As of February 7, 2025, Bac A Bank (BAB) has decreased its interest rates by 0.2-0.3 percentage points compared to the previous adjustment period. Specifically, for savings deposits below VND 1 billion, the bank offers an interest rate of 2.6% per annum for a 1-month term, 5.05% for 6 months, 5.6% for 12 months, and 6% for over 12 months.

Meanwhile, NCB has only reduced interest rates for 6-9 month terms starting February 11, 2025. NCB decreased the 6-month rate by 0.1 percentage points to 5.35% per annum and the 9-month rate by 0.15 percentage points to 5.45% per annum.

TPBank has reduced its interest rates for 1-3 month terms by 0.2 percentage points, offering rates between 3.5% and 3.8% per annum.

The state-owned banks (Agribank, Vietcombank, VietinBank, and BIDV) have maintained their deposit interest rates. For 1-month terms, the rates range from 1.6% to 2.2% per annum, 3-month terms are at 1.9-2%, 6-9 month terms are between 2.9% and 3%, and 12-month terms range from 4.6% to 4.7%.

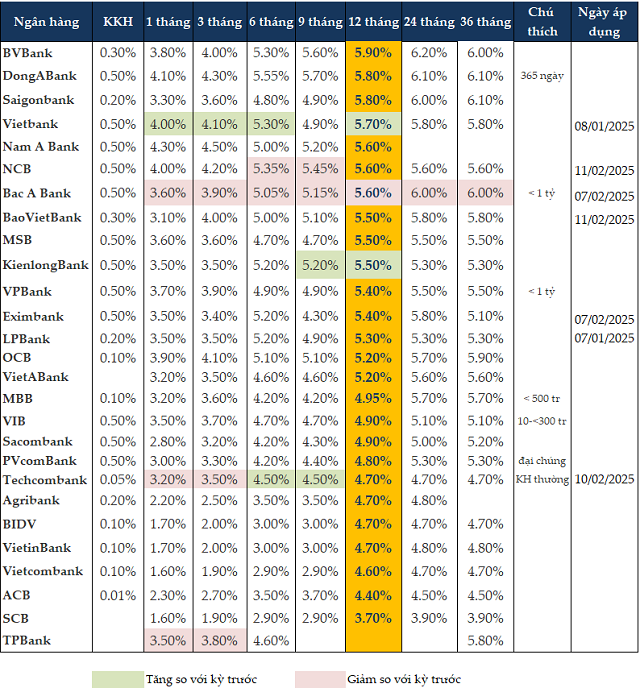

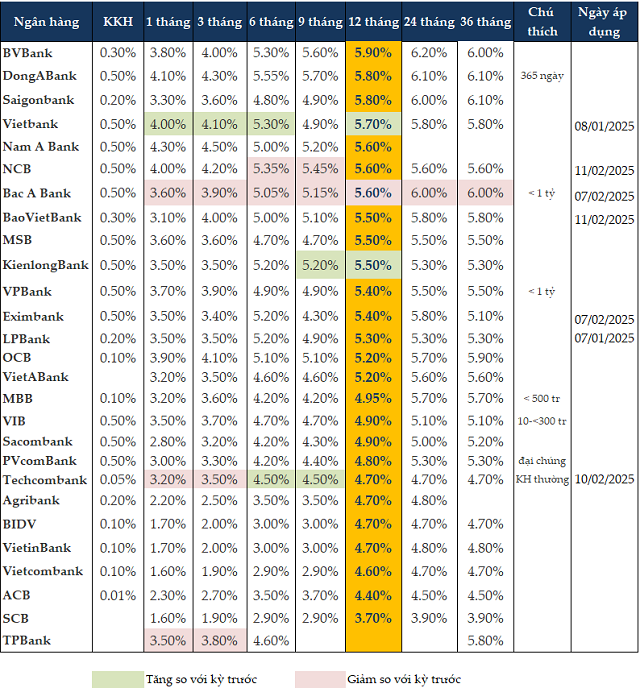

As of February 11, 2025, savings deposit rates for 1-3 month terms range from 1.5% to 4.6% per annum, 6-9 month terms are between 2.9% and 5.7%, and 12-month terms range from 3.7% to 5.9%.

