I. MARKET ANALYSIS OF SECURITIES ON 02/17/2025

– The main indices traded mixed on Monday. Specifically, the VN-Index closed at 1,272.72 points, down 0.26%. Meanwhile, the HNX-Index increased by 0.85% to reach 233.19 points.

– Matching volume on the HOSE reached over 739 million units, a 20.7% increase compared to the previous session. Matching volume on the HNX floor was approximately the same as last week’s closing, with more than 68 million units.

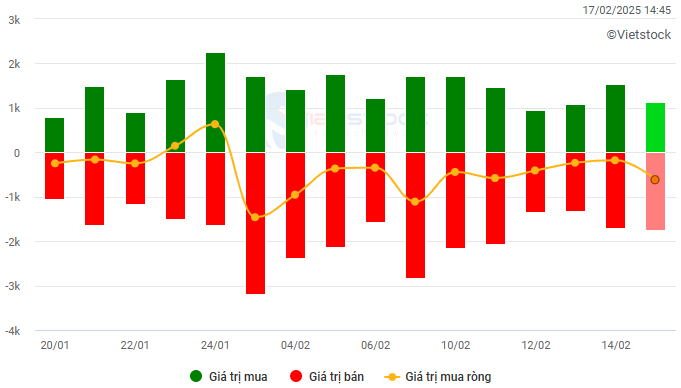

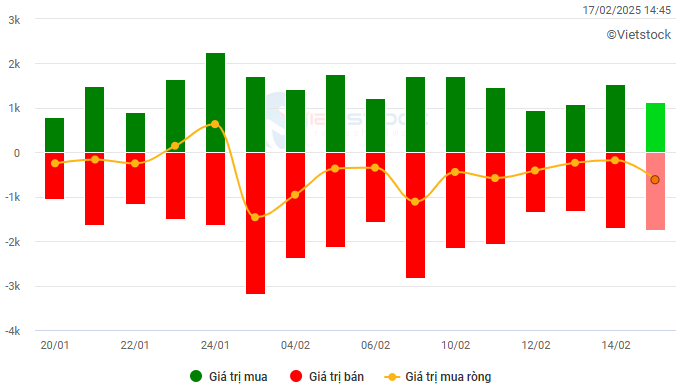

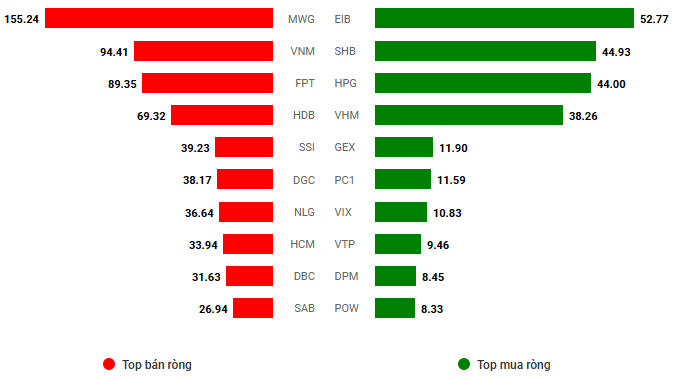

– Foreign investors increased selling pressure on the HOSE floor with a net sell value of nearly VND 618 billion and net sold more than VND 28 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market started the new week in a divided state. Money continued to flow into small- and mid-cap stocks, while trading in large-cap stocks was subdued, preventing the VN-Index from breaking out. From a tug-of-war around the reference level in the morning session, selling pressure intensified towards the end of the afternoon session, especially in pillar stocks, causing the VN-Index to lose 3.36 points and close at 1,272.72.

– The stocks that had the most negative impact on the VN-Index today included BID, MSN, and CTG, taking away nearly 2 points from the index. Meanwhile, no stock had a large enough capitalization to significantly affect the positive side. The top 10 positive stocks contributed less than 2 points to the VN-Index.

– The pillars performed quite negatively, with the VN30-Index falling 0.49% to 1,334.01 points. The breadth was tilted towards the sell side with 19 declining stocks, 9 advancing stocks, and 2 stagnant stocks. MSN and MWG were the worst performers, losing 2.5% and 2%, respectively, followed by BVH, TCB, and BID, which also recorded declines of over 1%. On the other hand, SHB and SSB were the two bright spots that went against the general trend, rising nearly 2% in the first session of the week.

