I. MARKET ANALYSIS OF STOCKS ON 02/12/2025

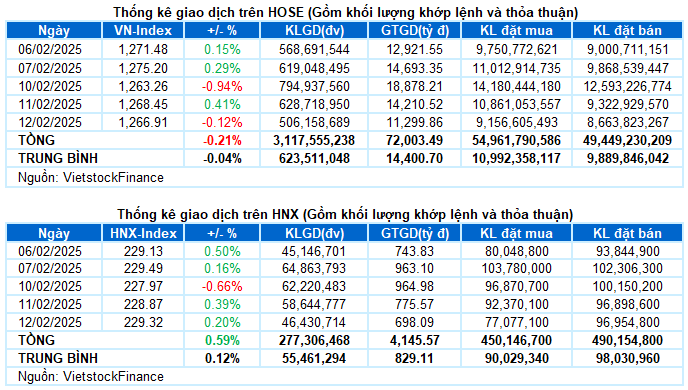

– The main indices fluctuated slightly during the trading session on February 12th. At the close, the VN-Index decreased by 0.12%, to 1,266.91 points; while the HNX-Index increased by 0.2%, reaching 229.32 points.

– The matching volume on the HOSE reached over 461 million units, a decrease of 19.3% compared to the previous session. The matching volume on the HNX also decreased by 19.7%, reaching over 46 million units.

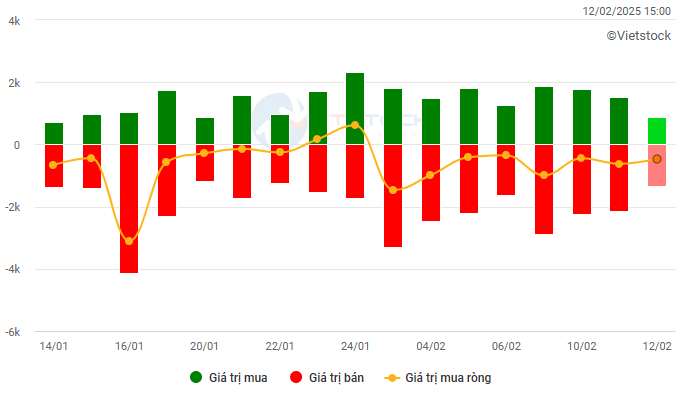

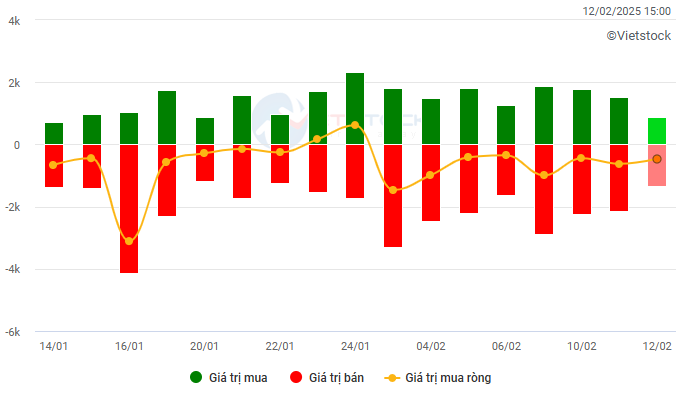

– Foreign investors maintained their net selling trend on the HOSE with a value of more than 448 billion VND and net sold nearly 10 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The market experienced a tug-of-war with declining liquidity in the session on February 12th. Although there were many bright spots from small and medium-cap stocks, the stagnation of the pillar group prevented the index from breaking through. Strong selling pressure towards the end of the session caused the VN-Index to fail to maintain its green status until the end of the day, closing with a decrease of 1.54 points compared to the previous session, down to 1,266.91 points.

– In terms of impact, BID, VCB, and MBB were the most negative pillars, taking away nearly 2 points from the VN-Index. On the other hand, BVH, VNM, and LPB led the gainers, contributing nearly 1 point.

– The pillar group traded rather quietly, with the VN30-Index ending the session down 0.2%, at 1,335.68 points. The breadth of the basket was balanced with 14 declining stocks, 11 gainers, and 5 stocks standing at the reference price. BVH was the most notable bright spot with a gain of 3.2%, while MBB and BID ranked at the bottom with adjustments of more than 1%. The remaining stocks fluctuated slightly around the reference price.

Divergence dominated the sector indices, causing them to fluctuate within a narrow range. Except for the healthcare sector, which recorded a significant decline of more than 1% as red dominated a wide range, notably IMP (-1.23%), DBD (-1%), DVN (-6.69%), DMC (-3.5%), DHT (-0.91%),…

Strong selling pressure towards the end of the session in many bank stocks such as BID (-1.11%), MBB (-1.3%), TCB (-0.7%), ACB (-0.77%), VCB (-0.44%),… caused the financial sector to close with a decrease of 0.32%. However, a series of insurance stocks surged impressively in the afternoon session, such as BVH (+3.23%), VNR (+5.88%), BIC (+4.08%), MIG (+3.47%), BMI (+2.43%), and ABI (+2.46%).

