Market liquidity increased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 736 million shares, equivalent to a value of more than 15.3 trillion VND. The HNX-Index reached nearly 72.6 million shares, equivalent to a value of more than 1.2 trillion VND.

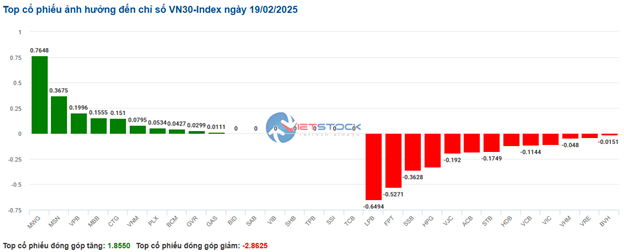

| Top 10 stocks with the strongest impact on the VN-Index on February 19th |

The VN-Index performed quite well in the afternoon session as buyers continued to appear, helping the index maintain its positive momentum until the end of the session and closing in the green. In terms of impact, GVR, BID, REE, and EIB were the most positive influences on the VN-Index, contributing over 2.3 points to the increase. On the other hand, GEE, BVH, SSB, and HPG were still under selling pressure, but their impact was not significant.

The HNX-Index followed a similar trajectory, with positive influences coming from IDC (+3.72%), CEO (+6.57%), BAB (+3.25%), and MBS (+1.8%), among others.

|

Source: VietstockFinance

|

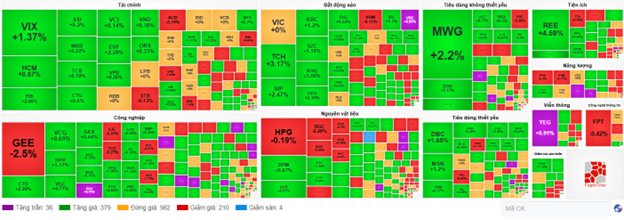

The real estate sector was the group with the strongest growth, up 1.29%, mainly driven by VHM (+0.51%), VIC (+0.5%), BCM (+2.59%), and VRE (+2.08%). This was followed by the telecommunications and industrial sectors, with increases of 1.24% and 1.22%, respectively. On the other hand, the materials sector saw the largest decline in the market, falling by -0.59%, mainly due to KSV (-9.98%), HPG (-0.19%), MSR (-11.95%), and VIF (-0.56%).

In terms of foreign trading, they returned to net buying on the HOSE exchange, focusing on stocks such as OCB (59.04 billion VND), FPT (47.01 billion VND), SIP (44.82 billion VND), and DBC (43.23 billion VND). On the HNX exchange, foreigners net bought over 62 billion VND, mainly investing in SHS (59.28 billion VND), CEO (15.71 billion VND), PVS (6.44 billion VND), and VTZ (1.83 billion VND).

| Foreign trading net buying and selling dynamics |

Morning Session: Extending the Uptrend

At the end of the morning session, the main indices remained in agreement with the uptrend. The VN-Index temporarily stood at 1,285.58 points, up 7.74 points, or 0.61%; the HNX-Index also extended its gain to 236.79 points (+0.4%). Buyers remained overwhelmingly dominant, with 431 stocks rising and 209 declining. The VN30 basket followed a similar pattern, with 24 gainers, 4 unchanged, and 2 losers.

The top 10 stocks with the most positive impact on the VN-Index contributed 3.8 points to the index’s gain, with 1.5 points coming from REE, GVR, and BID. In contrast, the total impact of the 10 stocks on the opposite side only took away half a point from the index, demonstrating the dominance of buyers.

The majority of stock groups turned green. The industrial group rebounded after two consecutive sessions of correction, temporarily leading the market with a 1.04% gain, led by ACV (+3.32%), HHV (+1.56%), CTD (+1.44%), HBC (+5.63%), FCN (+2.01%), TV2 (+4.9%), and PHP (+4.01%)… Following closely were the utilities, real estate, and consumer staples sectors, which also traded positively, breaking through 1% in the morning session with notable stocks such as REE hitting the ceiling price, POW (+1.63%), and QTP (+2.17%); TCH (+6.67%), SIP (+4.32%), CEO (+3.65%), and IDC (+2.61%); MCH (+2.29%), MSN (+1.51%), ANV (+2.08%), and DBC (+1.47%).

On the other hand, materials were the most heavily sold group in the morning session, falling by 0.79%. This was due to profit-taking pressure on mining stocks that had surged in the past. Stocks such as KSV, MSR, HGM, BMC, KVC, and KCB all corrected sharply, dragging down the entire group. However, the rest of the group still performed relatively well, especially construction material stocks like VGC, KSB, VCS, FCM, and BCC …, which continued to stand out.

Foreigners continued their familiar net selling trend, with a value of over 173 billion VND on all three exchanges this morning. The selling pressure was not concentrated on a few specific stocks but was spread across many stocks, with DGC, HHS, and DPM currently facing the strongest net selling pressure, with values hovering around the 30 billion VND mark.

10:40 am: Leaning Towards the Green in the Context of Modest Liquidity

Despite a lack of strong support from cash flow, the strong upward momentum at the beginning of the session helped the main indices maintain their positive momentum. As of 10:30 am, the VN-Index gained 5.16 points, trading around 1,283 points. The HNX-Index rose 0.96 points, trading around 236 points.

