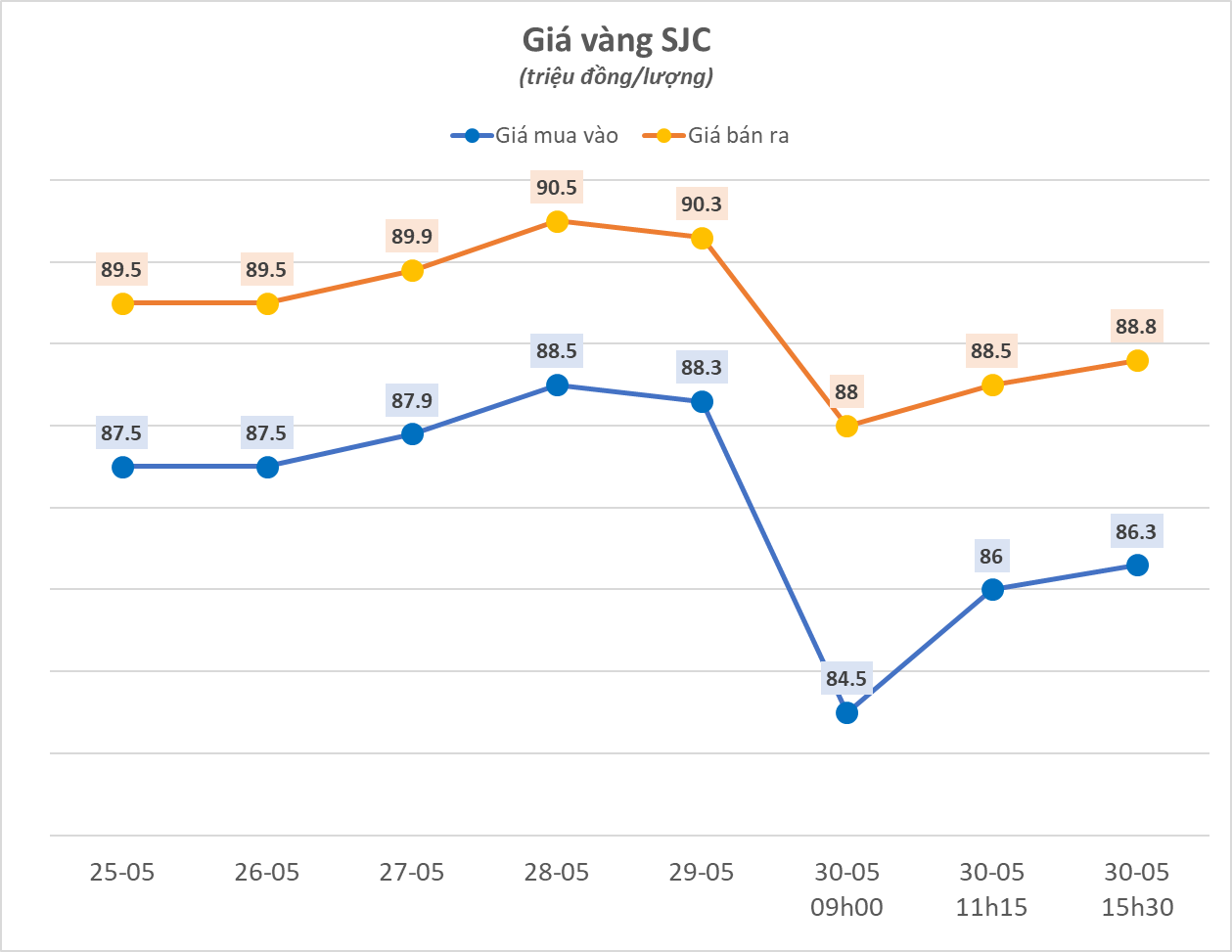

The Alarming State of Loan Quality

In 2024, the Vietnamese banking system witnessed a surge in non-performing loans, especially those that are potentially irrecoverable. This reflects the growing challenges faced by businesses in the post-COVID-19 economy.

The rise in non-performing loans has put pressure on banks to increase their buffer reserves, squeezing profits and threatening financial stability. It also poses a risk of credit downturn, which could have a negative impact on investment and consumption.

