VIS Rating anticipates improved cash flow in 2025 as leading developers drive sales. (Photo: Int)

VIS Rating has released the 2024 full-year financial results of the top 30 listed residential real estate developers by revenue. The report reveals a decline in net profit for the year, attributed to elevated interest expenses and operating losses incurred by developers facing legal issues.

In the fourth quarter of 2024, developers witnessed a significant surge in revenue, increasing by 183% year-over-year, which contributed to an 8% rise in annual revenue for 2024. However, net profit declined by 7% due to higher interest expenses and operating losses experienced by developers facing legal challenges, including Danh Khoi Group Joint Stock Company (NRC), Nam Bay Bay Investment Joint Stock Company (NBB), and LDG Joint Stock Company (LDG).

On the other hand, prominent developers such as Dat Xanh Group Joint Stock Company (DXG) – the parent company of Ha An (BBB, stable), Nam Long Investment Joint Stock Company (NLG), and Vinhomes Joint Stock Company (VHM), achieved higher profit margins upon the completion of their key projects, predominantly in the low-rise segment.

In 2024, the total debt of developers increased by 20% year-over-year to VND 208,000 billion, primarily to fund project development costs (as in the case of VHM, NLG, and DXG) and to supplement working capital or restructure maturing debt (such as NVL and NBB). This surge in debt resulted in a 41% increase in interest expenses compared to the previous year.

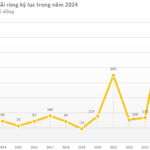

The industry’s cash position improved by 46% year-over-year in 2024, reaching the highest level in the past five years, driven by robust cash flow from investment and financing activities. This growth was facilitated by enhanced access to capital through bank loans and project restructuring initiatives like mergers and acquisitions, joint venture contracts, and equity transfers.

However, operating cash flow remained negative for most developers in 2024, as many accelerated disbursements to expedite project development after obtaining legal approvals and anticipated project launches in 2025, including VHM, Khang Dien House Trading and Investment Joint Stock Company (KDH), and Phat Dat Real Estate Development Joint Stock Company (PDR). In contrast, other developers continued to grapple with issues like delayed repayment of principal and interest on bonds and legal challenges related to projects, such as Nova Group Real Estate Joint Stock Company (NVL) and NBB.

“Despite improvements in revenue recognition and cash position, developers’ profits and operating cash flow remained weak in 2024. Nevertheless, we believe that 2025 will usher in enhanced operational efficiency for developers. The new housing supply, fueled by intensified project development activity since the second half of 2024, coupled with positive buyer sentiment, will propel sales and bolster developers’ financial performance in 2025,” said Duong Duc Hieu, Director and Senior Analyst at VIS Rating.

Previously, VIS Rating experts highlighted weak cash flow as the primary credit weakness among developers in Vietnam, with approximately 70% of the monitored companies exhibiting weak operating cash flow to service maturing debt.

VIS Rating expects this metric to improve in 2025 as cash inflows from sales are led by prominent developers like VHM, KDH, DXG, and NLG, who plan to significantly increase their launches in major cities.

The credit differentiation within the industry is anticipated to widen in 2025. Developers will confront substantial increases in project development costs while leverage ratios remain elevated. Notably, those with a history of delayed debt repayments will encounter heightened challenges in refinancing to avert future delays.

The Stock Market Blog: Expecting a Difference from Earnings Reports

The large-cap stocks, notably FPT and the banking sector, bore the brunt of today’s market downturn. Despite the sea of red, there were pockets of resilience. Impressively, many stocks witnessed robust cash flow support, indicating inherent strength that could set them apart in upcoming sessions.

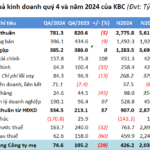

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.