The breadth of stocks within the VN30 basket was strongly polarized, with the selling side having a slight advantage. Among the decliners, LPB took away 0.64 points, LPB took away 0.52 points, SSB took away 0.36 points, and HPG took away 0.32 points from the overall index. Conversely, some stocks like MWG, MSN, VPB, and MBB were supported by buyers and contributed 1.4 points to the index’s gain.

Source: VietstockFinance

|

Stocks in the materials sector continued to weaken, recording the largest decline in the market of 0.79%. Notably, selling pressure was concentrated in KSV, which hit the floor price, while MSR fell by 8.41%, HPG by 0.19%, and DGC by 0.37%… Conversely, the green still prevailed in some large- and mid-cap stocks, but their impact was not significant, such as GVR rising by 1.13%, VGC by 3.33%, and DCM by 0.98%…

In a more positive development, the industrial sector witnessed the strongest recovery in the market, increasing by 1.58%. Buying interest mainly focused on stocks such as MVN, which rose by 0.24%, ACV by 3.51%, VEF by 2.06%, and PHP by 4.45%…

Following closely, the telecommunications sector also saw a decent recovery, despite the mixed performance of individual stocks. Specifically, buyers targeted stocks such as VGI, which rose by 0.96%, SGT by 1.66%, YEG hitting the ceiling price, and FOX by 6.91%… On the selling side, red appeared in CTR, which fell by 1.4%, VNZ by 0.42%, ELC by 0.68%, and VNB by 0.31%…

Notably, the YEG stock witnessed an early strong surge in the morning session, accompanied by a White Marubozu candlestick pattern and an increase in trading volume above the 20-session average, indicating heightened trading activity. Moreover, the stock’s price is currently finding support from the SMA 50-day moving average, while the MACD and Stochastic Oscillator indicators continue to trend upward after generating buy signals, further reinforcing the short-term recovery momentum.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, buyers maintained a slight edge. There were 379 gainers and 210 decliners.

Source: VietstockFinance

|

Opening: Maintaining a Mild Uptrend

At the start of the February 19 session, as of 9:30 am, the VN-Index rose quite positively, reaching 1,280.45 points. The HNX-Index also edged higher, climbing to 236.32 points.

The S&P 500 index closed at a record high on Tuesday (February 18) as investors shrugged off concerns about inflation and global trade. Specifically, the S&P 500 index added 0.24% to close at a record high of 6,129.58 points, after hitting an intraday record of 6,129.63 points before the close. The Nasdaq Composite Index advanced 0.07% to 20,041.26 points, while the Dow Jones index edged up 10 points, or 0.02%, to 44,556.34 points.

As of 9:30 am, industrial stocks were among the top-performing sectors, with notable gainers including CTD (+4.32%), HBC (+7.04%), ACV (+1.42%), and MVN (+3.38%)…

Telecommunications stocks also contributed significantly to the morning’s gains, as all stocks in this group traded in the green, including YEG (+4.93%), VGI (+0.72%), and FOX (+0.52%)…

– 09:39 19/02/2025

Market Beat: VN30 Under Siege in Final Hour, VN-Index Reverses Fortunes

The market closed with the VN-Index down 3.36 points (-0.26%) to 1,272.72, while the HNX-Index climbed 1.97 points (+0.85%) to 233.19. The market breadth tilted towards gainers with 425 advancing stocks against 314 declining ones. Within the VN30 basket, 19 stocks lost ground, 9 advanced, and 2 closed flat, indicating a mixed performance among large-caps.

Market Mayhem: Navigating the Storm

The VN-Index’s ascent narrowed amid sustained above-average trading volumes. This indicates persistent selling pressure as the index retests the old peak from December 2024 (around 1,270-1,285 points). Unless this dynamic changes in upcoming sessions, breaking out of this range seems unlikely. Notably, the Stochastic Oscillator is venturing deeper into overbought territory. Should a sell signal emerge and push the index out of this region, the risk of a downward correction heightens.

The Vietstock Daily: A Glimmer of Hope for the Short-Term Outlook

The VN-Index rebounded after a previous sharp decline, with trading volume remaining above the 20-day average. This indicates that investors are still actively trading. However, selling pressure at the old peak in December 2024 (corresponding to the 1,270-1,280-point range) remains strong. To sustain the upward momentum, the index needs to surpass this range. Currently, the MACD indicator is still showing a buy signal and is above the zero threshold. If this condition persists in the coming period, risks will be mitigated.

The Cautious Mindset Returns

The VN-Index retreated with below-average trading volume, indicating investor caution as the index nears its December 2024 peak (1,270-1,280 points). Additionally, the Stochastic Oscillator has signaled a sell-off in overbought territory, suggesting heightened short-term adjustment risks if the indicator falls from these levels.

The Power of Persuasive Writing: Crafting a Compelling Headline

“Vietstock Weekly: Upholding the Uptrend”

The VN-Index continued its upward trajectory, marking three consecutive weeks of gains since crossing above the 200-week SMA. Accompanying this rise is a surge in trading volume, which has exceeded the 20-week average since mid-November 2024. This indicates a positive shift in market participation. At present, the MACD indicator has just triggered a buy signal, crossing above the signal line. Should this momentum be sustained, the short-term outlook remains optimistic.