For the 12-month term, BVBank offers the highest interest rate at 5.9% per annum, followed by DongABank and Saigonbank at 5.8%.

DongABank maintains the highest interest rate for the 6-month term at 5.55% per annum, with NCB offering the second-highest rate at 5.35%.

For the 3-month term, Nam A Bank currently offers the highest interest rate at 4.5% per annum.

|

Personal savings deposit rates at banks as of February 11, 2025

|

According to Mr. Nguyen Quang Huy, CEO of Finance and Banking at Nguyen Trai University, the decrease in deposit interest rates at the beginning of February was influenced by several factors.

Firstly, the banks benefited from strong liquidity after the Tet holiday due to a surge in non-term deposits (CASA) and remittances. With a large volume of deposits and a decrease in credit demand post-Tet, banks tend to lower deposit rates to avoid excess capital.

Secondly, the credit demand decreased after the peak season. Before Tet, there was a high demand for loans to support production, business, and holiday inventory. However, after the holiday, individuals and businesses no longer have the same level of demand, resulting in slower credit disbursement. When deposit supply exceeds credit demand, banks do not need to compete by offering high deposit rates.

Thirdly, the loose monetary policies implemented by some central banks also put downward pressure on interest rates in global financial markets, including Vietnam. The State Bank of Vietnam (SBV) may continue its loose monetary policy to support the economy, contributing to an overall decrease in interest rates.

Fourthly, when credit growth slows and deposits are abundant, banks are motivated to reduce deposit rates to cut capital costs and improve their net interest margins (NIMs). Lower deposit rates also provide banks with more room to reduce lending rates, aligning with the SBV’s guidance to support businesses and the economy.

The overall trend indicates that interest rates will increase in the future.

However, Assoc. Prof. Dr. Dinh Trong Thinh, an economic expert, opined that while the interest rate level increased in January, it is normal to see a decrease in February as some banks have lower credit demands post-Tet or due to adjustments in production plans. Nevertheless, the general trend indicates that interest rates will rise in the upcoming period.

Mr. Nguyen Quang Huy forecasts that in the short term (Q1-Q2/2025), interest rates may continue to slightly decrease due to ample liquidity and low credit demand after Tet. The SBV is likely to maintain its loose monetary policy, encouraging banks to reduce lending rates, which will subsequently lead to lower deposit rates.

Looking further ahead, interest rates in Q3-Q4 may stabilize and slightly increase. If the economy recovers and production and business activities accelerate, credit demand could surge towards the end of the year, pushing deposit rates higher. However, the increase will not be significant as the SBV prioritizes its monetary policy to support economic growth.

If domestic inflation is well-controlled, the SBV may maintain low-interest rates in the medium and long term to support businesses and economic growth.

Cat Lam

– 12:00, February 13, 2025

Inflation Management Must Stay Grounded in Reality from the Start

In 2024, the consumer price index (CPI) rose by an average of 3.63% compared to 2023, remaining below the target set by the National Assembly. This marks a decade of Vietnam’s successful inflation control, with an average rate below 4%. Experts suggest that maintaining a CPI increase of around 4.5% in 2025 to support a substantial 8-10% growth will be a challenging task, requiring decisive and meticulous management from governing bodies from the get-go.

Unlocking Vietnam’s Economic Potential: Navigating the Path to 2025 with Optimism and Caution

According to the latest report by Standard Chartered Bank, Vietnam’s economy is projected to grow by 6.7% in 2025. With a forecasted growth of 7.5% in the first half and 6.1% in the latter half compared to the same period last year, this expansion is driven by robust business activity and sustained foreign investment.

The Growing Gap Between Credit and Deposits: A Record-Breaking Divide

While credit debt soared, banks’ capital mobilization lagged in 2024, creating an unprecedented gap between supply and demand.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)