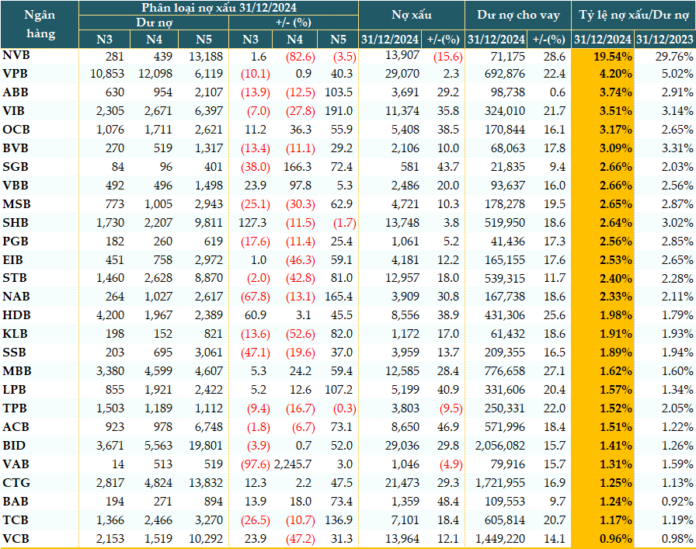

According to data from VietstockFinance, as of December 31, 2024, the total outstanding loans of 27 banks that have published financial statements amounted to over 11.8 million billion VND, an increase of nearly 18% from the beginning of the year.

All banks experienced positive credit growth, with NCB (NVB) leading the pack (+29%), followed by MB (MBB, +28%), HDBank (HDB, +26%), and VPBank (VPB, +22%)…

In parallel with the growth in credit, non-performing loans also increased significantly. As of the end of the fourth quarter, the total non-performing loans of the 27 banks stood at more than 227 thousand billion VND, an increase of nearly 17% compared to the beginning of the year. Bac A Bank (BAB) saw the highest growth in non-performing loans (+48%), followed by ACB (+47%), Saigonbank (SGB, +44%), and LPBank (LPB, +41%)…

However, there were three banks that managed to reduce their non-performing loans by the end of the year, namely NCB (-16%), TPBank (TPB, -9.5%), and VietABank (VAB, -5%).

It is noteworthy that the structure of non-performing loans is shifting in a negative direction. The potentially irrecoverable loans (Group 5) increased by more than 43%, while the substandard loans (Group 3) decreased by 1% and the doubtful loans (Group 4) decreased by nearly 11%.

|

Loan quality of banks as of December 31, 2024 (Unit: Billion VND)

Source: VietstockFinance

|

Mr. Nguyen Quang Huy – CEO of Finance – Banking, Nguyen Trai University, commented that businesses are struggling amid three storms: the aftermath of COVID-19, Storm Yagi, and supply chain shocks. While the pandemic is over, its “ghost” still haunts the economy. Many businesses that borrowed to maintain operations during the social distancing period are now facing depleted cash flows, inability to recover, and loss of repayment capacity. Before the economy could recover, Storm Yagi struck.

Strategic regions around the world have caused disruptions in the global supply chain, pushing up the cost of raw materials, transportation, and production. As a result, corporate profit margins have been eroded, and input costs have soared.

When these three storms converge, many businesses are unable to restructure their debts and lack the cash flow to sustain their operations, while 70% of the collateral for loans is real estate – a market that is currently stagnant and difficult to liquidate.

