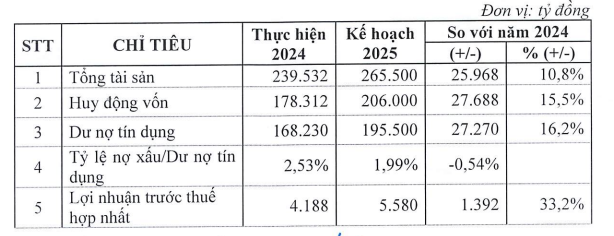

For 2025, Eximbank has set growth targets across the board compared to 2024. Total assets are expected to reach VND 265,500 billion, a 10.8% increase from the previous year. Capital mobilization will amount to VND 206,000 billion, a 15.5% surge, while credit balance is targeted at VND 195,500 billion, reflecting a 16.2% growth. The non-performing loan ratio is projected to decrease from 2.53% in 2024 to 1.99% in 2025.

Consolidated pre-tax profit is estimated to reach VND 5,580 billion, a significant 33.2% jump compared to 2024’s results.

Eximbank also announced that it will finalize its shareholder list on March 10, 2025, in preparation for the upcoming 2025 Annual General Meeting of Shareholders, scheduled for April 29 in Hanoi.

– 16:54, February 18, 2025

The Growing Gap Between Credit and Deposits: A Record-Breaking Divide

While credit debt soared, banks’ capital mobilization lagged in 2024, creating an unprecedented gap between supply and demand.

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

Delivering The Privia, KDH Achieves 2024 Profit Goals

Thanks to a surge in Q4 results, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) reported a 13% increase in consolidated net profit for 2024.