The Challenge of Offloading Investments

In early 2025, Mr. Tran Van Linh repeatedly posted listings to sell three apartment units in Hanoi. Mr. Linh shared that he noticed the rising prices of apartments in 2024 and the increasing “heat” in this sector, so in October 2024, despite the already high prices, he decided to invest in three apartment units in Long Bien district. The price of these units was approximately 70 million VND per square meter, equivalent to about 4.2 to over 5 billion VND per unit.

”

Seeing the continuous rise in apartment prices throughout 2024, while the number of new projects on the market was very limited, I thought the market would remain ‘hot’ in the following year. So, I decided to invest, thinking that if prices in 2025 increased by just 30%, my money would already yield significant profits. However, the beginning of the year has brought unfavorable signals, with many indicators suggesting that apartment prices have stabilized and may even decrease further. Therefore, I must quickly change my strategy to avoid being caught off guard if the market cools down

“, said Mr. Linh.

Currently, Mr. Linh is listing the three apartments for sale at a price approximately 300 to 400 million VND higher than his purchase price. However, there are very few interested buyers, and most of the inquiries are from brokers looking to sign distribution contracts. Mr. Linh is starting to worry due to the pressure of repaying large bank loans, and if prices drop, he will incur significant losses.

”

I am considering selling one apartment unit at the exact price I bought it, hoping to find a buyer soon. As for the other two units, I am still selling them at a price approximately 300 million VND higher per unit. I hope I can still offload these investments

“, shared Mr. Linh.

Apartment prices stabilize, investors anxious about holding ‘bombs’. (Illustration: Cong Hieu)

Meanwhile, according to Ms. Tran Thanh Thuy, a Hanoi-based apartment broker, there has been a noticeable decrease in the number of prospective buyers since the end of 2024. Many people say that the current prices are too high, so they want to wait and observe the market’s movements before making a decision. Several clients have even requested to be informed only about deeply discounted units.

”

Homebuyers today mainly have a wait-and-see attitude, observing price movements. Many believe that apartment prices are currently too high and exceed their actual value. They hope that in 2025, when the legal framework is improved and more projects enter the market, prices will decrease

“, said Ms. Thuy.

This situation worries apartment investors, making it challenging to offload their investments immediately, even as prices have started to stabilize. ”

The stabilization of apartment prices will further encourage buyers to wait for more attractive prices. In my opinion, there will be few apartment buyers at this time, even among those with genuine housing needs

“, added Ms. Thuy.

On the other hand, apartment prices have already increased significantly in 2024, so those who invested in this sector will undoubtedly face risks, with the primary concern being the difficulty of offloading their investments to avoid losses.

Has the Heat in the Apartment Sector Cooled Down?

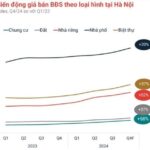

Commenting on the Hanoi apartment market, Associate Professor Dr. Dinh Trong Thinh stated that 2024 witnessed a rapid increase in prices in this sector, with no more projects priced below 60 million VND per square meter. Many mid-range projects even had their prices pushed to the threshold of 100 million VND per square meter. Apartment prices rose in both the primary and secondary markets, and even older projects were not exempt.

However, it is predicted that in the coming time, the upward trend in apartment prices will stabilize, and the market will become more stable, without the previous heat. Apartments will give way to other types of real estate, such as detached houses, townhouses, and land…

Accordingly, buyers’ capital will tend to shift from areas with high price thresholds to areas or projects with more competitive price ranges and more room for growth.

Sharing the same view, Ms. Nguyen Hoai An, Director of CBRE Hanoi, opined that the Hanoi apartment market is gradually alleviating the “thirst” for supply shortage. Prices will no longer increase “hotly” as in the previous period.

Nonetheless, according to experts, it is not easy to wait for housing prices to drop. This is because real estate prices can only decrease when there is a surplus in supply. In Vietnam, the housing supply is still insufficient and imbalanced across segments… Therefore, in the short term, it is challenging for real estate prices to decline.

Mr. Dinh Minh Tuan, Director of Business at PropertyGuru Vietnam, also predicted that in 2024, nearly 67% of new supply in the Hanoi market belonged to the luxury and ultra-luxury segments. It is anticipated that in 2025, Hanoi will no longer have primary projects priced below 50 million VND per square meter.

“It is difficult for apartment prices to decrease in the future. However, the market next year will stabilize and remain at a high level, without the current heat

“, Mr. Tuan assessed.

The Capital’s Property Market Stalls: Hanoi’s Real Estate Prices Stall, Listing Slashed by Hundreds of Millions after Just a Few Days

The Hanoi property market is showing signs of cooling off after a prolonged period of price hikes. In some areas, there have been reports of significant price reductions on property listings, with some properties being offered for hundreds of millions of dong less just days after their initial listing.

The Magnet of Hanoi: A Neighborhood That Attracts Investors and Experts Alike, With Property Prices Predicted to Soar.

“The gateway to southern Hanoi has become a magnet for investors, and rightly so. This area, with its undeniable allure, is set to be a hotspot for real estate ventures in the future. As the city expands and develops, the south will undoubtedly reap the benefits, and the projects there will thrive.”