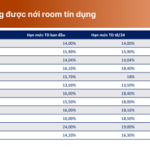

The highest “special interest rate” currently on offer is 9% per year at PVCombank, for a 12- or 13-month term with interest paid at maturity. This rate is 0.5% lower than three months ago. To qualify for this rate, customers must open a new deposit account with a minimum balance of VND 2,000 billion.

PVCombank’s 9% interest rate is significantly higher than its regular counter and online rates. The bank’s current counter interest rate for 12- and 13-month terms is 4.3% and 4.5% per year, respectively, while the online interest rate for these terms is 5.1% per year.

At HDBank, the “special interest rate” for 12- and 13-month terms is 7.7% and 8.1% per year, respectively. This rate is available to individual customers who opt for interest payment at maturity and have a minimum deposit of VND 500 billion.

MSB also requires a minimum deposit of VND 500 billion to earn its highest interest rate of up to 8% per year for a 13-month term and 7% for a 12-month term.

The bank is also offering an interest rate of up to 6.3% per year for 12-, 15-, and 24-month terms, regardless of the deposit amount. This rate is available to priority customers, those receiving salaries through MSB payment accounts, and employees of the bank and TNG Group.

At Vikki Bank (formerly known as DongA Bank), the “special interest rate” is 7.5% per year for a 13-month term. The minimum balance requirement is VND 200 billion, which is the most accessible among banks offering “special interest rates.”

Additionally, Vikki Bank offers an additional interest rate of 0.05% per year for customers with deposits between VND 500 million and VND 1 billion, and 0.1% per year for those with deposits of VND 1 billion or more, for individual customers with 6- to 12-month term deposits who opt for interest payment at maturity.

At LPBank, the highest counter interest rate is 5.5% per year. However, for customers with deposits of VND 300 billion or more, the interest rate for those who choose to receive interest at maturity is 6.5% per year, 6.3% per year for monthly interest payments, and 6.07% per year for interest payments at the beginning of the term.

ACB offers an interest rate of 6% per year for a 13-month term to VIP customers with a minimum deposit of VND 200 billion. If customers choose to receive monthly interest payments, the highest interest rate offered is 5.9% per year.

PVCombank boasts the highest “special interest rate” of up to 9% per year. Photo: Tung Doan. |

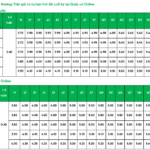

In addition to the “special interest rates,” some banks, such as BVBank, Eximbank, IVB, and KienlongBank, are leading the way in offering the highest interest rates for small online deposits.

Eximbank, for instance, offers an interest rate of up to 6.5% per year for online deposits with a 24- to 36-month term. The bank also provides an interest rate of up to 6.4% per year for 18-month online deposits and 6.1% per year for 15-month deposits.

BVBank’s highest interest rate is 6.45% per year for 24-month online deposits. The interest rates for 15- and 18-month deposits are 6.25% and 6.35% per year, respectively.

KienlongBank’s highest interest rate is 6.4% per year, but this is only available for deposits with a term of up to 60 months. The interest rate for 36-month deposits is 6.3% per year, while for 12- to 24-month deposits, it is 6.1% per year.

Indovina offers an interest rate of up to 6.2% per year for customers who open online savings accounts with a term of 24 months or more.

| ONLINE DEPOSIT INTEREST RATES AT BANKS AS OF FEBRUARY 22, 2025 (% per YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 4 | 5.5 | 5.6 | 5.8 | 5.6 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.6 | 3.9 | 5.05 | 5.15 | 5.6 | 6 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 6 |

| BVBANK | 3.95 | 4.15 | 5.45 | 5.75 | 6.05 | 6.35 |

| EXIMBANK | 4.7 | 4.75 | 5.7 | 5.7 | 5.8 | 6.4 |

| GPBANK | 3.5 | 4.02 | 5.35 | 5.7 | 6.05 | 6.15 |

| HDBANK | 3.85 | 3.95 | 5.3 | 4.7 | 5.6 | 6.1 |

| IVB | 4 | 4.35 | 5.35 | 5.35 | 5.95 | 6.05 |

| KIENLONGBANK | 4.3 | 4.3 | 5.8 | 5.8 | 6.1 | 6.1 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.5 | 5.8 |

| MB | 3.7 | 4 | 4.6 | 4.6 | 5.1 | 5.1 |

| MBV | 4.3 | 4.6 | 5.5 | 5.6 | 5.8 | 6.1 |

| MSB | 4.1 | 4.1 | 5 | 5 | 6.3 | 5.8 |

| NAM A BANK | 4.3 | 4.5 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 4.1 | 4.3 | 5.45 | 5.55 | 5.7 | 5.7 |

| OCB | 4 | 4.2 | 5.2 | 5.2 | 5.3 | 5.5 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.35 | 3.65 | 4.65 | 4.65 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.8 | 4.9 | 5.2 | 5.5 |

| VCBNEO | 4.15 | 4.35 | 5.85 | 5.8 | 6 | 6 |

| VIB | 3.8 | 3.9 | 4.9 | 4.9 | 5.3 | |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| VIETBANK |

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.

Transfer Money Faster with the New Feature on PVConnect

To enhance user experience, Vietnam Public Joint Stock Commercial Bank (PVcomBank) has successfully introduced a new feature on its digital banking platform, PVConnect: account information suggestions for fund transfers. This innovative feature, currently available in only a handful of banking apps, allows customers to effortlessly paste the beneficiary’s account information, with PVConnect automatically recognizing the account number, bank, and recipient’s name, thus streamlining the fund transfer process.

“Save VND 250,000 When You Dine with Us and Pay with Your PVcomBank Credit Card”

PVcomBank offers an exclusive benefit to its Lifestyle Mastercard credit cardholders when they dine at any restaurant under the Golden Gate culinary brand. This special promotion, named “Indulge in Asian Cuisine, Live Life to the Fullest,” is valid until January 31, 2025, and promises a rewarding epicurean experience.

Sure, I can assist you with that.

## Proposing a New Set of Criteria for Evaluating and Developing Green Projects: MSB’s Initiative for a Sustainable Future.

On September 21, at the Standing Government Conference on solutions to contribute to the country’s socio-economic development, chaired by the Prime Minister, MSB Chairman Tran Anh Tuan and CEO Nguyen Hoang Linh attended and made several proposals to boost credit growth across the system, improve banking performance, and promote economic recovery, in line with the State’s general policy.