Sectors performed in a clear divergence. On the upside, the bright spot from the mining stock group remained a notable highlight, helping the materials sector lead the market with a 1.52% gain. Many codes continued to hit the ceiling price, such as MSR, BMC, MTA, KCB, FCM, MVB, etc.

The healthcare, energy, real estate, and utilities sectors also managed to stay slightly positive by the end of the session, but the gains were modest due to the mixed performance within the industries. Typically, the real estate group, despite the presence of many stocks in the green, such as DIG (+1.9%), CEO (1.53%), SCR (+3.51%), SJS (+6.93%), BCR (+2.22%), etc., but the large-cap stocks at the industry leaders were in a state of slight decline to reference, causing the industry index to inch up only 0.14%.

On the opposite side, industry and telecommunications were the two groups that recorded the most noticeable adjustment pressure, falling 2.05% and 1.59%, respectively, in the first session of the week. Largely influenced by the plunge in stocks such as ACV (-4.98%), MVN (-5.52%), HVN (-2.23%), VTP (-2.5%), PHP (-12.27%), CTD (-3.8%); VGI (-1.76%), CTR (-2.43%), FOX (-1.34%), and ELC (-2.32%).

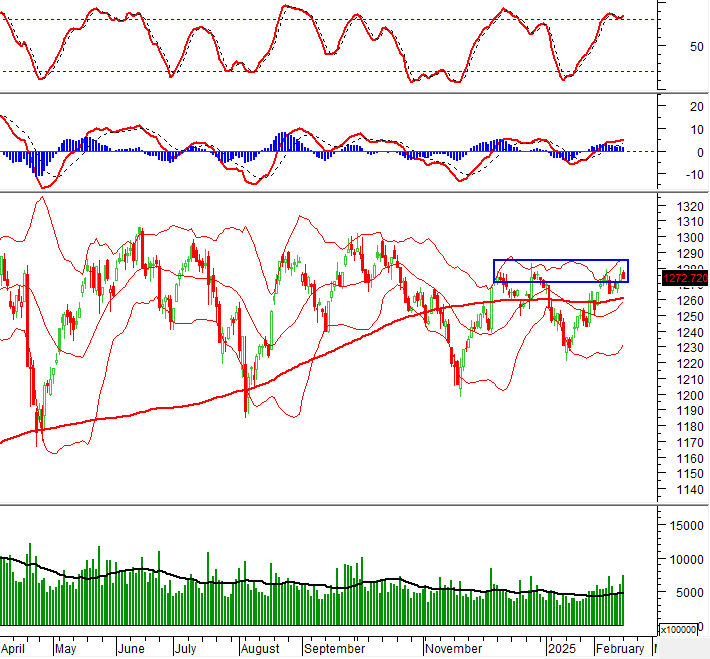

The VN-Index returned to a decrease and maintained a tug-of-war state when retesting the old peak of December 2024 (equivalent to the range of 1,270-1,285 points). This shows that this is an important resistance level as the index has continuously retested this range recently. Currently, the Stochastic Oscillator indicator is moving deep into the overbought zone. If a sell signal reappears and falls out of this zone, the risk of correction will increase in the coming sessions.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Continuously testing the old peak of December 2024

The VN-Index returned to a decrease and maintained a tug-of-war state when retesting the old peak of December 2024 (equivalent to the range of 1,270-1,285 points). This shows that this is an important resistance level as the index has continuously retested this range recently.

Currently, the Stochastic Oscillator indicator is moving deep into the overbought zone. If a sell signal reappears and falls out of this zone, the risk of correction will increase in the coming sessions.

HNX-Index – Breaking above the SMA 200-day moving average

The HNX-Index maintained its positive momentum and broke above the old peak of December 2024 (equivalent to the range of 228-231 points) and the SMA 200-day moving average. If, in the coming sessions, the index holds above this range with trading volume maintained above the 20-day average, the uptrend will be further reinforced.

However, the Stochastic Oscillator indicator is moving deep into the overbought zone. This suggests that the risk of short-term correction will increase if the indicator shows a sell signal again.