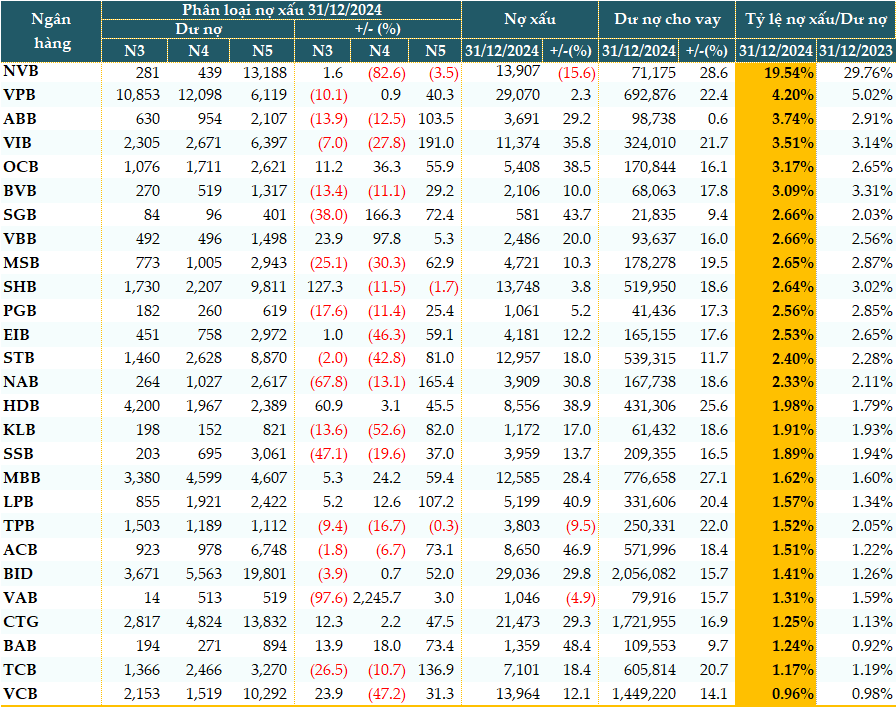

Non-performing loan ratio improved slightly

As of December 31, 2024, 14 out of 27 banks saw an increase in their non-performing loan ratio compared to the beginning of the year. The number of banks with a non-performing loan ratio above 3% stood at six, an improvement from nine in the previous quarter. However, at the beginning of the year, this number was only five.

Source: VietstockFinance

|

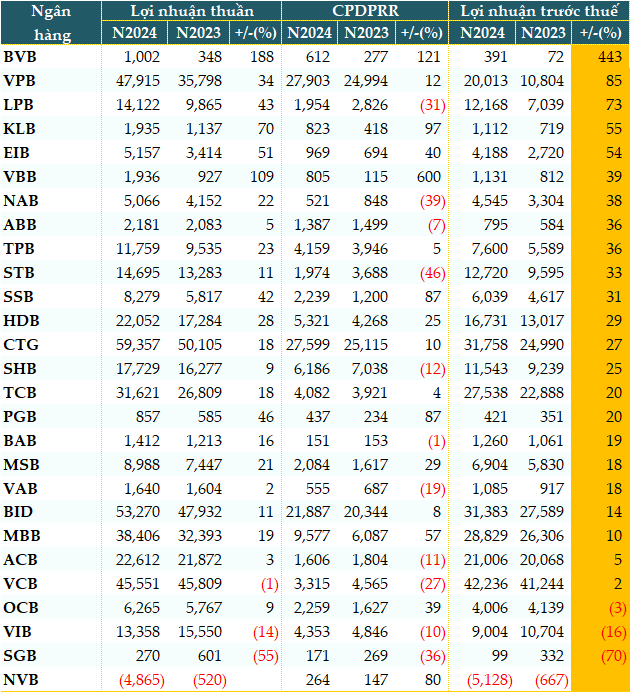

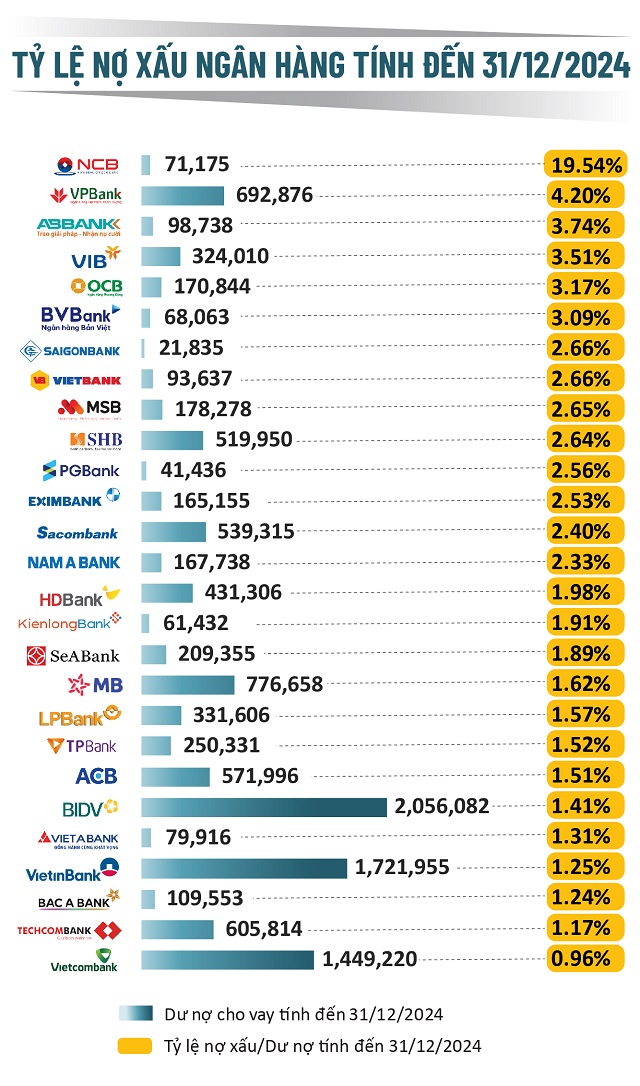

Associate Professor Dr. Nguyen Huu Huan – University of Economics Ho Chi Minh City opined that the sharp increase in non-performing loans and credit growth will partly affect the profitability of banks. While the non-performing loan ratio has increased across the banking system, smaller banks with weaker resilience and fewer reserves are more vulnerable than larger banks.

