|

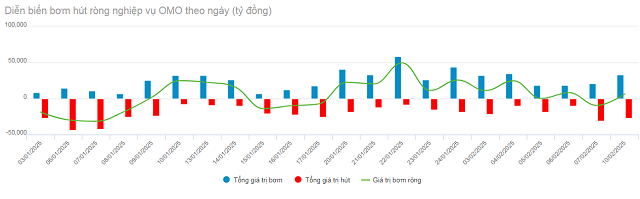

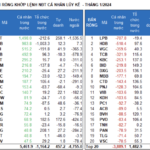

Net OMO pumping and sucking developments in the past week (03-10/02/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, the SBV lent through the collateral channel with a total volume of 126,439 billion VND, with terms of 14 days (50,267 billion VND) and 7 days (76,172 billion VND). The interest rate for both terms was fixed at 4%/year.

The new issuance on the aforementioned term purchase channel mainly aimed to meet a large volume of maturities (98,613 billion VND).

In addition, the regulator consistently issued bills throughout the week, but the scale was significantly reduced compared to the pre-Tet week. The total volume of newly issued bills with a term of 7 days and a fixed interest rate of 4%/year reached 18,600 billion VND.

On the other hand, the lot of 31,250 billion VND bills matured in the week of 01/20-03/02, returning the corresponding volume to the market.

At the end of the week of 10/02, the SBV net injected 40,476 billion VND into the market. The circulating volume in the term purchase channel was 161,406 billion VND, and 22,850 billion VND in the bill channel.

|

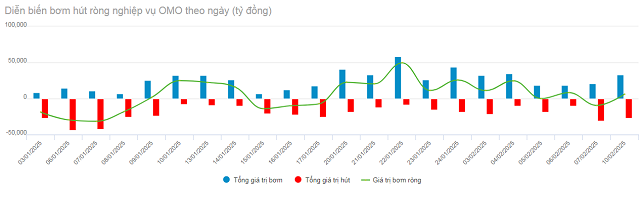

Interbank interest rate developments for overnight term since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

Regarding interbank interest rates, the overnight term rate soared to 5.7%/year in the 04/02 trading session when the system’s liquidity was tight after a long holiday. With the net injection move and liquidity support from the regulator, the interbank overnight interest rate cooled down to 4.38% at the end of the week (up 46 basis points compared to the pre-Tet week).

|

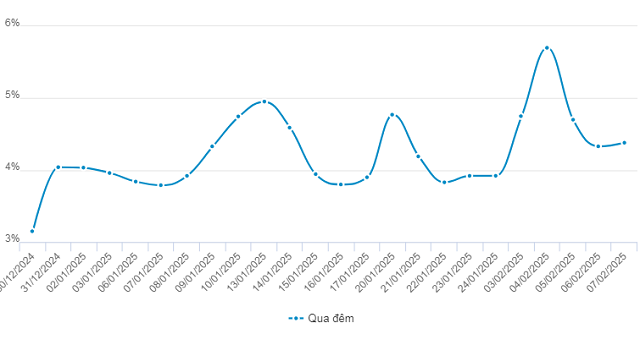

DXY movements since the beginning of 2025 up to the session of 11/02

Source: marketwatch

|

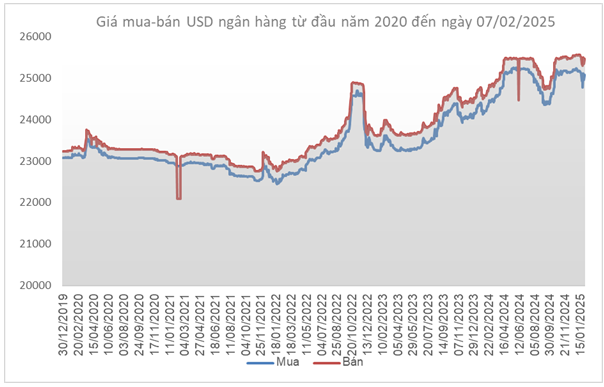

Last week, USD price remained high amid tensions between Trump and the US’s largest trading partners. At the close of 07/02, the DXY index increased by 0.63 points compared to the previous week (31/01), reaching 108.1 points, but lower than the 108.99 points of the first session of the week on 03/02.

The USD soared in the first session of the week on 03/02 due to President Donald Trump’s tariff moves but quickly cooled down after weak US employment data.

Source: VCB

|

USD/VND exchange rate at Vietcombank on 07/02 was listed at 25,080-25,470 VND/USD (buy-sell), up to 310 VND/USD in the buying direction but increased by only 170 VND/USD in the selling direction compared to the pre-Tet period.

– 10:31 11/02/2025

The Green Land’s New ‘Stock’ with a Capital of VND 1,800 Billion has Just Been Assigned a Securities Code: Fourth Quarter Profit Triples Year-on-Year

For the full year 2024, Regal recorded net revenue of VND 550 billion, a 48% decrease compared to 2023, while posting an impressive 36% growth in after-tax profit, which stood at VND 162 billion.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.

The Highest Central Exchange Rate in a Year

As of February 4th, the Dollar Index weakened by 0.5% to 108.96, retreating from a three-week high of 109.88 touched the previous day. Despite this, the USD/VND rate remained under pressure as markets forecast a diminishing likelihood of the FED executing two interest rate cuts this year, with the probability now sitting at just under 50%.

The First Month of 2025: VN-Index Slips, Liquidity Hits 3-Year Low, Foreigners Keep Selling

The first month of the year witnessed a significant 23.4% decline in average trading values, bringing the figure to a meager 11.406 trillion VND. This places the monthly liquidity at a three-year low, a concerning development for the market.