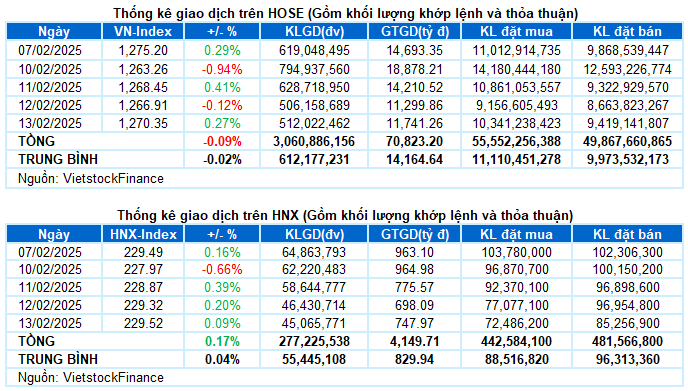

I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM FEBRUARY 13, 2025

– The main indices witnessed a slight increase during the trading session on February 13. The VN-Index closed at 1,270.35 points, a 0.27% increase; while the HNX-Index slightly increased by 0.09%, reaching 229.52 points.

– The matching volume on HOSE exceeded 471 million units, a 2.1% increase compared to the previous session. Conversely, the matching volume on the HNX floor decreased by 12.8%, reaching over 40 million units.

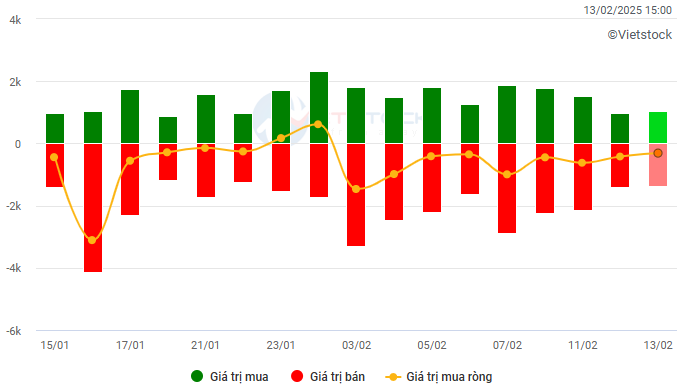

– Foreign investors continued to net sell on the HOSE floor with a value of more than VND 292 billion and net sold nearly VND 14 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

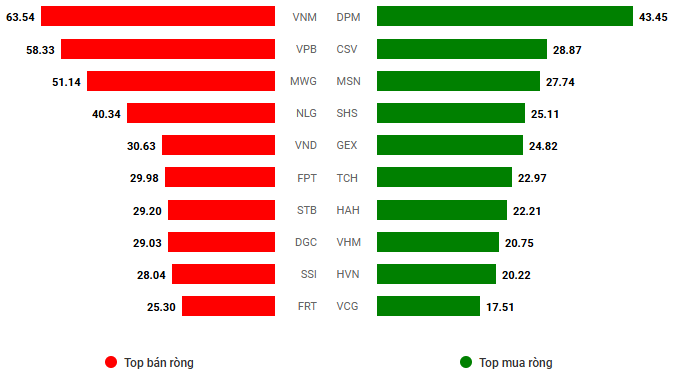

Net trading value by stock code. Unit: VND billion

– The tug-of-war around the 1,270-point threshold continued during the trading session on February 13. After a period of dominance by red stocks at the beginning of the session, the recovery efforts of the pillar group helped the index regain its green status by the end of the morning session and maintained this status until the end of the day. Nonetheless, the fluctuation range remained relatively narrow as investors remained cautious due to the market’s mixed performance. At the close, the VN-Index rose slightly by 0.27% to 1,270.35 points.

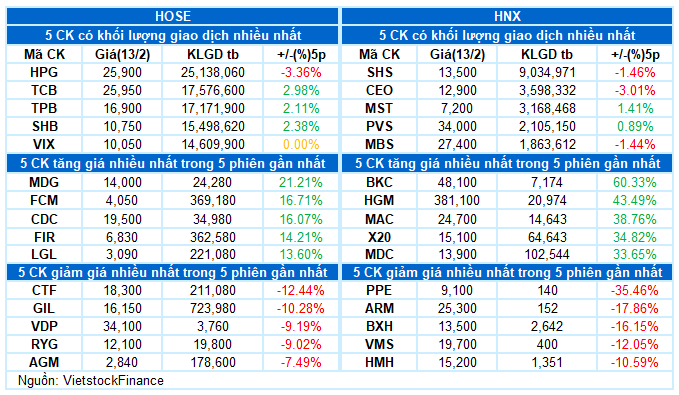

– In terms of influence, VHM, GVR, and CTG played a leading role, contributing nearly 2 points to the index’s increase. Conversely, the strong selling pressure on FPT and MWG stocks had a significant impact, causing the VN-Index to lose more than 1 point.

– Within the VN30 basket, despite the dominance of green stocks with 19 codes increasing, 8 codes decreasing, and 3 codes remaining unchanged, the VN30-Index only recorded a rather modest increase of 0.16%, reaching 1,337.78 points. The top two positions belonged to GVR (+2.4%) and VHM (+2%), respectively. Meanwhile, MWG experienced a significant decrease in pressure after the news about the ESOP plan, ranking last with a decrease of nearly 3%.

