CASA recovery by the end of 2024

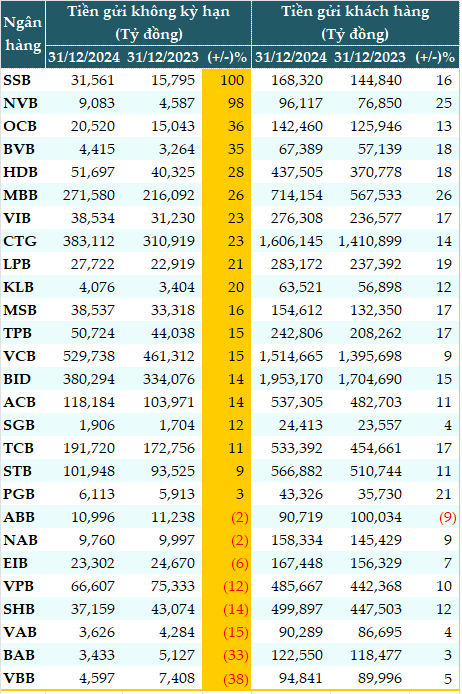

Figures from VietstockFinance show that as of December 31, 2024, the total customer deposits at 27 banks were nearly VND 11,140 trillion, up 13% from the beginning of the year. Of which, the total non-term deposits (CASA) were more than VND 2,420 trillion, up 16% from the beginning of the year.

19/27 banks recovered CASA compared to the beginning of the year, with an average growth rate of 27%; among them, SeABank (SSB) increased the most (doubled), followed by NCB (NVB, +98%), and OCB (+36%).

On the contrary, banks that recorded a decrease in CASA with an average rate of 15% include Vietbank (VBB, -38%), Bac A Bank (BAB, -33%), and VieABank (VAB, -15%).

However, the highest CASA still belongs to the state-owned group with Vietcombank (VCB, VND 529,738 billion, +15%), VietinBank (CTG, VND 383,112 billion, +23%), and BIDV (VND 380,294 billion, +14%).

MB (MBB) continues to lead the private group (VND 271,580 billion, +26%), followed by Techcombank (TCB, VND 191,720 billion, +11%) and ACB (VND 118,184 billion, +14%).

|

CASA at banks as of December 31, 2024

Source: VietstockFinance

|

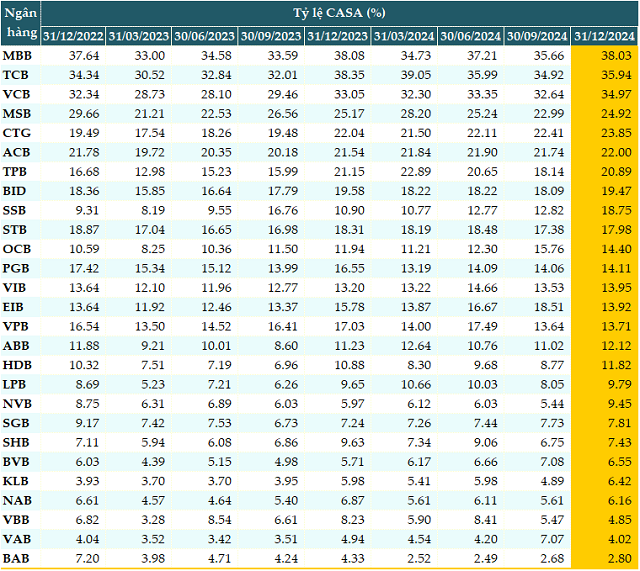

Improved CASA ratio: idle money or unattractive market?

As of the end of Q4/2024, 14/27 banks had a lower CASA ratio compared to the beginning of the year; but compared to the end of Q3, 22 banks improved this ratio.

MBB leads the banking system in terms of CASA ratio, reaching 38.03%, although slightly lower than at the beginning of the year. This is followed by TCB with 35.94%, third is VCB (34.97%), and fourth is MSB (24.92%).

Explaining the growth in the CASA ratio, a representative of Techcombank said that breakthrough data-based solutions such as Auto Profit, the Loyalty Program (Techcombank Rewards), and new features for retailers have contributed to a 27% increase in non-term deposit balances (CASA) in 2024.

Meanwhile, a representative of MSB shared that the contribution ratio of CASA is relatively balanced between individual, SME, and large corporate segments in the bank’s total non-term deposits. Among them, the main segment contributed about VND 27,000 billion in CASA.

|

CASA ratio at banks improved by the end of 2024

Source: VietstockFinance

|

The CASA volume at banks increased by up to 16% compared to the beginning of the year, reflecting a huge amount of money “lying” in the financial system. This is a positive signal for bank liquidity, but at the same time, it also raises the question of why this money is not flowing into investments.

Last year, the financial market went through a volatile period. Traditional investment channels such as gold, real estate, corporate bonds, or securities, which used to be attractive destinations for idle money, faced many challenges.

In this context, idle money flowed into banks as a safe haven, waiting for clearer investment opportunities. Especially, many banks have launched attractive preferential policies for non-term deposits, creating an incentive to keep CASA money in a waiting state.

Where will the CASA money flow in 2025?

Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University assesses that the strong growth of CASA is not only a sign of defense. It is also an indicator of a new investment wave that is taking shape. In 2025, when the economy enters a stronger recovery phase, some investment channels can become destinations for this money.

The government is promoting policies to support social housing, creating great opportunities for real buyers. Social housing and affordable housing segments can be the first segments to attract money back.

If Vietnam is officially upgraded to an emerging market in 2025, foreign capital will return strongly, creating a big push for the stock market. This could be a golden time for CASA money to enter.

FDI enterprises continue to expand their investment in Vietnam, creating opportunities for startups and small businesses in the production and service sectors. CASA capital can flow into these potential business models.

The trend of shifting supply chains to Vietnam is opening up great opportunities for industrial real estate and logistics infrastructure. Industrial real estate will also be an attractive investment channel in 2025.

The tourism industry after the pandemic is regaining its growth momentum. Money can flow into accommodation, resort, and entertainment service business models…

In general, 2025 will be an important time to observe the shift of CASA capital. When clearer opportunities arise, CASA money will no longer “sleep” in banks but will flow into truly potential fields.

– 08:00 17/02/2025

The Impact of Soaring Interbank Interest Rates on Banks: A Critical Analysis

The VIS Rating assessment highlights the potential risks faced by small and medium-sized banks if the interbank interest rates remain elevated in the coming months. This could lead to a challenging liquidity situation for these financial institutions, warranting careful monitoring and strategic responses.

The Cash Flows Strongly into the Banks

According to the latest data released by the State Bank of Vietnam, resident deposits reached over VND 6,920 trillion by the end of August 2024, a 6% increase compared to the end of 2023. This significant growth showcases the thriving economy and the confidence of residents in the country’s financial system.

“Capital Conundrum: The Investment Enigma”

Investing is a hot topic right now, and for good reason. Young people are increasingly seeking financial freedom and looking for ways to grow their wealth beyond their regular income. However, investing can be a challenging endeavor if you don’t have a solid understanding of finance.