Market liquidity slightly decreased compared to the previous session, with the VN-Index matching volume reaching over 667 million shares, equivalent to a value of more than 14.4 trillion VND; HNX-Index reached over 66.9 million shares, equivalent to a value of more than 1 trillion VND.

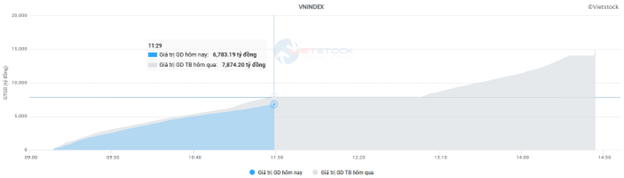

| Top 10 stocks with the strongest impact on the VN-Index on February 21, 2025 |

The VN-Index weakened in the afternoon session due to increased selling pressure, but buying support emerged towards the end of the session, helping the index stay in positive territory. In terms of impact, VCB, CTG, BCM, and MWG were the most positive influences on the VN-Index, contributing over 3.8 points to the index. On the other hand, FPT, VIC, VHM, and GAS faced strong selling pressure and took away more than 1 point from the overall index.

In contrast, the HNX-Index had a less positive performance, dragged down by KSV (-8.15%), NVB (-1.72%), BAB (-1.61%), and MBS (-1.04%)…

|

Source: VietstockFinance

|

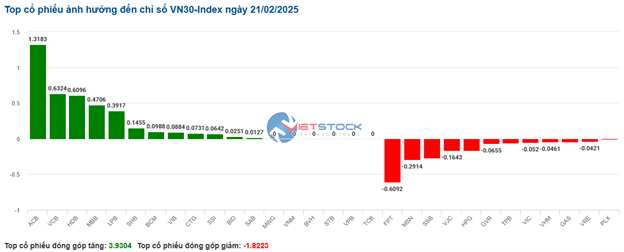

The non-essential consumer goods sector was the strongest performer in the market, rising 0.6%, led by MWG (+2.47%), PLX (+0.23%), PNJ (+0.21%), and GEE (+2.82%). The financial and essential consumer goods sectors followed with gains of 0.6% and 0.57%, respectively. On the other hand, the information technology sector recorded the largest decline in the market, falling 0.68%, mainly due to losses in FPT (-0.7%) and CMG (-0.45%).

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, focusing on FPT (145.03 billion VND), KDH (54.77 billion VND), STB (52.68 billion VND), and MWG (47.28 billion VND). On the HNX exchange, foreign investors were net buyers, with a focus on CEO (8.37 billion VND), SHS (5.07 billion VND), VTZ (4.02 billion VND), and HUT (1.49 billion VND).

| Foreign Buying and Selling Activities |

Morning Session: Market Fluctuates Near the Previous Peak of 1,300 Points

VN-Index maintained its positive territory thanks to the efforts of a few large-cap stocks. At the midday break, the VN-Index stood at 1,295.19 points, up 0.17%, while the HNX-Index fell 0.03% to 237.94 points. The market breadth was slightly negative, with 368 declining stocks and 334 advancing stocks.

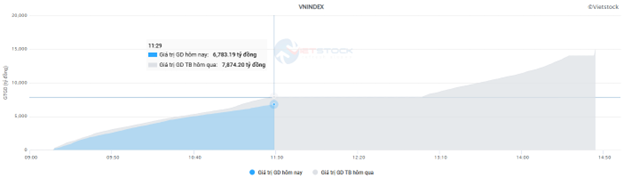

Liquidity decreased slightly compared to the previous session as investors became more cautious near the important resistance level. The trading volume of the VN-Index reached nearly 305 million units, equivalent to a value of almost 6.8 trillion VND, a decrease of 14% compared to the previous morning. The HNX-Index recorded a trading volume of nearly 35 million units, with a value of approximately 500 billion VND.

Source: VietstockFinance

|

VCB was the main pillar, contributing 1.8 points to the VN-Index. Stocks such as VNM, BCM, and MWG also supported the index by adding more than 1.5 points. The adjustment was more focused on mid- and small-cap stocks, with FPT being the only significant negative influence, taking away nearly half a point from the VN-Index.

The market continued to witness a mixed performance across sectors, with most sectors fluctuating within a narrow range. On the positive side, the non-essential consumer goods sector led the gains with a 0.7% increase, mainly driven by strong buying interest in MWG (+2.47%), PLX (+0.46%), GEE (+1.13%), PNJ (+0.43%), STK (+1.69%), PRT (+6.36%), and PET (+1.03%)… Stocks such as VNM (+1.65%), VHC (+1.7%), ANV (+1.46%), VLC (+2.78%), and SAB (+0.97%) also stood out, helping the essential consumer goods sector rise by 0.41%.

Large-cap sectors, such as financials and real estate, also exhibited a mixed performance. While stocks like VCB (+1.42%), HDB (+1.09%), BVH (+1.58%), and VAB (+1.9%) recorded gains, along with BCM (+2.76%), SNZ (+2.25%), SIP (+1.52%), and CEO (+2.11%)… the majority of stocks in these sectors faced corrective pressures.

