I. VIETNAMESE STOCK MARKET WEEK 10-14/02/2025

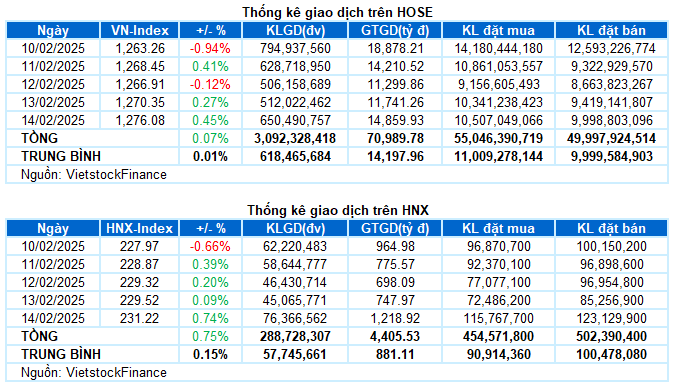

Trading: The main indices continued to rise in the last trading session of the week. By the end of February 14, VN-Index increased by 0.45% compared to the previous session, reaching 1,276.08 points; HNX-Index rose by 0.74% to 231.22 points. For the whole week, the VN-Index gained 0.88 points (+0.07%), while the HNX-Index added 1.73 points (+0.75%).

The market slowed down significantly after three consecutive weeks of gains. Following a sharp plunge at the beginning of the week, the indices quickly balanced out, but the subsequent sessions saw a tug-of-war between buyers and sellers, along with declining trading volume, indicating investor uncertainty near the previous highs. The final session’s upward movement was not entirely convincing as the indices opened with a gap up, but buying momentum faded toward the end, once again highlighting the hesitation of funds despite persistent demand. The VN-Index ended the week at the 1,276.08 level.

In terms of impact, BID, HVN, and GVR contributed the most to the VN-Index’s rise in the last session, adding 3 points. The negative influence was not significant, with CTG, MSN, and STB being the most notable adjusters, taking away nearly 1 point from the overall index.

Green dominated most industry groups. The materials sector led the market, surging 2.21%, with standout performances from stocks like GVR (+3.06%), HSG (+2.1%), PHR (+%), and NTP (+2.29%). Numerous stocks also hit the ceiling price, including MSR, BMC, KSV, KCB, MTA, ACM, and FCM, among others.

Following closely was the energy sector, which also attracted strong buying interest, climbing 1.6%. Notable gainers with substantial volume included PVD (+3.19%), PVS (+1.18%), BSR (+1.26%), AAH (+9.8%), PVC (+2.78%), and NBC (+4.39%).

The only group that lagged was essential consumer goods, dragged down by selling pressure in large-cap stocks such as VNM (-0.66%), MSN (-1.16%), MCH (-1.37%), HNG (-2.74%), ANV (-1.18%), and PAN (-1.64%).

