In the international market, as of February 14th, the DXY index dropped by 1.31 points compared to the previous week (February 7th) to 106.79 points, the lowest in nearly two months.

The USD price fell sharply after the US announced that retail sales in January 2025 declined the most in nearly two years (down 0.9% month-on-month, the largest drop since March 2023), indicating a significant economic slowdown at the beginning of Q1 2025.

On February 13th, President Donald Trump directed his economic team to develop a plan to impose reciprocal tariffs on any country that imposes taxes on US imports. This move could potentially cause inflation, driving the demand for safe-haven assets like gold, a traditional hedge against inflation and geopolitical instability. This also diminishes the appeal of the greenback.

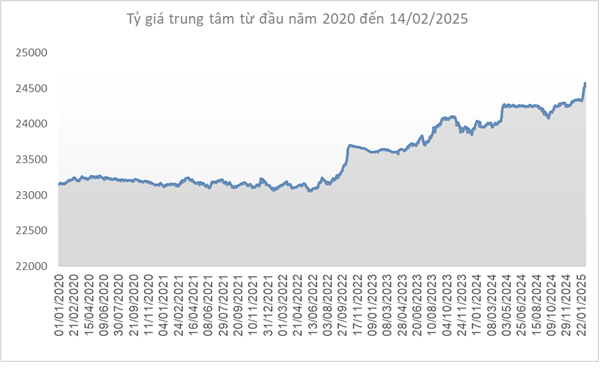

Source: SBV

|

In Vietnam, the central exchange rate of the Vietnamese Dong to USD increased by VND 100/USD compared to the previous week (February 7th), reaching VND 24,562/ USD on February 14th, 2025.

With a 5% margin, the allowed trading range for USD at commercial banks is between VND 23,334 – 25,790/USD.

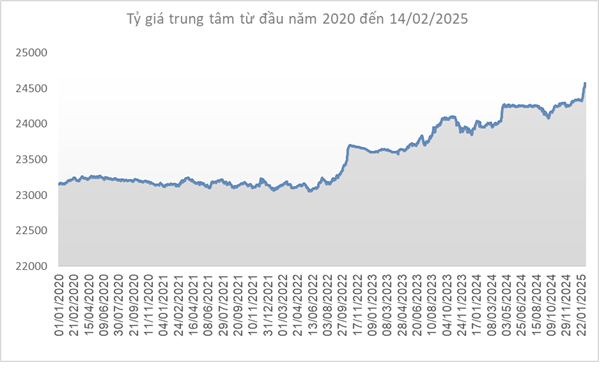

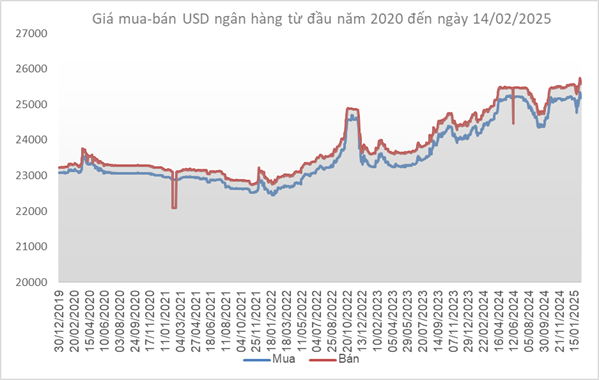

The State Bank of Vietnam’s Foreign Exchange Reserve Management Department sets the USD/VND reference exchange rate at VND 23,394 – 25,750/USD (buying – selling).

Source: VCB

|

At Vietcombank, the USD/VND exchange rate on February 14th was listed at VND 25,190 – 25,580/USD (buying – selling), an increase of VND 110/USD in both buying and selling prices.

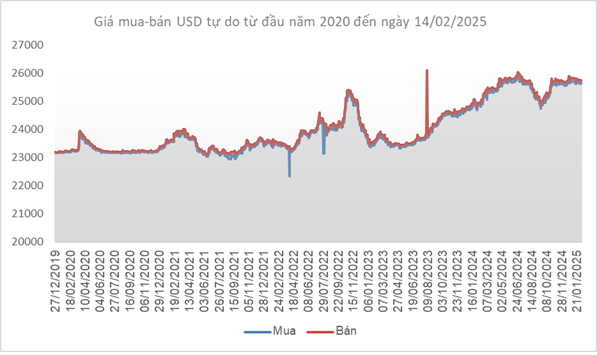

Source: VietstockFinance

|

In the free market, the exchange rate decreased by VND 20/USD in both buying and selling prices compared to the previous week, settling at VND 25,650 – 25,750/USD (buying – selling).

– 19:13 16/02/2025

The Greenback Falls Further

Last week (February 17-21, 2025), the value of the US dollar continued its downward trajectory in the international market as President Donald Trump’s tough trade policies raised fears of a potential economic stall coupled with rising inflation.

Inflation Management Must Stay Grounded in Reality from the Start

In 2024, the consumer price index (CPI) rose by an average of 3.63% compared to 2023, remaining below the target set by the National Assembly. This marks a decade of Vietnam’s successful inflation control, with an average rate below 4%. Experts suggest that maintaining a CPI increase of around 4.5% in 2025 to support a substantial 8-10% growth will be a challenging task, requiring decisive and meticulous management from governing bodies from the get-go.

Unlocking Vietnam’s Economic Potential: Navigating the Path to 2025 with Optimism and Caution

According to the latest report by Standard Chartered Bank, Vietnam’s economy is projected to grow by 6.7% in 2025. With a forecasted growth of 7.5% in the first half and 6.1% in the latter half compared to the same period last year, this expansion is driven by robust business activity and sustained foreign investment.

The Art of Inflation: Unveiling January 2025’s CPI and Core Inflation Dance

Some localities adjusted healthcare service prices according to Circular No. 21/2024/TT-BYT, and there were increases in transportation and food prices due to higher travel and shopping demands during the Tet holiday. These were the main drivers of the 0.98% month-over-month rise in the consumer price index (CPI) for January 2025. Compared to January 2024, the CPI rose by 3.63%, while the core inflation rate for January 2025 increased by 3.07%.