Rising raw material prices could challenge VNM

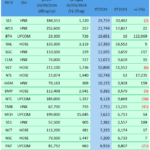

According to the SMP (Skim Milk Powder) price chart, we can see that the downward trend in the price of raw materials for producing skimmed milk powder, which started in March 2022, has ended and formed a bottom at the 2,240-2,360 USD/MT range, and is now entering a recovery trend.

However, the recovery trend is likely to stall in the coming period as SMP tests the 3,000-3,200 USD/MT range. This range coincides with the old peak in December 2019 and the old bottom that was broken in February 2021, so it is very solid.

The stagnation of SMP price growth means that production costs will not increase too much, as SMP is an important raw material in the production of VNM‘s dairy products. Looking back, we can see that SMP has had a significant impact on VNM‘s stock trends. VNM grew strongly in the 2013-2017 period, coinciding with SMP peaking and falling from 5,500 USD/MT to 1,680 USD/MT. Similarly, the long adjustment phase of VNM from 2018 to the present also coincides with SMP’s continuous upward trend.

SMP price chart for the period 2012-2025

(Unit: USD/MT)

Source: TradingView

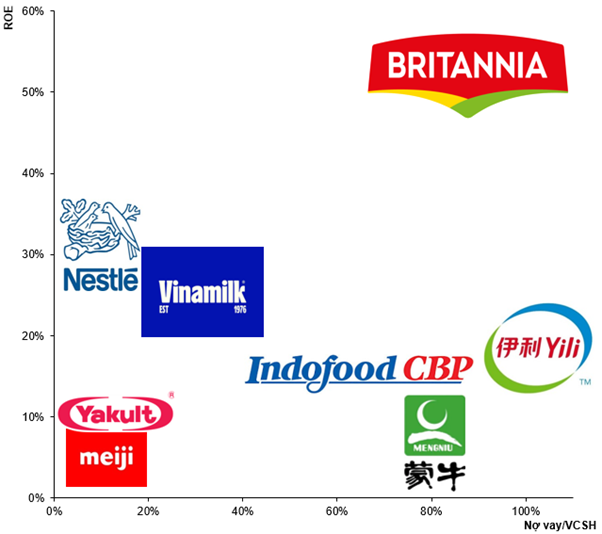

VNM belongs to the high-profit and safe capital structure group

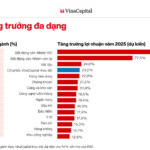

Compared to large competitors in the Asian region (China, India, Japan…), VNM maintains an ideal balance between profitability and financial risk control. We can easily identify the main groups as follows:

The first group has a safe capital structure but low profitability, typically Japanese companies such as Yakult Honsha Co Ltd and Meiji Holdings Co Ltd.

The second group has high profitability but also high financial leverage, with India’s Britannia Industries Ltd as a typical example.

With a ROE of 25.64% and Debt/Equity of 26.4%, VNM belongs to the high-profit and safe capital structure group. Considering these two criteria, only Nestle India Ltd in Asia outperforms VNM.

Leading enterprises in China and Indonesia, such as China Mengniu Dairy Co, Inner Mongolia Yili Industrial Group Co Ltd, and Indofood Cbp Sukses Makmur Tbk, all have high Debt/Equity ratios but not very impressive profitability.

Representative enterprises in the food and beverage industry in the Asian region

Source: Investing.com and VietstockFinance

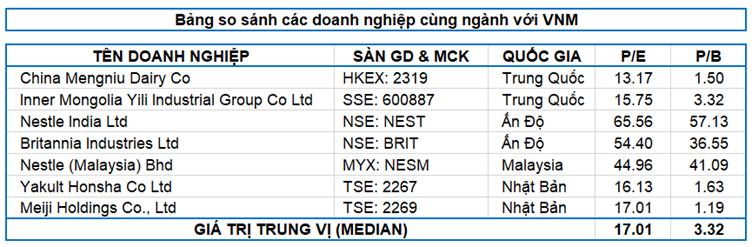

Stock Valuation

As VNM is the leading company in the dairy industry in Vietnam, there is no equivalent comparison with stocks traded on HOSE, HNX, and UPCoM. Therefore, using domestic stocks as a peer group to value VNM would not be reasonable and comprehensive.

The author uses enterprises in the same industry in Asia as a basis for determining the value of VNM‘s stock. The selected enterprises are mainly located in Asia, such as China, India, and Japan…

Source: Investing.com

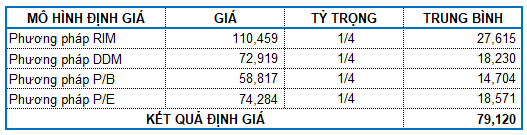

The author uses Market Multiple Models (P/E, P/B) in combination with the RIM (Residual Income Model) and DDM (Dividend Discount Model) methods, with equal weights. As a result, the fair value of VNM is determined to be 79,120 VND. Thus, the market price is still quite attractive for long-term investment purposes.

VNM – Is it time to buy? (Part 1)

Enterprise Analysis Division, Vietstock Consulting

– 12:00 21/02/2025

Who Will Claim the EPS Throne in Q3 2024?

Once again, the companies with the highest EPS for the first nine months of this year are the usual suspects—renowned for their history of attractive cash dividend payouts to shareholders. And perhaps it is this very reason that these companies’ stock prices are soaring high in the stock market.

The ROE Race: Q3 2024 Bank Rankings Unveiled. HDBank Maintains Lead as MB Closes in on ACB, with Techcombank Making a Strong Comeback.

In less than a year, the ROE rankings of commercial banks have witnessed significant fluctuations and divergences. Within the large bank cohort, HDBank retains its leading position, closely followed by MB and ACB, while Vietcombank, Techcombank, and VPBank are anticipated to demonstrate robust recoveries.