Accordingly, more than 5.5 million MIC shares will be delisted from UPCoM from March 4, 2025, with the last trading day being March 3, 2025. From March 19, 2025, these shares will start trading on the HNX exchange.

The reference price for the first trading day on the HNX shall be determined based on the average closing price of the MIC shares on UPCoM for the 30 consecutive trading sessions prior to the delisting date.

Previously, MIC shares were listed on the HNX exchange in 2007 but were delisted in 2014 and moved to UPCoM in 2015.

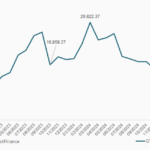

On the day the Board of Directors of the Company passed the above resolution, the MIC share price dropped by more than 14% to 24,300 VND/share. However, the next day (February 20), the MIC share price rebounded by over 12% and quickly hit the ceiling price in the morning session of February 21.

| Price movement of MIC shares from the beginning of 2025 up to now |

MIC was formerly known as the Industrial Sand Exploitation and Export Enterprise of Quang Nam – Da Nang, established in 1984 by the People’s Committee of Quang Nam – Da Nang province. After several name changes, the Company was equitized in 2004 and renamed Quang Nam Mineral Industry Joint Stock Company as it is known today.

|

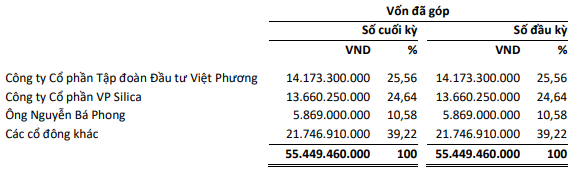

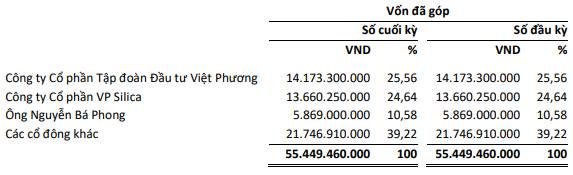

Shareholder structure of MIC as of September 30, 2024

Source: MIC

|

The Company currently has a charter capital of over VND 55 billion. The main business lines include mineral exploitation, processing, and trading (excluding prohibited minerals). According to its website, MIC offers four main products: silica sand, low-iron quartz sand, super-fine crushed sand, and glass fiber fabric.

In terms of financial performance, in the first nine months of 2024, MIC‘s net profit decreased by more than 23% to nearly VND 9 billion, despite increases in net revenue and financial income. This decline was attributed to significant rises in cost of goods sold, financial expenses, and management fees, which offset the Company’s gains.

– 09:49 21/02/2025

Market Beat: VN-Index Surges Over 6 Points in Late Recovery

The market was volatile during the afternoon session, with the VN-Index dipping into negative territory at one point. At the close of trading on January 16th, all three major indices managed to recover, but the gains were narrower compared to the morning’s enthusiasm.