Analysis of Money Flow

Movement of smart money flow: The Negative Volume Index indicator of the VN-Index cut above the EMA 20-day moving average. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Foreign capital flow movement: Foreign investors continued to net sell in the trading session on February 17, 2025. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

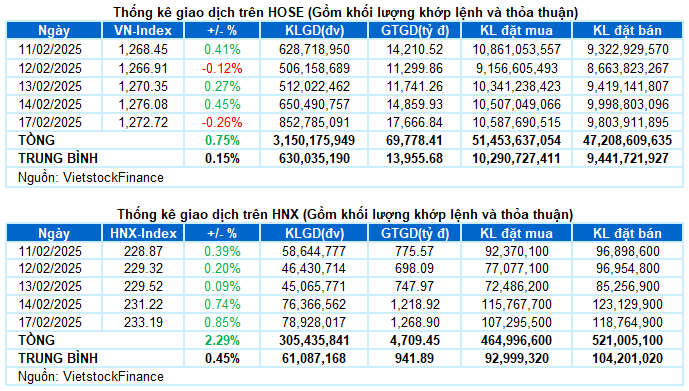

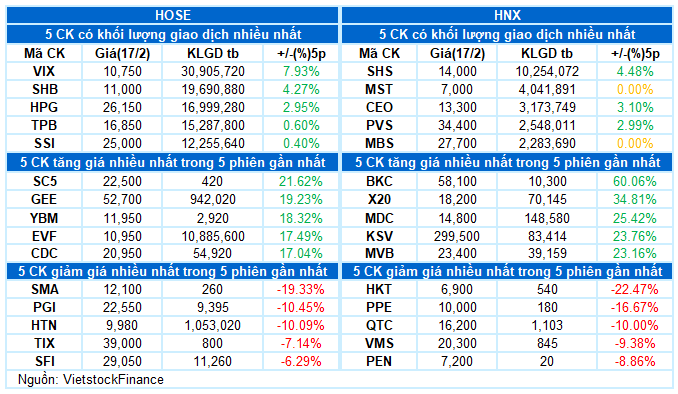

III. MARKET STATISTICS ON 02/17/2025

Economic and Market Strategy Division, Vietstock Consulting and Research

– 17:19 02/17/2025

Market Beat: A Tale of Contrasting Headlines and Cautious Sentiment

The market closed with the VN-Index down 1.54 points (-0.12%) to 1,266.91, while the HNX-Index climbed 0.45 points (+0.2%) to 229.32. The market breadth tilted towards gainers with 349 advancing stocks against 375 declining ones. The large-cap basket, VN30-Index, witnessed a similar performance with 14 losers, 11 gainers, and 5 stocks closing flat, indicating a relatively balanced session.

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.

Market Beat: Foreigners Turn Net Buyers, VN-Index Surges Over 10 Points

The market closed with strong gains, seeing the VN-Index climb by 10.42 points (+0.82%), settling at 1,288.56; while the HNX-Index rose by 1.95 points (+0.83%) to close at 237.79. The market breadth tilted in favor of bulls with 532 gainers versus 250 decliners. The large-cap stocks in the VN30 basket painted a predominantly green picture, with 26 tickers in the green, 3 in the red, and 1 unchanged.

Market Beat: VN30 Under Siege in Final Hour, VN-Index Reverses Fortunes

The market closed with the VN-Index down 3.36 points (-0.26%) to 1,272.72, while the HNX-Index climbed 1.97 points (+0.85%) to 233.19. The market breadth tilted towards gainers with 425 advancing stocks against 314 declining ones. Within the VN30 basket, 19 stocks lost ground, 9 advanced, and 2 closed flat, indicating a mixed performance among large-caps.

Market Beat: Effort Rewarded, VN-Index Closes Above 1,270

The VN-Index extended its recovery efforts from the latter half of the morning session into the afternoon, posting a gain of 3.44 points to close at 1,270.35 on February 13. This came despite a notable corrective phase just before 2 pm. The HNX-Index and UPCoM also ended the session in positive territory, with the former climbing 0.2 points to 229.52 and the latter advancing 0.93 points to 97.74.