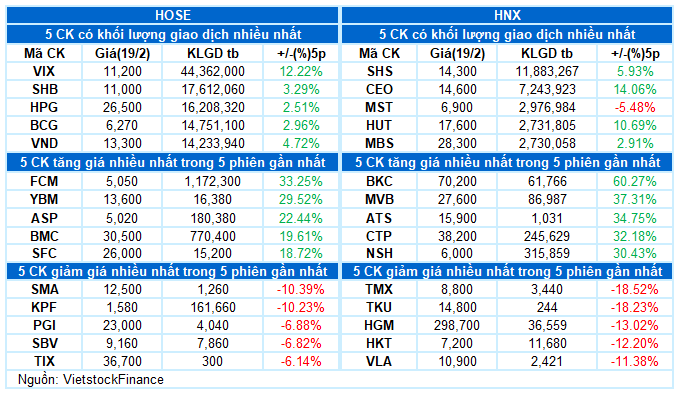

I. MARKET ANALYSIS OF STOCKS ON 02/19/2025

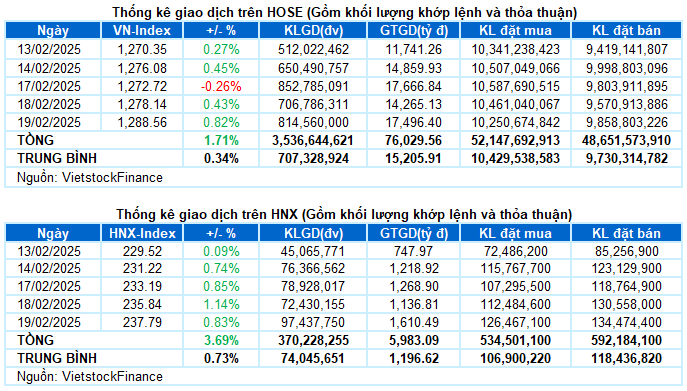

– The main indices continued to surge in the trading session on February 19th. Specifically, the VN-Index closed at 1,288.56 points, up by 0.82%, while the HNX-Index extended its winning streak to seven consecutive sessions, reaching 237.79 points.

– The trading volume on the HOSE reached over 736 million units, a 16.8% increase compared to the previous day. The trading volume on the HNX remained almost unchanged, with nearly 73 million units traded.

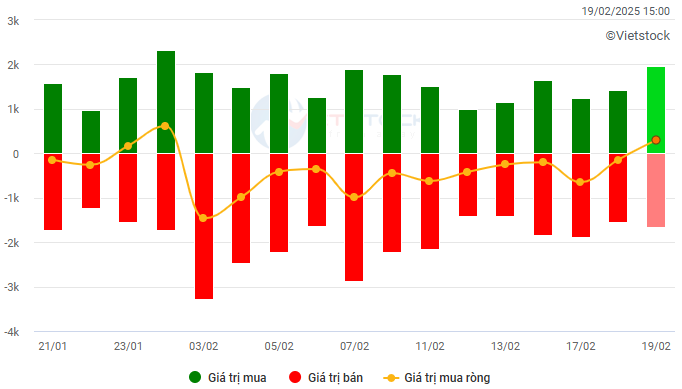

– Foreign investors returned to net buying on the HOSE, with a value of more than VND 254 billion, and on the HNX with a value of nearly VND 63 billion.