Stocks related to public investment also recorded many notable bright spots in today’s session, including VCG (+3.36%), HHV (+2.36%), LCG (+2.33%), FCN (+1.02%), KSB (+1.51%), PLC (+1.17%), HT1 (+2.03%),… In addition, the telecommunications group recovered quite well as green reappeared in many stocks such as VGI (+0.58%), MFS (+3.6%), TTN (+2.87%), and FOC (+1.85%).

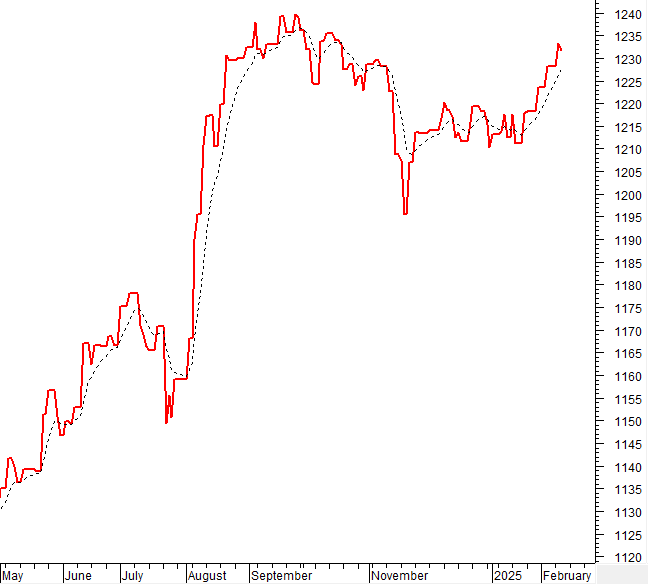

The VN-Index returned to negative territory with trading volume below the 20-day average. This indicates that investors are becoming cautious as the index approaches the old peak of December 2024 (equivalent to the 1,270-1,280 range). In addition, the Stochastic Oscillator indicator has given a sell signal in the overbought region. This suggests that the risk of short-term adjustments will increase if the indicator falls out of this region in the future.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator indicator gives a sell signal

The VN-Index returned to negative territory with trading volume below the 20-day average. This indicates that investors are becoming cautious as the index approaches the old peak of December 2024 (equivalent to the 1,270-1,280 range).

In addition, the Stochastic Oscillator indicator has given a sell signal in the overbought region. This suggests that the risk of short-term adjustments will increase if the indicator falls out of this region in the future.

HNX-Index – Heading towards the old peak of December 2024

The HNX-Index continued to gain points and had the opportunity to retest the old peak of December 2024 (equivalent to the 228-231 range). If, in the next sessions, the index surpasses this region, the situation will become even more optimistic.

However, the Stochastic Oscillator indicator is moving deep into the overbought region and is likely to give a sell signal again. If this happens, the risk of short-term adjustments will remain.

Analysis of Capital Flows

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index cut above the EMA 20 line. If this status continues in the next session, the risk of sudden declines (thrust down) will be limited.

Fluctuations in foreign capital flow: Foreign investors continued to net sell in the trading session on February 12, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON 02/12/2025

Department of Economic Analysis & Market Strategy, Vietstock Consulting

– 17:11 02/12/2025

The Power of Persuasive Writing: Crafting a Compelling Headline

“Vietstock Weekly: Upholding the Uptrend”

The VN-Index continued its upward trajectory, marking three consecutive weeks of gains since crossing above the 200-week SMA. Accompanying this rise is a surge in trading volume, which has exceeded the 20-week average since mid-November 2024. This indicates a positive shift in market participation. At present, the MACD indicator has just triggered a buy signal, crossing above the signal line. Should this momentum be sustained, the short-term outlook remains optimistic.

The Ultimate Headline: VN-Index: Navigating the Crucial Test Ahead

The VN-Index surged, closely hugging the upper band of the Bollinger Bands, reflecting a highly optimistic investor sentiment. The index has surpassed its previous peak of 1270-1285 points from December 2024 and is now approaching the crucial resistance level of 1300 points. A breakthrough above this level would further enhance the positive outlook. However, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming period, as a potential sell signal from the indicator could trigger a shift in market dynamics.

Market Beat: VN-Index Plunges, Steel Stocks Take a Hit on News of Tariffs

The market closed with notable losses, as the VN-Index dipped by 11.94 points (-0.94%) to close at 1,263.26, while the HNX-Index fell by 1.52 points (-0.66%), settling at 227.97. The market breadth was overwhelmingly bearish, with 489 declining stocks outweighing 270 advancing stocks. Within the large-cap VN30 basket, bears held the edge, as evidenced by 16 tickers in the red versus 9 in the green, while 5 remained unchanged.

Is Hesitation Creeping In?

The VN-Index edged higher, forming a Doji candlestick pattern. This reflects investors’ indecision as the index retests the old peak of December 2024 (1,270-1,280 points). However, trading volume remained above the 20-day average, indicating positive market participation. The Stochastic Oscillator and MACD remain upward-trending, providing buy signals. If this momentum persists, the outlook will turn increasingly optimistic.

The Cash Flow Comeback Before the Holiday Break

The VN-Index soared by over 17 points, surging past the 200-day SMA. This rally was accompanied by a spike in trading volume above the 20-day average, indicating a resurgence of active participation by investors. The Stochastic Oscillator and MACD both flashed bullish signals, with the latter crossing above the Signal Line. If this momentum persists, the outlook for the market is exceedingly positive.