While land plots in Ho Chi Minh City’s districts such as District 9, Hoc Mon, Cu Chi, and Binh Chanh started to show signs of recovery in mid-2024, provincial land took a slower pace with transactions only picking up towards the end of 2024.

According to observations, residential land plots in Nhon Trach and Long Thanh districts of Dong Nai province, Di An and Tan Uyen districts of Binh Duong province, as well as agricultural and garden land in Cam My and Dinh Quan districts of Dong Nai province, and Ham Thuan Nam district of Binh Thuan province, have witnessed improved liquidity.

Prices have started to recover compared to the beginning of 2023, but they are still 10-20% lower than the 2021-early 2022 period. Some investors who had been holding on to land in these areas have begun to offload their inventory after a period of illiquidity.

Notably, residential land plots with attractive prices have been snapped up by investors from the northern region since the end of 2024, causing a slight increase in prices in certain areas. In Nhon Trach district of Dong Nai province, land prices increased by 7-10% compared to the beginning of 2024 as the Lunar New Year approached. After the holiday, while land prices in Nhon Trach remained stable, expectations about price appreciation and liquidity have gradually formed among investors.

Investors are starting to pay attention to provincial land. Photo: Tieu Bao

In reality, at the beginning of 2024, when forecasting the provincial land market, experts predicted that land products around major infrastructure and locations close to Ho Chi Minh City would recover first, followed by a spillover effect to neighboring areas.

Now, as prices and demand for land in Ho Chi Minh City have noticeably rebounded, the “spillover effect” has started to shift to the provincial market. Investors believe that the post-Tet period marks the beginning of a new cycle for provincial land. In the 2026-2027 period, prices are expected to surge again. However, a “hot” market and price increases similar to the previous period are unlikely to occur in 2025.

Mr. Tran Khanh Quang, an experienced real estate investor, opined that the land market remains unpredictable and could even experience fluctuations due to various influencing factors, such as adjustments to the land price framework starting in 2025. Notably, in many localities, the land price framework has increased by 50% to 500%, making the land market challenging to predict.

However, according to Mr. Quang, the land market currently has a significant inventory. Additionally, economic difficulties affect investors’ psychology, so land transactions will remain stagnant in the second quarter of 2025. It is not until the end of 2025, when inventory levels decrease, that land transactions are expected to improve.

“The market’s vibrancy in 2025 will attract investors’ attention, encouraging them to explore and invest. However, strong price fluctuations, land fever, or speculation that drove prices up in previous years are unlikely to recur,” emphasized Mr. Quang.

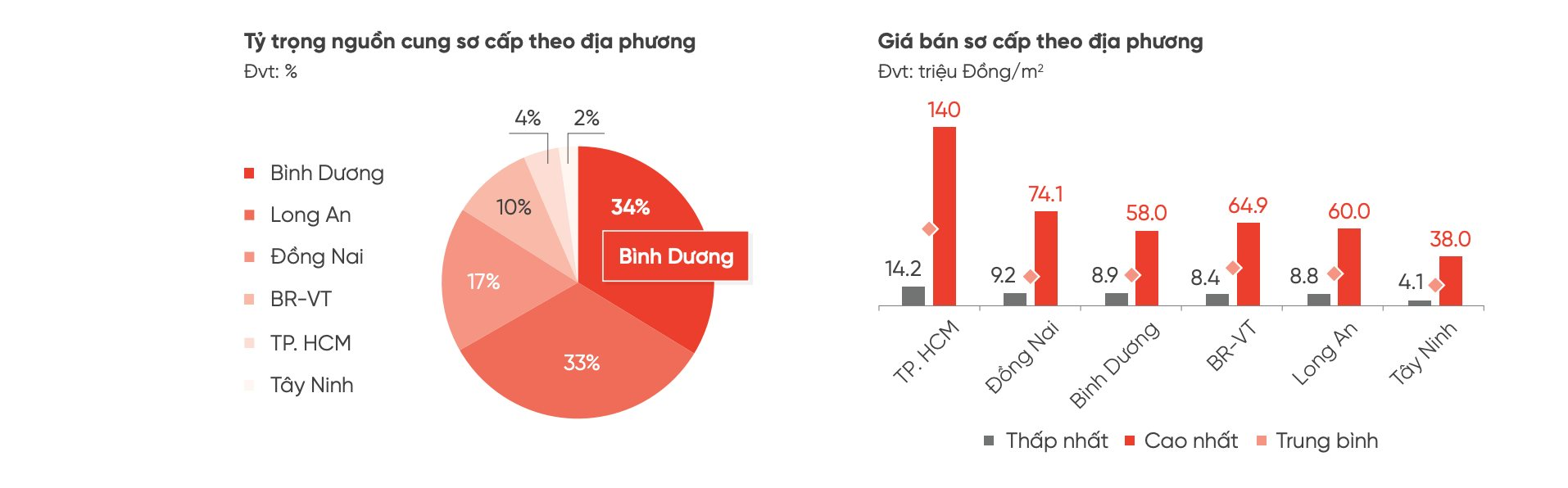

The supply of land in the South is mainly concentrated in the provinces neighboring Ho Chi Minh City. Data from DKRA Group’s 2024 report.

Sharing a similar viewpoint, Mr. Vo Hong Thang, Deputy Director of DKRA Group, stated that provincial land would have opportunities in the future due to stricter regulations on land subdivision and plot sales in urban areas. However, more time is needed for a significant improvement in supply and demand.

According to Mr. Thang, the land segment is expected to increase in 2025 but is unlikely to witness a dramatic surge. The number of land plots offered for sale is expected to range from 3,000 to 3,500, distributed in the provinces of Binh Duong, Dong Nai, and Long An. Other areas, such as Ho Chi Minh City, Ba Ria-Vung Tau, and Can Tho, will continue to face a scarcity of land supply.

“The Law on Real Estate Business prohibits the sale of land plots in wards and districts belonging to third-tier cities and above, leading to a reduction in supply. This forces new projects to be developed in areas farther from city centers, such as in communes or fourth-tier cities and below,” said Mr. Thang.

“For attractive land funds, developers often prioritize high-profit segments such as apartment buildings or townhouses. The distance from the city center reduces the appeal and transactions of the land segment, especially when investors remain cautious,” Mr. Thang added.

The Power of Modern Distribution Channels in Driving Festive Season Sales

The Lunar New Year of the Snake 2025 witnessed an increase in consumer spending, yet prices for essential goods remained relatively stable. The market steadied amidst a shift in consumer behavior, with a growing trend towards mindful spending.

The Savvy ‘Land Hustlers’: Unveiling the Story of Auctioned Land at a Whopping $5.3 Million per Square Meter in a Suburban Street

Our client was determined not to miss out on the prime corner lot, so they decided to bid on 5 additional adjacent lots. Astonishingly, they won the auction for all 6 lots, with the winning bid for the corner lot reaching a remarkable 120 million VND per square meter in the auction area belonging to the Northern Residential Area of An Thi Town, An Thi District, Hung Yen Province. The market value of these lots has soared, with resellers offering prices upwards of 300 million VND to 1 billion VND per lot, depending on the location.

Unleashing the Power of Words: Crafting Captivating Copy for a Vibrant City

Unveiling the Economic Pulse of Ho Chi Minh City: Positive Growth with Retail Leading the Charge

The Ho Chi Minh City economy in January 2025 witnessed positive growth, especially in retail and consumer services, with revenue reaching nearly VND 108,000 billion. Moving forward, the city will continue to focus on key tasks, accelerate public investment disbursement, and promote administrative reform.