboration contract for the Khe Cat project – signed between CRE and Thanh Dat VN – would be immediately transferred to the account used for bond repayment. Furthermore, the bond’s interest rate was adjusted downward from 12% per annum to 10.5% per annum, effective February 2025.

The consolidated Q4/2024 financial statements show that CRE has VND 800 billion on deposit with Thanh Dat VN as a guarantee for the purchase of real estate products in the Khe Cat residential project.

|

Thanh Dat VN was established in 2014 in Ha Long, Quang Ninh, with a charter capital of VND 40 billion. The company primarily operates in the wholesale sector, with Ms. Dam Thi Ha serving as its legal representative. In late 2019, its capital increased to VND 200 billion, with Mr. Le Huy Lan as Chairman and legal representative, and Mr. Vu Minh Thanh as Director. In 2021, Mr. Vuong Hong Khanh (CEO of Cen Invest) became the Director, and Mr. Vuong Van Tuong (Vice Chairman of Cen Invest) assumed the role of Chairman. By mid-2022, the charter capital had risen to VND 305 billion. Mr. Tuong also served as a member of the Board of Directors and the Audit Committee of CRE. In mid-2020, the Quang Ninh Provincial People’s Committee issued a decision approving Thanh Dat VN as the investor for the Khe Cat project. According to the decision, the project covers an area of nearly 11.3 hectares, with a total investment of nearly VND 762 billion. It comprises 246 terraced houses, 80 villas, kindergartens, public works, and service facilities. The project was scheduled for completion in 2023, with business operations commencing from 2024 to 2025. |

Mr. Vuong Hong Khanh (left) and Mr. Vuong Van Tuong

|

– 16:23 13/02/2025

“Encapital Raises $4.3 Million in Bond Offering”

Encapital Financial Technology JSC successfully issued a 100 billion VND bond on December 6, 2024, secured by shares of a securities company listed on the Ho Chi Minh Stock Exchange (HOSE).