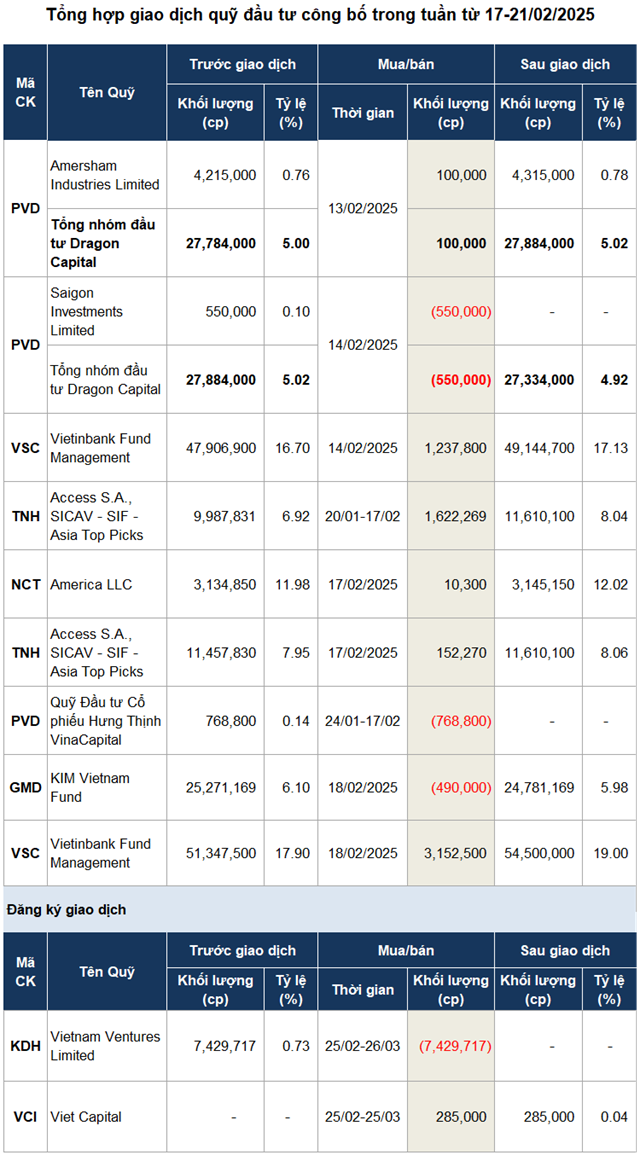

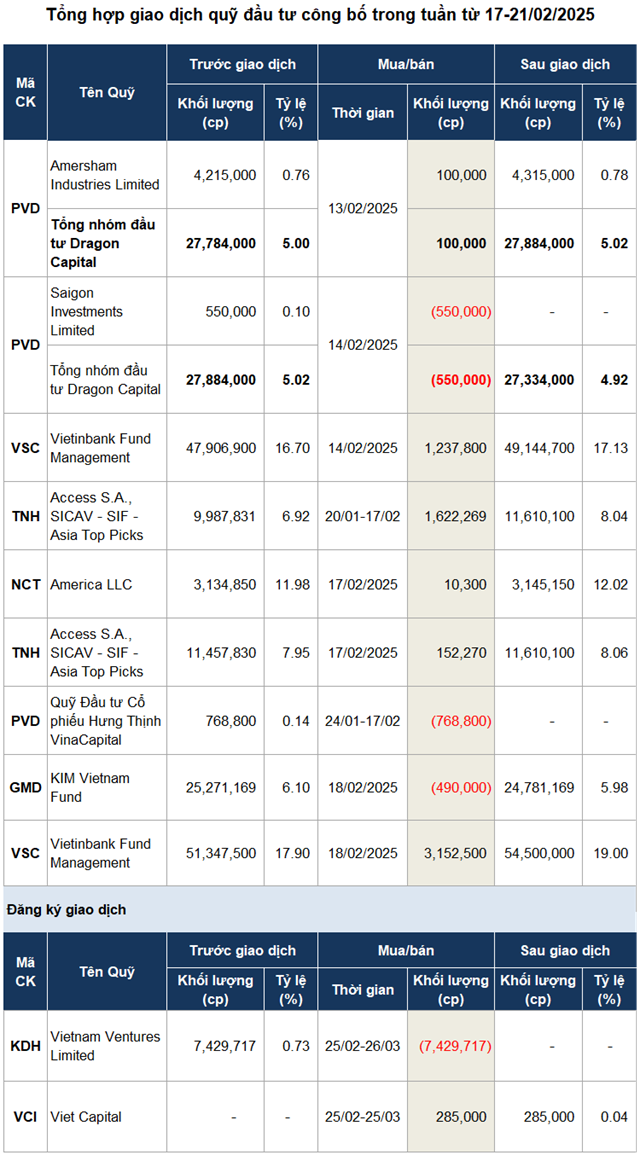

The transactions of Vietinbank Fund at VSC (Vietnam Container Joint Stock Company) became the focus of buying power.

Specifically, Vietinbank Fund bought nearly 3.2 million VSC shares in the February 18 session, increasing its ownership from 17.9% (51.3 million shares) to 19% (54.5 million shares).

During the February 18 session, there were no matched orders for VSC shares. Therefore, it is likely that Vietinbank Fund purchased VSC shares through market orders, with a transaction value of VND58 billion.

In mid-June 2024, Vietinbank Fund spent approximately VND215 billion to purchase 9.2 million VSC shares, increasing its ownership from 4.8% to 8.25% (22 million shares) and becoming a major shareholder. Subsequently, the investment fund continued to buy an additional 21 million VSC shares on July 3, 2024, increasing its ownership from 8.25% to 16.12%. Most recently, the fund also spent approximately VND23 billion to accumulate 1.24 million VSC shares during the February 14 session, increasing its ownership to over 17%.

| Price movement of VSC shares from the beginning of 2024 to the session on February 21, 2025 |

In the stock market, the price of VSC shares tended to decrease after reaching a peak of VND22,100/share (June 10, 2024). As of the close of the February 18, 2025 session, the share price had decreased by more than 19% compared to the peak, but it had increased by 12% compared to the beginning of the year.

| Price movement of NCT shares from the beginning of 2024 to the session on February 21, 2025 |

Further consolidating the buying power of the investment funds last week were the transactions of the foreign fund America LLC and Access S.A., SICAV – SIF – Asia Top Picks.

| Price movement of TNH shares from the beginning of 2024 to the session on February 21, 2025 |

On February 17, America LLC purchased 10,300 NCT (Noi Bai Cargo Services Joint Stock Company) shares, increasing its ownership to over 12%. Meanwhile, Access S.A., SICAV – SIF – Asia Top Picks bought 152,270 TNH (TNH Hospital Group Joint Stock Company) shares, raising its ownership to over 8%.

| Price movement of GMD shares from the beginning of 2024 to the session on February 21, 2025 |

On the selling side, KIM fund reduced its ownership of GMD (Gemadept Joint Stock Company) to below the 6% threshold after selling 490,000 GMD shares in the February 18 session.

Source: VietstockFinance

|

– 07:28 23/02/2025

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)