On the other hand, the information technology sector, weighed down by the two leading stocks, FPT (-0.77%) and CMG (-0.45%), was the worst-performing sector in the market, declining by 0.75%. FPT also faced strong net selling pressure from foreign investors during the morning session, with a net sell value of nearly 68 billion VND.

10:30 AM: Selling Pressure Resurfaces, VN-Index Struggles to Break Out

Selling pressure returned, causing the main indices to weaken and fluctuate around the reference level. As of 10:30 AM, the VN-Index gained a slight 0.21 points, hovering around 1,293 points. The HNX-Index lost 0.27 points, trading around 237 points.

The VN30 basket of stocks exhibited a mixed performance, with an equal number of gainers and decliners. Specifically, bank stocks such as ACB, VCB, HDB, and MBB contributed 1.32 points, 0.63 points, 0.61 points, and 0.47 points to the index, respectively. Conversely, FPT, MSN, SSB, and VJC faced selling pressure, taking away more than 1.3 points from the VN30-Index.

Source: VietstockFinance

|

The industrial sector recorded the best performance in the market, although it also experienced some mixed movements. Notable gainers in the sector included VEF, which rose 1.44%, HUT up 1.16%, HHV climbing 1.56%, and FCN surging 5.88%… Meanwhile, stocks like CII, VJC, PC1, and SCS faced selling pressure but recorded only minor losses.

The financial sector also attracted investment attention, with MBB rising 0.44%, ACB gaining 1.16%, HDB increasing 1.09%, and VCB climbing 1.31%… On the downside, stocks such as VCI, VIX, VPB, and TCB traded in negative territory, but their losses were not significant.

In contrast, the information technology sector had a less positive performance, as the sector leader, FPT, continued to face selling pressure, along with other stocks like CMG, HPT, and CMT. This weighed heavily on the sector, while the remaining stocks, such as VTB, VTE, SMT, and VBH, remained unchanged, except for ITD, which advanced 1.72%.

As of 10:30 AM, the sell-side dominated the market again, with 340 declining stocks and 302 advancing stocks.

Source: VietstockFinance

|

Opening: Cautious Start to the Session

On February 21, as of 9:30 AM, the VN-Index hovered around the reference level, reaching 1,296.08 points. The HNX-Index also edged slightly higher, trading around 238.39 points.

The VN30 basket of stocks leaned slightly towards the positive side, with 11 decliners, 13 gainers, and 6 unchanged stocks. Notably, SSB, VRE, and FPT were the top losers, while BCM, ACB, and MBB were the biggest gainers.

As of 9:30 AM, the information technology sector was the group with the most negative impact on the market. Specifically, stocks like FPT falling 0.7% and CMG losing 0.11% weighed on the sector.

Additionally, the telecommunications services sector also witnessed a pessimistic sentiment, with most large-cap stocks in the sector trading in negative territory, such as CTR declining 0.92%, VGI falling 0.83%, and YEG slipping 0.31%…

– 09:43 21/02/2025

The Stock Market Week of February 17-21, 2025: Navigating Intensifying Foreign Investor Pressure

The VN-Index sustained a positive upward trajectory this week, with trading volumes above the 20-day average, indicating brisk investor activity. However, foreign investors continued their selling spree, maintaining a net selling position. If this trend persists, it could significantly impact the market as the VN-Index approaches the crucial resistance level of 1,300 points.

The Market Tug-of-War: Will the Stalemate Finally End?

The VN-Index rose while maintaining a tug-of-war stance following recent alternating sessions of gains and losses. Moreover, with trading volume remaining below the 20-day average, it indicates that investor caution is still prevalent. The Stochastic Oscillator indicator is also signaling a sell-off within the overbought territory, with a potential exit from this zone in the coming period. Should this occur, the risk of short-term corrections persists.

The Stock Market Week of February 10-14, 2025: Foreign Investors Continue Their Selling Spree

The VN-Index concluded a week of volatile trading with a modest gain. The index currently hovers above the 200-day SMA, and trading volume exhibits positive signs of improvement. This indicates a vibrant and active trading environment. However, the prolonged foreign selling streak could hinder the index’s growth trajectory in the coming period.

The Market Tug-of-War: Can the Bulls Break Free?

The VN-Index retreated, continuing its volatile movement as it retested the old peak of December 2024 (1,270-1,285 points). This threshold has proven to be a significant resistance level, as the index has repeatedly tested this zone recently. Presently, the Stochastic Oscillator is venturing deep into overbought territory. Should a sell signal emerge and the index falls out of this zone, the risk of a correction heightens in upcoming sessions.

Market Beat: A Tale of Contrasting Headlines and Cautious Sentiment

The market closed with the VN-Index down 1.54 points (-0.12%) to 1,266.91, while the HNX-Index climbed 0.45 points (+0.2%) to 229.32. The market breadth tilted towards gainers with 349 advancing stocks against 375 declining ones. The large-cap basket, VN30-Index, witnessed a similar performance with 14 losers, 11 gainers, and 5 stocks closing flat, indicating a relatively balanced session.