## PV GasD Wins Legal Battle Against Pomina Steel, but the Steelmaker’s Troubles Persist

In a ruling dated February 4, 2025, the court upheld an agreement between the two parties, requiring Pomina Steel to pay over VND 15 billion to PV GasD. The deadline for payment was set as April 30, 2025, with interest accruing on any late payments.

Pomina Steel was also ordered to pay VND 61.5 million in first-instance court fees, while PV GasD will be reimbursed for their advanced court fees. The dispute was first heard by the court on November 27, 2024, and went through a mediation process before the agreement was reached on January 23, 2025.

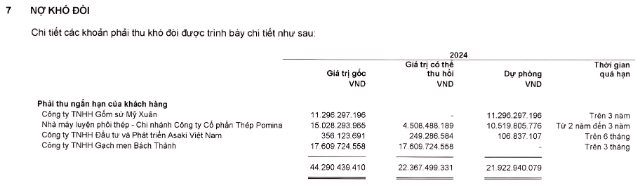

As of late 2024, PV GasD was still accounting for a difficult-to-collect debt of over VND 15 billion from Pomina Steel’s billet plant, with overdue periods ranging from 2 to 3 years.

Pomina Steel has yet to release its financial statements for the fourth quarter of 2024, but their business performance remains bleak. The company has incurred continuous losses from the second quarter of 2022 to the third quarter of 2024, with cumulative losses exceeding VND 2,300 billion. Revenue in the last two years has only reached a few hundred billion dong per quarter, a sharp decline from the previous thousand-billion-dong figures.

The idle steel plants in Di An and Ba Ria-Vung Tau continue to incur interest expenses, further exacerbating the steelmaker’s losses. Pomina Steel is currently seeking investors for restructuring and resuming production.

Pomina Steel’s Spiraling Losses: No End in Sight

Source: PV GasD

|

PV GasD also has outstanding receivables from other companies, including My Xuan Ceramic and Porcelain Co., Ltd. (VND 11.3 billion), Bach Thanh Enamel Brick Joint Stock Company (VND 17.6 billion), and Asaki Vietnam Investment and Development Co., Ltd. (VND 356 million).

On February 10, 2025, PV GasD’s Low-Pressure Gas Distribution Enterprise (XNMB) received a court ruling from the People’s Court of Tien Hai District, Thai Binh Province, ordering Asaki Vietnam to pay over VND 256 million in outstanding gas charges.

– 10:28 25/02/2025

The Rising Cost of Electricity: A Strain on Household Budgets

The soaring electricity prices are impacting not just the manufacturing industry, but also small businesses, cafes, and households alike.

The Ever-Growing Debt Burden of Real Estate Enterprises

As of mid-2024, many real estate businesses, despite their substantial assets, continue to struggle with mounting debts. The burden of increasing loan balances weighs heavily on these companies, presenting a challenging landscape for the industry.