**EVNFinance Reports Impressive Financial Results with a Focus on Sustainable Growth**

|

On January 20, 2025, EVNFinance released its self-prepared financial statements for the fourth quarter of 2024, reporting a remarkable doubling of net interest income year-over-year to 1,444 billion VND. The company’s cumulative pre-tax profit for 2024 reached 703.7 billion VND. If the audited results remain unchanged, EVNFinance’s total pre-tax profit for 2024 will exceed the target set by the 2024 Annual General Meeting by 20% (585 billion VND) and represent a significant 72% increase compared to 2023.

According to EVNFinance’s leadership, the company has just completed its audit and is expected to publish its audited financial statements by the end of February 2025. EVNFinance has demonstrated efficient performance, achieving the highest net interest income and pre-tax/post-tax profit in its 16-year history since its establishment.

EVNFinance’s management shared that the company has adhered to the permitted credit growth rate granted by the State Bank for its business operations. Additionally, the loan portfolio as of December 31, 2024, compared to 2023 and the first six months of 2024, exhibits a diversified range of industries and loan types. Notably, there has been a reduction in loans to the real estate and construction sectors, with a shift towards lending to enterprises in the fields of trade, wholesale, and retail; smart green transportation; and green energy, including renewable energy sources. This shift aligns with EVNFinance’s strategy, approved by the 2024 Annual General Meeting, to integrate sustainable development factors into its business operations.

In response to market trends, EVNFinance’s leadership has been proactive in strategizing and taking timely actions to steer the company’s business operations. These strategic adjustments have yielded positive results for EVNFinance as of the end of 2024. The company has focused on developing loan products that cater to the diverse needs of its customers and has been committed to creating digital financial products targeting SME clients, in line with its vision to become a comprehensive financial company.

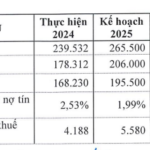

Looking ahead to 2025, EVNFinance is crafting ambitious business plans to boost revenue and profit growth, which will be presented at the upcoming 2025 Annual General Meeting. With a suitable business strategy, the addition of two new branches in Hanoi and Haiphong, and the absence of credit growth restrictions from the State Bank for 2025, EVNFinance is poised to dynamically manage its traditional and consumer lending activities. The company aims to maintain the safety of financial ratios while keeping the non-performing loan ratio below 1%.

With these new business plans in motion, EVNFinance is confident that the EVF stock will witness growth and become an attractive investment prospect.

– 15:22 26/02/2025

The Secret Behind Eximbank’s Record Pre-Tax Profit of Over VND 4,000 Billion

“With a strategic focus on diversifying its revenue streams and financial services offerings, Eximbank has carefully structured its lending portfolio to prioritize safety and efficiency. This approach has been instrumental in driving impressive business results for the bank, setting it on a path towards a remarkable year in 2024.”

“Eximbank Aims High: Targeting a 33% Surge in Profit for 2025”

On February 17, 2025, the Board of Directors of the Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) approved the proposal of the Acting General Director regarding the 2025 business plan for submission to the Annual General Meeting for approval.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.