Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 739 million shares, equivalent to a value of more than 15.4 trillion dong; HNX-Index reached over 68.3 million shares, equivalent to a value of more than 1.1 trillion dong.

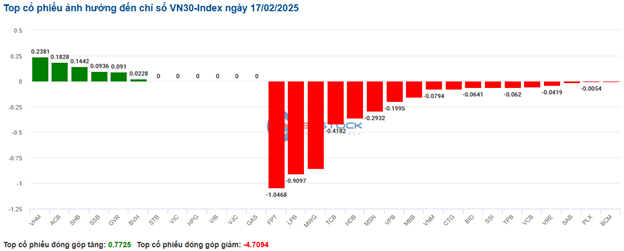

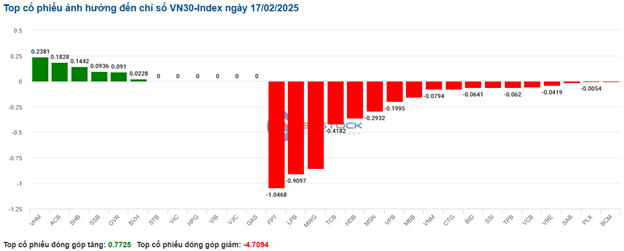

VN-Index opened the afternoon session with a continuation of the tug-of-war, with sellers gradually gaining the upper hand, causing the index to plunge and close in a rather negative red. In terms of impact, BID, MSN, CTG, and TCB were the most negative stocks, taking away more than 2.3 points from the index. On the other hand, GEE, SSB, VIX, and GVR were the stocks that managed to stay in the green, but their contribution was not significant.

| Top 10 stocks impacting the VN-Index on 17/02/2025 |

On the contrary, the HNX-Index had a rather optimistic performance, with the index being positively influenced by stocks such as KSV (+6.21%), NVB (+5.77%), DTK (+3.73%), and HUT (+1.88%)…

|

Source: VietstockFinance

|

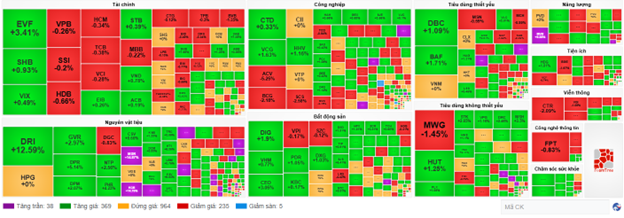

The industrial sector witnessed the sharpest decline in the market, falling by 2.05%, mainly due to transportation group stocks such as ACV (-4.98%), MVN (-5.52%), HVN (-2.23%), and GMD (-0.65%). This was followed by the telecommunications and information technology sectors, which decreased by 1.59% and 0.88%, respectively. Conversely, the materials sector demonstrated a robust recovery of 1.52%, with green signals observed in HPG (+0.19%), GVR (+0.66%), KSV (+6.21%), MSR (+14.87%), and DPM (+0.41%)

In terms of foreign trading activities, they continued to net sell over 617 billion dong on the HOSE exchange, focusing on stocks like MWG (155.24 billion), VNM (94.41 billion), FPT (89.35 billion), and HDB (69.32 billion). On the HNX exchange, foreign investors net sold more than 28 billion dong, mainly offloading SHS (18.38 billion), NVB (14.58 billion), TNG (3.33 billion), and PVS (2.12 billion)

| Foreign Trading Activities |

Morning Session: VN-Index continues to fluctuate around the 1,275-point threshold

The tug-of-war around the 1,275-point level persisted during the morning session. At the midday break, the VN-Index inched up by 0.1%, reaching 1,277.4 points, while the HNX-Index climbed by 0.68% to 232.79 points. The performance of the large-cap stocks was rather lackluster, while mid- and small-cap stocks attracted cash flow, resulting in a higher number of advancing stocks (400) compared to declining ones (257).

