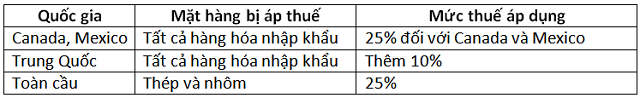

Escalating Trade Tensions

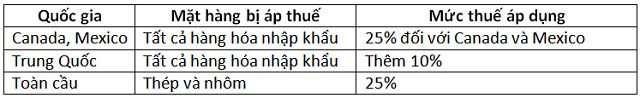

Since the beginning of 2025, the administration of US President Donald Trump has implemented a series of notable tariff policies on imported goods from multiple countries. These tariff policies reflect the Trump administration’s trade strategy, aiming to protect domestic economic interests and reduce trade deficits with international partners.

While tariffs on goods from Canada and Mexico were postponed until March after negotiations with their leaders, tariffs on Chinese goods have taken effect. China has stated that it will retaliate, escalating the trade war between the two countries.

Impact on the Stock Market

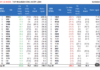

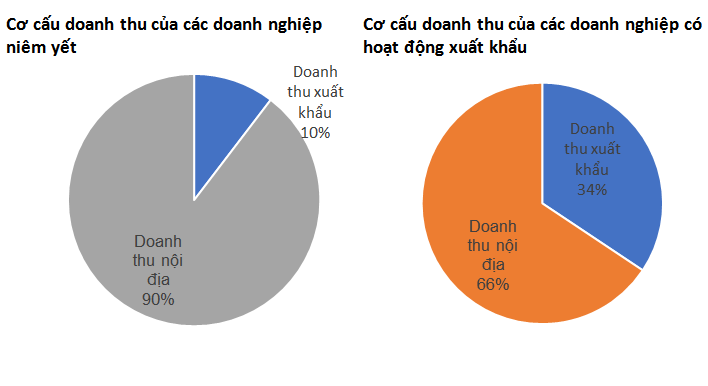

Although the Vietnamese economy relies heavily on exports, the impact of this move on the stock market is limited. Foreign-invested enterprises, which account for about 70% of export value, are mainly non-listed companies in the Vietnamese stock market.

There are 144 export-revenue-generating companies listed on the stock market, accounting for about 9% of listed companies (based on 3 indices). Their market capitalization comprises only 18% of the total market capitalization. International markets account for approximately 34% of their revenue, but only about 10% of the total revenue of all listed companies.

However, this 10% revenue comes from diverse markets such as the US, Japan, and Europe, not solely from the US market. Therefore, if we further dissect the data, revenue from the US market may account for only about 3-4% of the total market revenue. Hence, the impact of US tariff policies on these listed companies is not significant.

Additionally, the two sectors with the largest market capitalization are finance and real estate, which derive their revenue from the domestic market. As a result, the direct impact of tariff policies on the stock market might not be substantial.

It is worth noting that Vietnam is not currently among the top countries targeted by US tariff policies. Moreover, as the US and Vietnam share a Comprehensive Strategic Partnership, the imposition of tariffs may be delayed or set at a lower rate compared to China.

Indirect Impact on Exchange Rates

While the direct impact of US tariff policies on the market is limited, the trade tensions could have indirect effects, albeit challenging to quantify. These indirect effects will permeate through various channels to influence the market, either through income or exchange rates and interest rates.

Vietnam’s economy is heavily reliant on exports. When trade flourishes, and exports surge, workers’ income increases, prompting people to spend more. This boost in consumption stimulates the growth of businesses. Additionally, many companies that do not directly generate export revenue provide auxiliary products and services for export activities, creating numerous job opportunities.

Another way these policies can affect the market is through exchange rates and interest rates. At present, as the US enacts tariff policies on other countries, the US dollar tends to appreciate against other currencies, including the VND. To prevent capital outflows back to developed markets, the State Bank will need to maintain interest rates at attractive levels or refrain from reducing them to support the economy. This will indirectly impact the production activities of listed companies. Moreover, maintaining a high exchange rate also negatively affects investor sentiment, leading to a pessimistic outlook for the stock market and triggering sell-offs.

The banking and real estate sectors, which currently hold the largest market capitalization, accounting for over 50% of the total, are sensitive to fluctuations in exchange rates and interest rates. Thus, the dynamics of these factors are the primary influencers of the market’s future trajectory.

– 12:00 21/02/2025

Unlocking Growth: Vietnam-Guangxi (China) Trade Partnership

With a mutual goal of expanding their scope and presence, the two sides aim to gradually balance the trade scales between Vietnam and China. This comes at a time when global commerce is facing pressures from mounting trade tensions between major world economies.

The Packaging Industry’s Green Evolution: Tackling the Plastic Waste Challenge

The Vietnamese packaging industry faces sustainability challenges due to rising plastic consumption, which is projected to surpass 11 million tons by 2025. To address this issue, businesses must proactively transform their operations by embracing eco-friendly solutions, reducing emissions, and promoting a circular economy.

The Oracle of Omaha: Unlocking Secrets to Success in Warren Buffett’s Letter to Shareholders

The legendary investor, Warren Buffett, has once again shared his insightful perspectives on a range of topics in his highly anticipated annual letter. From the US fiscal situation, advice for the Trump administration, to his proud 60-year journey at Berkshire Hathaway, Buffett offers a wealth of wisdom and experience in his latest correspondence.