Trading value of foreign investors on the HOSE, HNX, and UPCOM exchanges. Unit: VND billion

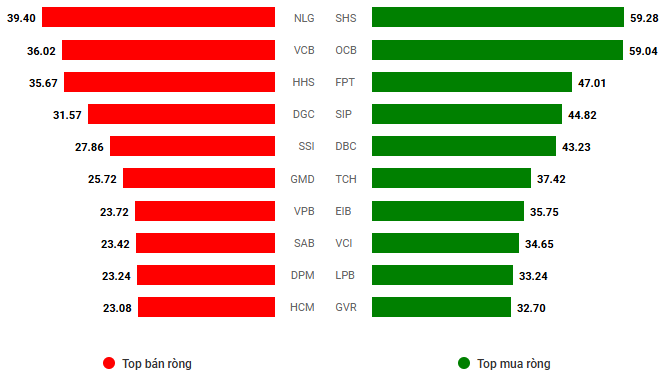

Net trading value by stock code. Unit: VND billion

– The stock market flourished on February 19th as the upward momentum not only persisted but also spread broadly. Unlike previous sessions, the positive sentiment allowed the VN-Index to continuously expand its gains without faltering towards the end of the session. Notably, foreign investors reversed their net buying stance after a prolonged period of net selling, providing significant impetus to the market. At the close, the VN-Index rose by 10.42 points to 1,288.56 points.

– In terms of impact, GVR, BID, and REE were the most influential stocks, contributing nearly 2 points to the VN-Index’s increase. On the other hand, no stocks had a significant negative impact, indicating the dominance of buyers.

– The VN30-Index ended the day up by 0.54%, settling at 1,344.64 points. Buyers overwhelmingly prevailed, with 26 stocks advancing, 3 declining, and 1 remaining unchanged. Notably, BCM, GVR, MWG, and VRE all surged by more than 2%, while BVH, SSB, and HPG were among the few stocks that moved against the overall trend.

Green dominated the sector performance, with real estate leading the market, climbing by 1.29%. Numerous stocks witnessed robust gains accompanied by high liquidity, notably TCH and SIP hitting the daily limit-up, KBC (+3.25%), SZC (+3.49%), CEO (+6.57%), DXG (+3.73%), VRE (+2.08%), IDC (+3.72%), NLG (+3.01%), and NTL (+4.31%).

Additionally, the telecommunications, industrials, energy, and utilities sectors also performed strongly, all advancing by more than 1%. Notable gainers within these sectors included YEG (+6.91%), VGI (+1.67%); ACV (+3.22%), TV2 (+4.42%), HBC (+7.04%), BCG (+2.45%), HAH (+2.09%); BSR (+1.75%), AAH (+3.7%); GAS (+1.03%), POW (+1.22%), QTP (+1.45%), and REE hitting the ceiling price.

Despite the prevalent optimism, two sectors concluded the session in negative territory: materials and healthcare. This downturn was largely influenced by MSR’s steep decline of 11.95%, along with KSV and HGM plunging to the daily limit-down; IMP (-1.74%), DBD (-2.16%), PMC (-3.67%), DMC (-1.27%), and others.

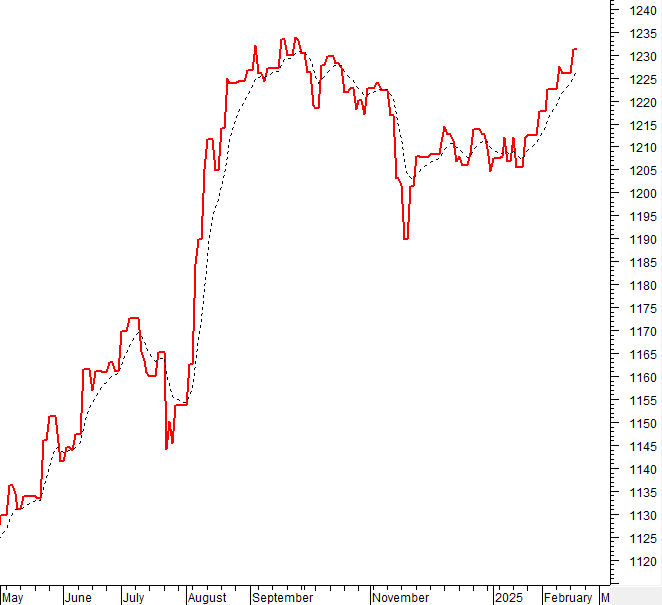

The VN-Index’s robust ascent, coupled with its proximity to the Upper Band of the Bollinger Bands, reflects the prevailing bullish sentiment among investors. Presently, the index has surpassed the previous peak of December 2024 (approximately 1,270-1,285 points) and is approaching the crucial resistance level of 1,300 points. Should the index surpass this threshold, the outlook would become even more favorable. However, the Stochastic Oscillator indicator is venturing deep into overbought territory, warranting caution in the near term should a sell signal emerge.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator ventures deep into overbought territory