Within the top stocks influencing the VN-Index, GVR stood out on the positive side, contributing 0.8 points to the overall gain of the index. The remaining stocks had a less significant impact. Leading the negative side were FPT and BID, with each stock deducting approximately 0.3 points from the VN-Index.

The sector performance exhibited a clear divergence. On the upside, the standout performance of the mining and chemicals stocks continued to propel the materials sector to the top spot, rising by 2.27% by the end of the morning session. Following closely was the healthcare sector, which also witnessed robust buying interest, notably in stocks such as IMP (+2.6%), DBD (+2.51%), DVN (+1.86%), DVM (+7.32%), and LDP (+1.85%)

The financial sector displayed a mixed performance. A few notable gainers this morning included SHB (+1.85%), EIB (+1.83%), SSB (+2.05%), ABB (+2.63%), VAB (+8.33%), NVB (+5.77%), and VIX (+1.97%). In contrast, the top large-cap stocks in the sector either posted slight losses or remained unchanged, impeding the index’s ability to break out.

The sectors dominated by red signals at the end of the morning session included telecommunications, industry, information technology, consumer staples, and energy. Among them, the stocks significantly impacting their respective sectors’ indices were VGI (-1.76%), CTR (-2.34%); ACV (-5.07%), MVN (-1.58%), PHP (-5.43%); FPT (-0.76%), CMG (-0.89%); MSN (-1.17%), MCH (-1.58%). HNG (-1.39%), and others.

Foreign investors persistently net sold nearly 379 billion dong across all three exchanges during the morning session. MWG was the stock that experienced the highest net selling value, amounting to 78 billion dong. Conversely, SHB topped the net buying list, although the value was relatively modest, surpassing 27 billion dong.

10:30 am: Materials Sector Continues to Shine

The buyers gradually lost their foothold, causing the main indices to retreat to the reference levels. As of 10:30 am, the VN-Index rose by 0.54 points, hovering around 1,276 points. Meanwhile, the HNX-Index climbed by 1.69 points, trading around the 232-point level.

Most of the stocks in the VN30 basket were painted in red, lacking positive momentum. Notably, FPT pushed the index up by 1.04 points, LPB contributed a gain of 0.9 points, MWG added 0.85 points, and TCB lifted the index by 0.42 points. Conversely, only a few stocks, including VHM, ACB, SHB, and SSB, received support from buyers, but their impact was not significant.

Source: VietstockFinance

|

The telecommunications sector faced intense selling pressure, recording the most significant decline in the market of 1.32%. Notably, VGI fell by 1.76%, CTR dropped by 1.59%, VNZ decreased by 0.78%, and ELC slipped by 1.66%…

Following closely, the industrial sector also witnessed a substantial drop of 1.35%, with selling pressure primarily concentrated in transportation stocks such as MVN, which declined by 4.28%, ACV fell by 3.74%, GMD decreased by 0.65%, and VTP dropped by 2.31%…

Interestingly, the financial sector exhibited a mixed performance after the previous gaining session. At the time of writing, sellers seemed to have the upper hand in stocks like VCB, which fell by 0.11%, BID decreased by 0.62%, CTG dropped by 0.12%, and TCB slipped by 0.38%… Conversely, stocks like ACB rose by 0.19%, SSB climbed by 0.51%, BVH increased by 0.74%, and SHB advanced by 0.46%…

On a contrasting note, the materials sector continued its upbeat performance, marking the fifth consecutive gaining session. Notably, mining stocks like KSV, MSR, and MTA quickly turned purple. Additionally, GVR rose by 2.14%, DCM climbed by 0.28%, DPM advanced by 1.11%, and BMP increased by 1.69%…

From a technical perspective, the materials sector index continued its robust upward momentum during the morning session of February 17, 2025, forming a Three White Soldiers candlestick pattern, indicating the persistence of bullish sentiment among investors. Furthermore, a Golden Cross emerged between the 50-day SMA and the 100-day and 200-day SMAs, while the MACD indicator maintained its upward trajectory after generating a buy signal, suggesting positive prospects in the medium and long term.