According to data from VietstockFinance, the total credit risk provision of the 27 banks in 2024 was 133,193 billion VND, an increase of 8% compared to the previous year. Sixteen out of 27 banks increased their credit risk provisions, although this did not significantly affect their profits in 2024. As a result, three banks reported a decrease in pre-tax profits, and one bank reported a loss.

|

Pre-tax profits of banks in 2024 (Unit: Billion VND)

Source: VietstockFinance

|

Managing Non-Performing Loans and Reviving the Economy

The surge in non-performing loans presents a challenging situation for the Vietnamese banking system, but if we look at the bigger picture, it also offers an opportunity to restructure the economy towards sustainability.

To overcome this difficult period, close coordination is required between banks, businesses, and regulatory authorities. Bold and effective measures are necessary to prevent the risk of non-performing loans from spreading beyond the banking sector and dragging the entire economy into a downward spiral.

The issue at hand is not just about managing non-performing loans, but also about creating a foundation for businesses to stand firm and grow in a rapidly changing world. It is high time for all parties to take decisive action to ensure that non-performing loans do not hinder the development of the financial system.

In the short term, Mr. Nguyen Quang Huy suggested that there is a need for solutions to manage risks and support businesses. Banks should be more flexible in negotiating with businesses that still have potential, offering reasonable debt repayment extensions. They should also expedite the sale of non-performing loans to the Vietnam Asset Management Company (VAMC) to free up their balance sheets.

Currently, the real estate market is facing challenges in liquidation due to legal obstacles, even with reduced prices. Regulatory authorities need to implement more relaxed mechanisms to speed up the auction process and recover capital.

Moreover, as the economy undergoes a digital transformation and e-commerce flourishes, banks should provide selective financial support to businesses seeking to adapt to these changes, thereby enhancing their debt repayment capacity.

In the long term, there is a need to build a sustainable financial system. The lending model at banks should be reformed, and real estate credit should be tightly controlled. Banks should instead focus on financing sectors such as manufacturing, technology, renewable energy, exports, and high-tech agriculture to promote sustainable growth.

Risk management through an early warning system will enable banks to detect loans at risk of turning bad and take timely action. Additionally, there should be a greater focus on mechanisms to encourage foreign investment in resolving non-performing loans. Opening up the market for buying and selling non-performing loans and attracting foreign investment funds can help improve liquidity in the financial system.

Recently, at the conference on deploying tasks for the banking industry in early 2025, Prime Minister Pham Minh Chinh requested that the banking industry promote the application of science and technology, digital transformation, and cost reduction to lower lending interest rates. He also emphasized focusing credit on priority sectors and programs, such as the development of social housing and the elimination of temporary and dilapidated housing. The Prime Minister further directed credit towards traditional growth drivers like investment, exports, and consumption, including infrastructure development, and towards new growth drivers like digital transformation. He also mentioned continuing to handle weak banks, effectively controlling bad debts, and preventing similar incidents to that of SCB. Additionally, he stressed the importance of taking the lead in digital transformation, in conjunction with implementing Proposal 06 and building a database for the banking industry. Effective communication of policies, ensuring equality, and creating a conducive environment for individuals and businesses to thrive were also highlighted.

– 08:08 12/02/2025

VCBS Ranks in the Top 10 Brokerage Firms by Market Share in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) unveiled the top 10 securities companies with the largest brokerage market share in Vietnam. This list showcases the leading firms in the industry, commanding a significant portion of the market and playing a pivotal role in shaping Vietnam’s burgeoning investment landscape.

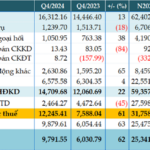

The Powerhouse Performer: VietinBank’s Stellar Growth with a Near 2.4 Million Billion Dong Total Asset Portfolio, Witnessing a 61% Surge in Pre-Tax Profit for Q4/2024

For the fourth quarter of 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) reported a remarkable performance with a pre-tax profit of over VND 12,245 billion, surging by 61% year-on-year. This impressive growth is attributed to a significant reduction in credit risk provisions.

The Art of Refinement: Banking Asset Quality Under Control

Experts believe that even with the expiration of Circular 02, the asset quality of banks can be kept in check throughout 2025.