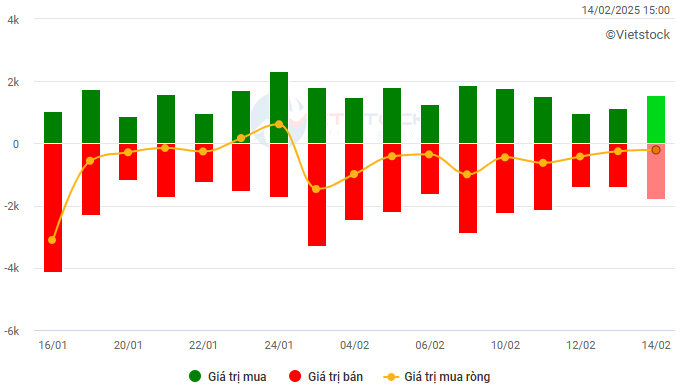

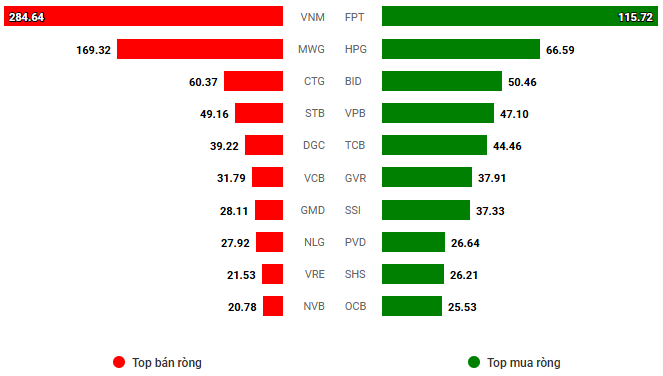

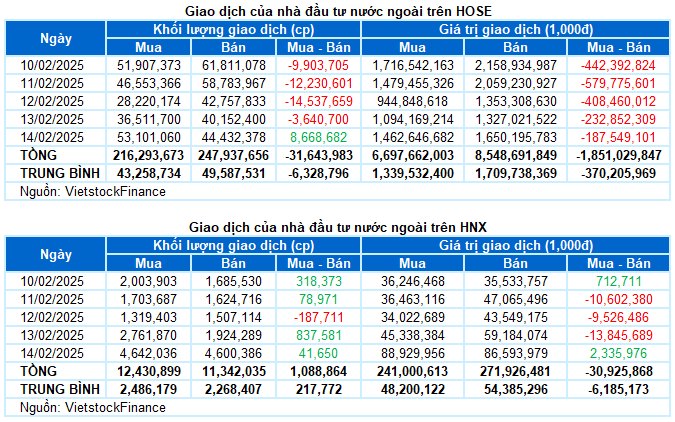

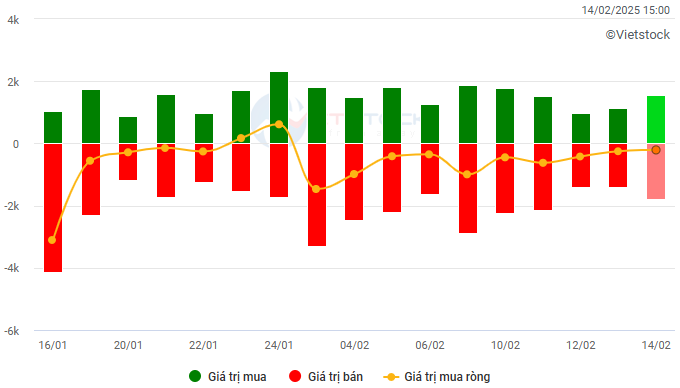

Foreign investors continued to net sell nearly VND 1,882 billion on both exchanges during the week. They net sold over VND 1,851 billion on the HOSE and almost VND 31 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

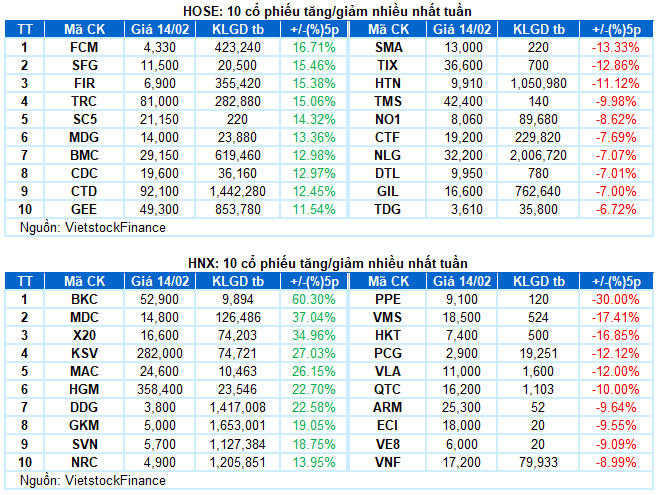

Stocks with notable performance during the week include FCM

FCM rose 16.71%: FCM experienced a vibrant trading week, surging 16.71%. The stock witnessed robust buying interest, climbing in 4 out of 5 sessions, and formed bullish candlestick patterns like Rising Window and White Marubozu. Moreover, trading volume remained above the 20-day average, indicating active participation from investors.

However, the Stochastic Oscillator is venturing deep into overbought territory. This suggests that the potential for a downward correction may increase if a sell signal emerges.

Stocks with significant declines during the week include HTN

HTN fell 11.12%: HTN underwent a challenging trading week, recording losses in 4 out of 5 sessions, and slipped below the SMA 200 and the Middle Band of Bollinger Bands. This indicates strong selling pressure on the stock.

Currently, the Stochastic Oscillator and MACD are trending downward after generating sell signals, suggesting that the risk of short-term corrections persists.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Consulting

– 17:17 14/02/2025

The Market Tug-of-War: Can the Bulls Break Free?

The VN-Index retreated, continuing its volatile movement as it retested the old peak of December 2024 (1,270-1,285 points). This threshold has proven to be a significant resistance level, as the index has repeatedly tested this zone recently. Presently, the Stochastic Oscillator is venturing deep into overbought territory. Should a sell signal emerge and the index falls out of this zone, the risk of a correction heightens in upcoming sessions.

Market Beat: A Tale of Contrasting Headlines and Cautious Sentiment

The market closed with the VN-Index down 1.54 points (-0.12%) to 1,266.91, while the HNX-Index climbed 0.45 points (+0.2%) to 229.32. The market breadth tilted towards gainers with 349 advancing stocks against 375 declining ones. The large-cap basket, VN30-Index, witnessed a similar performance with 14 losers, 11 gainers, and 5 stocks closing flat, indicating a relatively balanced session.

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.

Market Beat: Foreigners Turn Net Buyers, VN-Index Surges Over 10 Points

The market closed with strong gains, seeing the VN-Index climb by 10.42 points (+0.82%), settling at 1,288.56; while the HNX-Index rose by 1.95 points (+0.83%) to close at 237.79. The market breadth tilted in favor of bulls with 532 gainers versus 250 decliners. The large-cap stocks in the VN30 basket painted a predominantly green picture, with 26 tickers in the green, 3 in the red, and 1 unchanged.

Market Beat: VN30 Under Siege in Final Hour, VN-Index Reverses Fortunes

The market closed with the VN-Index down 3.36 points (-0.26%) to 1,272.72, while the HNX-Index climbed 1.97 points (+0.85%) to 233.19. The market breadth tilted towards gainers with 425 advancing stocks against 314 declining ones. Within the VN30 basket, 19 stocks lost ground, 9 advanced, and 2 closed flat, indicating a mixed performance among large-caps.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)