However, the index is currently testing the July 2024 peak (corresponding to the 4,455-4,545-point range), and the Stochastic Oscillator is venturing into the overbought territory, forming a Bearish Divergence. Should a sell signal emerge, and the indicator falls out of this zone, the risk of a downward correction in the short term will heighten.

Source: https://stockchart.vietstock.vn/?stockCode=15

|

Compared to the opening, buyers still held a slight advantage. There were 370 advancing stocks and 236 declining stocks.

Source: VietstockFinance

|

Opening: Positive Start to the Session

At the beginning of the trading day on February 17, as of 9:30 am, the VN-Index edged up slightly to 1,276 points. Similarly, the HNX-Index also witnessed a mild increase above the reference level, hovering around 233 points.

Red signals temporarily dominated the VN30 basket, with 10 declining stocks, 7 advancing stocks, and 13 stocks remaining unchanged. Notably, MWG, LPB, and FPT were the most negative stocks. Conversely, GVR, BVH, and SHB were the top gainers.

The materials sector took the lead among the best-performing groups in the market, registering a growth of nearly 2%. Within this sector, stocks that recorded notable gains included GVR, which rose by 0.66%, DPM increased by 1.52%, BMP climbed by 0.59%, PHR advanced by 4.04%, DRI rose by 1.48%, KSB increased by 1.97%, and DPR climbed by 1.94%,…

On the flip side, the industrial sector painted a rather dull picture, with large-cap stocks in this group turning red from the get-go, such as VTP, which fell by 1.15%, ACV dropped by 3.02%, CTD declined by 0.76%, BCG slipped by 2.68%, and VJC decreased by 0.21%,…

– 09:44 17/02/2025

Market Mayhem: Navigating the Storm

The VN-Index’s ascent narrowed amid sustained above-average trading volumes. This indicates persistent selling pressure as the index retests the old peak from December 2024 (around 1,270-1,285 points). Unless this dynamic changes in upcoming sessions, breaking out of this range seems unlikely. Notably, the Stochastic Oscillator is venturing deeper into overbought territory. Should a sell signal emerge and push the index out of this region, the risk of a downward correction heightens.

The Vietstock Daily: A Glimmer of Hope for the Short-Term Outlook

The VN-Index rebounded after a previous sharp decline, with trading volume remaining above the 20-day average. This indicates that investors are still actively trading. However, selling pressure at the old peak in December 2024 (corresponding to the 1,270-1,280-point range) remains strong. To sustain the upward momentum, the index needs to surpass this range. Currently, the MACD indicator is still showing a buy signal and is above the zero threshold. If this condition persists in the coming period, risks will be mitigated.

The Cautious Mindset Returns

The VN-Index retreated with below-average trading volume, indicating investor caution as the index nears its December 2024 peak (1,270-1,280 points). Additionally, the Stochastic Oscillator has signaled a sell-off in overbought territory, suggesting heightened short-term adjustment risks if the indicator falls from these levels.

The Power of Persuasive Writing: Crafting a Compelling Headline

“Vietstock Weekly: Upholding the Uptrend”

The VN-Index continued its upward trajectory, marking three consecutive weeks of gains since crossing above the 200-week SMA. Accompanying this rise is a surge in trading volume, which has exceeded the 20-week average since mid-November 2024. This indicates a positive shift in market participation. At present, the MACD indicator has just triggered a buy signal, crossing above the signal line. Should this momentum be sustained, the short-term outlook remains optimistic.

The Ultimate Headline: VN-Index: Navigating the Crucial Test Ahead

The VN-Index surged, closely hugging the upper band of the Bollinger Bands, reflecting a highly optimistic investor sentiment. The index has surpassed its previous peak of 1270-1285 points from December 2024 and is now approaching the crucial resistance level of 1300 points. A breakthrough above this level would further enhance the positive outlook. However, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming period, as a potential sell signal from the indicator could trigger a shift in market dynamics.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)