**Services**

|

Techcombank is committed to enhancing its financial services offerings, making it easier for customers to open accounts at WinMart/WinMart+/WiN stores (owned by WinCommerce) across Vietnam. The bank aims to meet all customers’ needs for deposits, withdrawals, and diverse payment methods through this extensive network. This strategic direction is a key focus for Techcombank in 2025, and the bank plans to achieve it by strengthening its collaboration with WinCommerce, delivering a seamless value chain for customers.

WinCommerce, Vietnam’s largest modern retail chain in terms of scale, currently operates nearly 4,000 WinMart/WinMart+/WiN stores across urban and rural areas. The company continuously innovates to bring added value to its consumers.

The partnership between WinCommerce and Techcombank is a significant step towards realizing WinCommerce’s “Point of Life” strategy. With the slogan “WiN is all you need,” WinCommerce aims to create an ecosystem that serves 100 million Vietnamese consumers, catering to their daily essential needs and providing financial products and services.

Over the past two years, Techcombank and the Masan Group (owner of WinCommerce) have been working together to extend their reach and offer comprehensive financial and retail benefits to customers. Through this collaboration, shoppers at WinMart/WinMart+/WiN stores can easily access Techcombank’s financial touchpoints and optimized products and services while meeting their daily essential and lifestyle needs.

|

Recognizing the importance of financial inclusion, especially in remote areas, Techcombank and WinCommerce officially launched a payment agency model in key sales points across three provinces: Bac Ninh, Bac Giang, and Can Tho. Initially, 45 stores in the WinCommerce retail chain have been converted into Techcombank payment agencies, offering superior convenience to customers.

This innovative agency banking model, to be implemented across WinCommerce’s urban and rural sales network, not only addresses financial access but also plays a crucial role in the digital transformation journey, fostering sustainable economic development and contributing to Vietnam’s integration and growth.

Immediately after the Lunar New Year, the Year of the Tiger, in 2025, both parties collaborated closely to implement detailed plans for services, sales, and technical aspects, with the goal of transforming WinCommerce into a payment agency for Techcombank.

——————————–

About Techcombank

Techcombank, with the vision of “Transforming Finance, Elevating Lives,” is one of the largest joint-stock banks in Vietnam and a leading bank in Asia. With a customer-centric strategy, Techcombank provides diverse financial solutions and banking services to 15.4 million customers, including individuals and businesses, through an extensive network of transaction points across Vietnam and a leading digital banking platform. The bank’s ecosystem approach and partnerships in key economic sectors set it apart in one of the world’s fastest-growing economies. Techcombank is the only Vietnamese bank to be recognized as the “Best Bank in Vietnam” within one year by three prestigious global organizations: Euromoney, Global Finance, and FinanceAsia.

Techcombank is currently rated AA- by FiinRatings, has a baseline credit assessment (BCA) of ba3 by Moody’s, and is rated BB- by S&P. The bank is listed on the Ho Chi Minh City Stock Exchange (HoSE) under the ticker symbol TCB.

– 08:40 19/02/2025

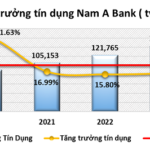

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.

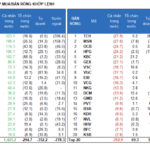

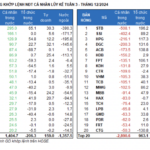

The Pre-Festive Season Sell-Off: Individual Investors Dump Stocks, Net-Selling 2.6 Trillion VND Last Week

Individual investors sold a net 2,594.7 billion VND, of which they sold a net 2,194.5 billion VND in stocks.

“VPBank and Thegioididong.com Collaborate to Launch Payment Agency Model”

As the first bank to be granted permission by the State Bank of Vietnam to implement a payment agency model in the country, VPBank’s collaboration with The Gioi Di Dong Joint Stock Company marks a significant step forward. Together, they offer customers convenient access to financial services across 3,000 The Gioi Di Dong and Dien May Xanh retail stores nationwide.

“BIDV Unveils Electronic Customer Authentication via VNeID”

Hanoi, December 2nd, 2024 – Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and the Research and Application Center for Population Data and Civil Status (Center for RAR) under the Ministry of Public Security, have signed an agreement to implement electronic customer authentication services through VNeID on the BIDV SmartBanking application.