Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 461 million shares, equivalent to a value of more than 10.1 trillion VND; HNX-Index reached over 46 million shares, equivalent to a value of more than 683 billion VND.

VN-Index opened the afternoon session with a continuation of the tug-of-war between buyers and sellers, with the latter gradually gaining the upper hand, causing the index to weaken and close in the red. In terms of impact, BID, VCB, MBB, and HPG were the most negative stocks, taking away more than 2 points from the index. On the other hand, BVH, VNM, LPB, and VHM remained resilient and contributed more than 1.1 points to the overall index.

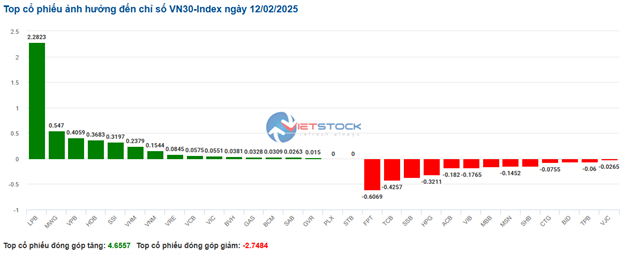

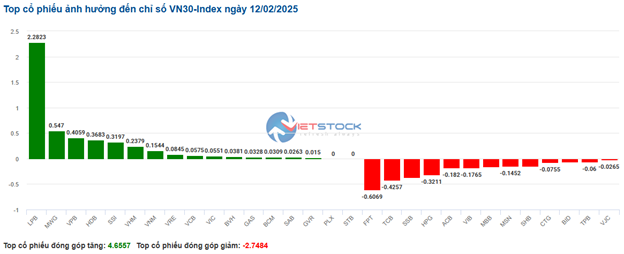

| Top 10 stocks with the strongest impact on the VN-Index on 12/02/2025 (in points) |

In contrast, the HNX-Index had a rather optimistic performance, with positive contributions from stocks such as KSV (+1.26%), HGM (+10%), VNR (+5.88%), and VIF (+3.55%)…

|

Source: VietstockFinance

|

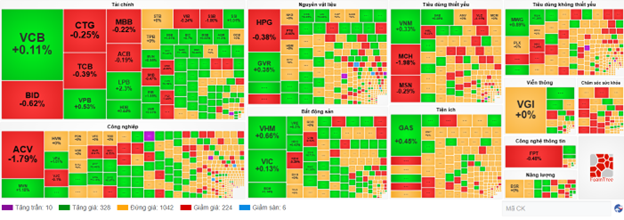

The healthcare sector witnessed the sharpest decline in the market, falling by -1.2% mainly due to DHG (-0.39%), IMP (-1.23%), DHT (-0.91%), and DVN (-6.69%). This was followed by the financial and industrial sectors, which decreased by 0.32% and 0.22%, respectively. On the other hand, the telecommunications sector recorded a modest recovery of 0.41%, with gains seen in VGI (+0.58%), CTR (+0.08%), ELC (+0.34%), FOC (+1.85%), and TTN (+2.87%)

In terms of foreign investors’ activities, they continued to net sell over 448 billion VND on the HOSE exchange, focusing on stocks such as MWG (107.64 billion), HPG (50.46 billion), VHM (45.51 billion), and HCM (42.71 billion). On the HNX exchange, foreign investors net sold over 9 billion VND, mainly offloading IDC (16.99 billion), CEO (2.89 billion), MBS (1.83 billion), and VTZ (1.41 billion)

| Foreign investors’ buying and selling activities |

Morning Session: Investment stocks in focus

The main indices continued to fluctuate slightly above the reference level, with liquidity decreasing compared to the previous session. The positive performance of investment stocks was the most notable development in the latter half of the morning session. At the midday break, the VN-Index stood at 1,270.49 points, inching up 0.16%; while the HNX rose 0.36% to 229.69 points.

There were no standout performers among the top stocks influencing the VN-Index. LPB led the gainers, contributing 0.5 points to the index, while BID took away 0.3 points. The remaining stocks had a negligible impact, indicating a highly polarized market.

The focus shifted to investment stocks as the 9th Extraordinary Session of the 15th National Assembly opened this morning. Expectations of accelerated public investment disbursement triggered strong buying interest in this sector, resulting in significant gains for several stocks despite the overall subdued market sentiment. These included VCG (+3.12%), HHV (+2.36%), FCN (+2.37%), LCG (+2.79%), PLC (+2.34%), KSB (+2.26%), HT1 (+2.44%), PC1 (+1.5%), C4G (+1.14%), and CII (+1.04%)…

In other sectors, narrow fluctuations dominated, with most sectors recording changes of less than 1%. The financial sector saw a few notable gainers, including LPB (+1.89%), EIB (+1.58%), NVB (+1.05%), VND (+1.19%), and VIX (+1.61%)… However, large-cap stocks in the sector mostly traded slightly lower or sideways, resulting in a near-unchanged sector index.