The VN-Index’s vigorous ascent, coupled with its proximity to the Upper Band of the Bollinger Bands, underscores the prevailing bullish sentiment among investors. At present, the index has surpassed the previous peak attained in December 2024 (approximately 1,270-1,285 points) and is approaching the pivotal resistance level of 1,300 points. Should the index breach this barrier, the outlook would turn even more favorable.

However, the Stochastic Oscillator indicator is delving into overbought territory, warranting caution in the near term. Should a sell signal emerge, a correction may be imminent.

HNX-Index – Opportunities to target the previous peak of August 2024

The HNX-Index sustained its upward trajectory while closely hugging the Upper Band of the Bollinger Bands, indicative of optimistic investor sentiment. Presently, the index is testing the previous peaks of September and October 2024 (approximately 234-238 points) and may surpass this zone in the forthcoming sessions. Should this scenario unfold, the HNX-Index would have the potential to target the subsequent peak of August 2024 (approximately 239-242 points).

Nevertheless, the Stochastic Oscillator indicator is delving into overbought territory. Should a sell signal emerge, causing the index to retreat from this zone, the likelihood of a correction would intensify.

Analysis of Capital Flows

Fluctuations in Smart Money Flows: The Negative Volume Index indicator of the VN-Index has crossed above the 20-day EMA. If this condition persists in the next session, the risk of an abrupt downturn (thrust down) will be mitigated.

Fluctuations in Foreign Capital Flows: Foreign investors resumed net buying on February 19, 2025. Should they maintain this stance in the upcoming sessions, the outlook would become even more optimistic.

III. MARKET STATISTICS ON 02/19/2025

Economy and Market Strategy Analysis Department, Vietstock Consulting

– 17:18 02/19/2025

Market Beat: VN-Index Plunges, Steel Stocks Take a Hit on News of Tariffs

The market closed with notable losses, as the VN-Index dipped by 11.94 points (-0.94%) to close at 1,263.26, while the HNX-Index fell by 1.52 points (-0.66%), settling at 227.97. The market breadth was overwhelmingly bearish, with 489 declining stocks outweighing 270 advancing stocks. Within the large-cap VN30 basket, bears held the edge, as evidenced by 16 tickers in the red versus 9 in the green, while 5 remained unchanged.

Is Hesitation Creeping In?

The VN-Index edged higher, forming a Doji candlestick pattern. This reflects investors’ indecision as the index retests the old peak of December 2024 (1,270-1,280 points). However, trading volume remained above the 20-day average, indicating positive market participation. The Stochastic Oscillator and MACD remain upward-trending, providing buy signals. If this momentum persists, the outlook will turn increasingly optimistic.

The Cash Flow Comeback Before the Holiday Break

The VN-Index soared by over 17 points, surging past the 200-day SMA. This rally was accompanied by a spike in trading volume above the 20-day average, indicating a resurgence of active participation by investors. The Stochastic Oscillator and MACD both flashed bullish signals, with the latter crossing above the Signal Line. If this momentum persists, the outlook for the market is exceedingly positive.

The Vietstock Daily: A Tentative Rise?

The VN-Index’s consecutive gains, coupled with below-average trading volumes, reflect investors’ cautious sentiment. This dynamic needs to change in upcoming sessions to sustain the upward trajectory. Notably, the Stochastic Oscillator has signaled a buy in the oversold region. If this buying signal persists and the index moves out of this region, the short-term outlook will turn even more positive.

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)