The company announced that it will invest from the time the bonds are issued until their maturity or early redemption. The bonds can be pledged at LPBank or an approved third party.

The investment will be entrusted to the Investment and Securities Business Division of the LPBS business unit to optimize capital efficiency.

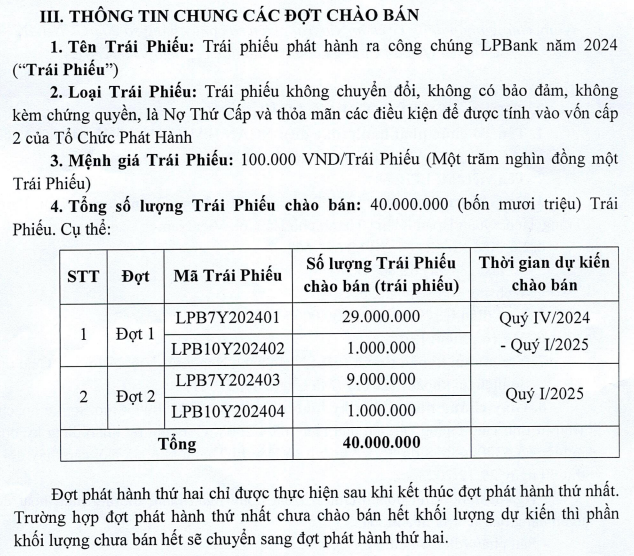

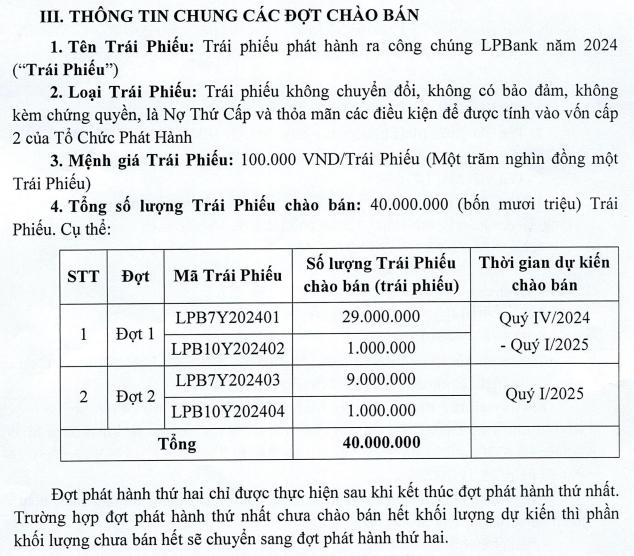

This is one of four bonds from LPBank’s public offering in 2024, totaling 40 million bonds with a value of VND 4,000 billion. The bond issues are divided into two phases, with Phase 1 including LPB7Y202401 and LPB10Y202402 offered in Q4 2024 – Q1 2025, and Phase 2 including LPB7Y202403 and LPB10Y202404 offered in Q1 2025.

All the bonds are non-convertible, unsecured, without warrants, and are subordinated debt that meets the conditions to be considered Tier 2 capital for LPB.

Of these, LPB7Y202401 has the largest volume with 29 million bonds, equivalent to VND 2,900 billion. The bond’s floating interest rate is determined by the reference rate plus a margin of 2.9% per annum. Notably, LPBS is also the issuing and registering agent, and registrar for this bond issue.

Source: LPBank’s Public Offering Announcement dated January 9, 2025

|

As of the end of 2024, LPBS’s asset size was nearly VND 5,100 billion, 18.4 times higher than at the beginning of the year, with significant increases in most items. Notably, new loan balances stood at nearly VND 2,700 billion; this was followed by an increase in cash and cash equivalents from over VND 44 billion to over VND 896 billion, mainly in bank deposits for securities company operations; the emergence of more than VND 612 billion in financial assets FVTPL, almost entirely in listed bonds; and new long-term investments of VND 500 billion in shares of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG).

LPBS’s business activities were strongly supported by an increase in equity capital from VND 250 billion to VND 3,888 billion through the offering of 363.8 million shares to existing shareholders at a price of VND 10,000 per share, which concluded on April 16, 2024.

Huy Khai

– 12:03 24/02/2025

“Danang’s Upcoming Land Auction for Project Development: Unlocking a 7.2 Trillion VND Opportunity”

Danang is set to auction two prime plots of land spanning 14 hectares. The first, a prestigious site in the Nại Hiên Đông ward of Sơn Trà district, boasts a prime location adjacent to the Han River. With a starting price of over 40 million VND per square meter, this parcel is earmarked for the development of a luxury hotel. The second plot, located in Cẩm Lệ district, has a more modest starting price of nearly 8 million VND per square meter. The total investment for these two projects is estimated at over 7.1 trillion VND.

The Industrial Real Estate Tycoons’ Vision: Crafting a 3,000-Hectare Legacy in Khanh Hoa

The Becamex-VSIP joint venture proposes to develop a 3,000-hectare project in Dien Khanh and Ninh Hoa, divided into three key zones: industrial, urban, and service. This ambitious undertaking aims to create a thriving, well-rounded community by offering a diverse range of opportunities and amenities.

The Province West of Ho Chi Minh City Continues to ‘Reap Rewards’ with Infrastructure Developments, Pushing Forward with 14 Major Transport Projects in 2025

The infrastructure developments and mega-projects in Long An are significantly reshaping the landscape of the province’s real estate market.