The healthcare sector paused its upward momentum after recent gains, with the sector index adjusting by 0.56% due to losses in DVN (-4.09%), DHT (-0.91%), DMC (-1.21%), IMP (-0.41%), and DBD (-0.67%)…

Foreign investors significantly reduced their trading activities in the morning session but maintained their net selling position of over 211 billion VND across all three exchanges. The most sold stocks were MWG (40.94 billion), HCM (28.04 billion), and SSI (25.26 billion). Conversely, VCG was the most bought stock by foreign investors in the morning session, but the value was relatively modest at nearly 24 billion VND.

10:30 am: Investors remain cautious, VN-Index fluctuates around 1,270 points

The market breadth tilted slightly towards the positive side, but buying and selling forces were well-balanced, preventing the main indices from breaking out. As of 10:30 am, the VN-Index gained 2.14 points, hovering around 1,270 points. The HNX-Index rose 0.49 points, trading around 229 points.

Stocks in the VN30 basket exhibited a slightly more positive bias. Specifically, LPB, MWG, VPB, and HDB contributed 2.28 points, 0.54 points, 0.40 points, and 0.36 points, respectively, to the overall index. Conversely, FPT, TCB, SSB, and HPG faced strong selling pressure, taking away more than 1.7 points from the VN30-Index.

Source: VietstockFinance

|

The non-essential consumer goods sector posted strong gains, providing support to the broader market despite a polarized performance. Large caps such as MWG (+1.24%), PNJ (+0.42%), GEX (+3.3%), and GEE (hitting the daily limit-up price) contributed to the sector’s performance. On the other hand, stocks like FRT (-0.98%), SAS (-0.42%), TLG (-0.64%), and TNG (-0.43%) recorded modest losses.

Following the recovery trend, the real estate sector also witnessed a decent advance. Notable gainers included VHM (+0.66%), VIC (+0.25%), BCM (+1.28%), VRE (+0.61%), and KBC (+1.56%)

In another development, the information technology sector faced selling pressure, resulting in a slight decline of 0.43%. This was driven by losses in FPT (-0.41%) and ITD (-0.69%). Conversely, only three stocks managed to stay in positive territory: CMG (+1.27%), SBD (+1.27%), and CMT (+0.56%)… while more than ten stocks remained unchanged, including ELC, DLG, HPT, and POT…

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks trading sideways and a slight advantage for the buying side. There were 328 gainers (including 10 stocks hitting the daily limit-up price) and 224 decliners (including 6 stocks hitting the daily limit-down price)

Source: VietstockFinance

|

Opening: Real estate stocks take the lead

At the start of the February 12 session, as of 9:30 am, the VN-Index opened in positive territory, climbing to 1,271.22 points. Meanwhile, the HNX-Index also edged higher, reaching 229.31 points.

The green dominated the VN30 basket, with 8 decliners, 16 advancers, and 6 stocks trading sideways. Among the decliners, SSB, VIB, and STB witnessed the sharpest drops. On the other hand, BCM, GVR, and LPB were the top gainers.

Real estate stocks took the lead in the market this morning, with the sector rising by 0.54%. Several stocks witnessed positive momentum right from the opening bell, including VHM (+0.79%), SZC (+2.05%), KBC (+1.56%), NLG (+1.2%), DXG (+0.34%), and VRE (+0.91%)…

Additionally, the non-essential consumer goods sector also contributed positively to the market’s performance. Notable gainers included MWG (+0.53%), GEX (+2.59%), GEE (+2.84%), PLX (+0.49%), PNJ (+0.74%), and DGW (+0.66%)…

– 09:42 12/02/2025

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.

Market Beat: Foreigners Turn Net Buyers, VN-Index Surges Over 10 Points

The market closed with strong gains, seeing the VN-Index climb by 10.42 points (+0.82%), settling at 1,288.56; while the HNX-Index rose by 1.95 points (+0.83%) to close at 237.79. The market breadth tilted in favor of bulls with 532 gainers versus 250 decliners. The large-cap stocks in the VN30 basket painted a predominantly green picture, with 26 tickers in the green, 3 in the red, and 1 unchanged.

Market Beat: VN30 Under Siege in Final Hour, VN-Index Reverses Fortunes

The market closed with the VN-Index down 3.36 points (-0.26%) to 1,272.72, while the HNX-Index climbed 1.97 points (+0.85%) to 233.19. The market breadth tilted towards gainers with 425 advancing stocks against 314 declining ones. Within the VN30 basket, 19 stocks lost ground, 9 advanced, and 2 closed flat, indicating a mixed performance among large-caps.

Market Beat: Effort Rewarded, VN-Index Closes Above 1,270

The VN-Index extended its recovery efforts from the latter half of the morning session into the afternoon, posting a gain of 3.44 points to close at 1,270.35 on February 13. This came despite a notable corrective phase just before 2 pm. The HNX-Index and UPCoM also ended the session in positive territory, with the former climbing 0.2 points to 229.52 and the latter advancing 0.93 points to 97.74.

Market Mayhem: Navigating the Storm

The VN-Index’s ascent narrowed amid sustained above-average trading volumes. This indicates persistent selling pressure as the index retests the old peak from December 2024 (around 1,270-1,285 points). Unless this dynamic changes in upcoming sessions, breaking out of this range seems unlikely. Notably, the Stochastic Oscillator is venturing deeper into overbought territory. Should a sell signal emerge and push the index out of this region, the risk of a downward correction heightens.