The materials group was the most notable bright spot today, with an outstanding increase of 2.21%. The purple color shone brightly in many mining stocks such as KSV, MSR, HGM, TMG, BMC, BKC, and KCB. Additionally, many fertilizer, rubber, and chemical stocks also increased simultaneously, including DCM (+3.86%), DPM (+4.74%), DDV (+3.14%), LAS (+5.32%), GVR (+2.43%), PHR (+2.52%), DPR (+5.47%), CSV (+5.87%), etc.

On the contrary, telecommunications and information technology had to “bottom out” the market with decreases of 1.63% and 1.26%, respectively. This was influenced by the decline of large-cap stocks in the industry, including VGI (-1.97%), CTR (-1.14%), FOX (-0.83%), VNZ (-0.61%), and FPT (-1.31%).

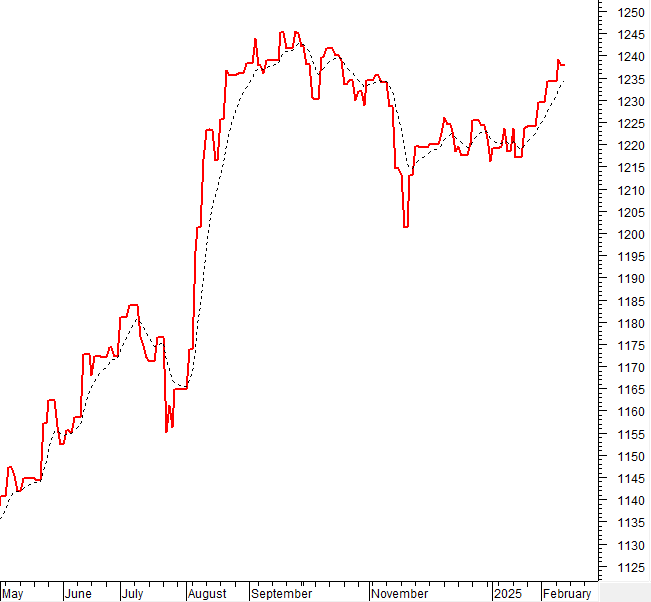

The VN-Index increased while maintaining a tug-of-war status after forming alternating rising and falling sessions recently. Additionally, the trading volume remained below the 20-day average, indicating that investors’ cautious sentiment still prevailed. Moreover, the Stochastic Oscillator indicator is signaling a sell-off in the overbought zone and is likely to exit this zone in the coming period. If this occurs, the risk of short-term adjustments may persist.

II. TREND AND PRICE FLUCTUATION ANALYSIS

VN-Index – Stochastic Oscillator Indicator Likely to Exit Overbought Zone

The VN-Index increased while maintaining a tug-of-war status after forming alternating rising and falling sessions recently. Additionally, the trading volume remained below the 20-day average, indicating that investors’ cautious sentiment still prevailed.

Moreover, the Stochastic Oscillator indicator is signaling a sell-off in the overbought zone and is likely to exit this zone in the coming period. If this occurs, the risk of short-term adjustments may persist.

HNX-Index – Trading Volume Declined Below the 20-Day Average

The HNX-Index maintained its upward momentum while retesting the old peak of December 2024 (corresponding to the 228-231-point range). However, the trading volume declined below the 20-day average, indicating a decrease in participating cash flow.

Currently, the Stochastic Oscillator indicator has signaled a sell-off in the overbought zone. This suggests that the risk of short-term adjustments will increase if the indicator falls out of this zone in the near future.

Analysis of Cash Flow

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of the VN-Index cut up above the EMA 20 day line. If this status continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Fluctuation of Cash Flow from Foreign Investors: Foreign investors continued to net sell during the trading session on February 13, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS FOR FEBRUARY 13, 2025

Department of Economic Analysis & Market Strategy, Vietstock Consulting

– 17:02 13/02/2025

The Stock Market Week of February 10-14, 2025: Foreign Investors Continue Their Selling Spree

The VN-Index concluded a week of volatile trading with a modest gain. The index currently hovers above the 200-day SMA, and trading volume exhibits positive signs of improvement. This indicates a vibrant and active trading environment. However, the prolonged foreign selling streak could hinder the index’s growth trajectory in the coming period.

The Market Tug-of-War: Can the Bulls Break Free?

The VN-Index retreated, continuing its volatile movement as it retested the old peak of December 2024 (1,270-1,285 points). This threshold has proven to be a significant resistance level, as the index has repeatedly tested this zone recently. Presently, the Stochastic Oscillator is venturing deep into overbought territory. Should a sell signal emerge and the index falls out of this zone, the risk of a correction heightens in upcoming sessions.

Market Beat: A Tale of Contrasting Headlines and Cautious Sentiment

The market closed with the VN-Index down 1.54 points (-0.12%) to 1,266.91, while the HNX-Index climbed 0.45 points (+0.2%) to 229.32. The market breadth tilted towards gainers with 349 advancing stocks against 375 declining ones. The large-cap basket, VN30-Index, witnessed a similar performance with 14 losers, 11 gainers, and 5 stocks closing flat, indicating a relatively balanced session.

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.

Market Beat: Foreigners Turn Net Buyers, VN-Index Surges Over 10 Points

The market closed with strong gains, seeing the VN-Index climb by 10.42 points (+0.82%), settling at 1,288.56; while the HNX-Index rose by 1.95 points (+0.83%) to close at 237.79. The market breadth tilted in favor of bulls with 532 gainers versus 250 decliners. The large-cap stocks in the VN30 basket painted a predominantly green picture, with 26 tickers in the green, 3 in the red, and 1 unchanged.