Source: Author’s Compilation

|

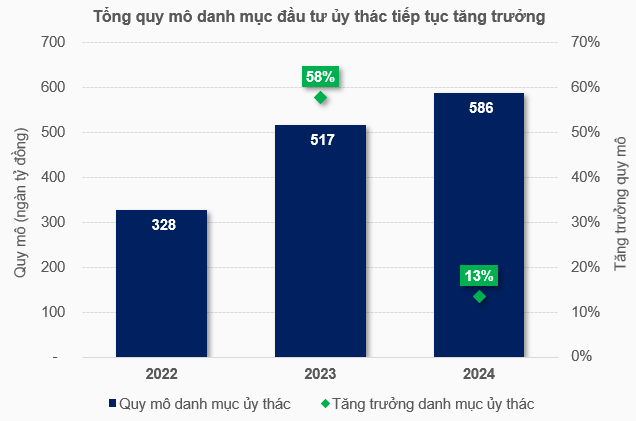

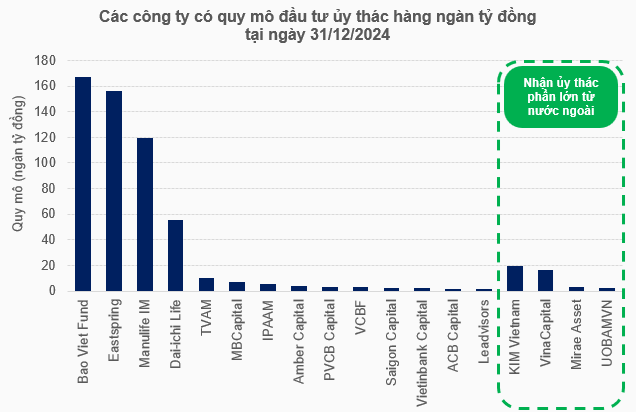

The Billion-Dollar Club Welcomes 18 Members

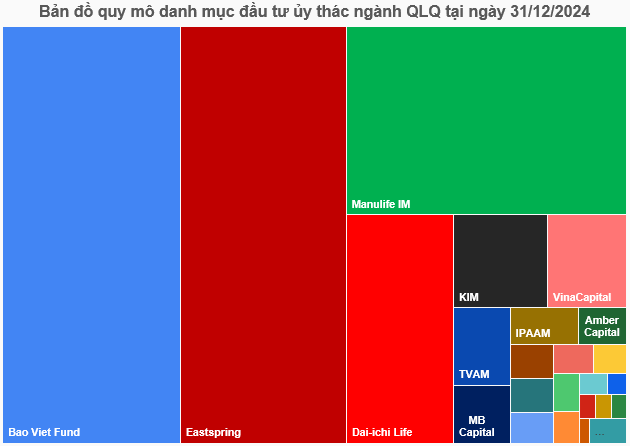

According to the investment trust scale map (as of the end of 2024), QLQ Bao Viet Fund tops the market in both the scale of entrusted investment portfolio (over VND 167 trillion) and the ratio of entrusted portfolio to total assets (777 times). Eastspring Investments ranked second with a scale of over VND 156 trillion and a ratio of 294 times. The common denominator of these two companies is the presence of industry giants in the insurance sector, with Bao Viet Fund backed by Bao Viet and Eastspring Investments by Prudential.

Additionally, two other companies in the industry boast significant trust scales thanks to a similar model: QLQ Dai-ichi Life Vietnam and QLQ Manulife Investment (Manulife IM).

Source: Author’s Compilation

|

A noticeable gap is evident between these four companies and the rest of the market. The market witnessed an additional 14 companies entrusted with thousands of billions of dong, including four companies with a majority of foreign capital: QLQ KIM Vietnam, VinaCapital, QLQ Mirae Asset (MAFMC), and QLQ UOB Asset Management (UOBAMVN). Since the beginning of the year, the “billion-dollar club” has gained two new members.

Source: Author’s Compilation

|

A Diverse Portfolio Landscape

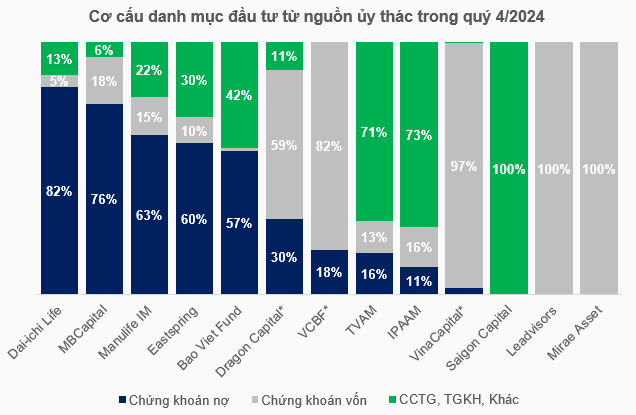

As analyzed, the trust activities are dominated by companies backed by large insurance groups. Consequently, the entrusted funds tend to be directed towards financial assets that offer safety, notably government bonds, which present lower risks than equity securities (stocks and fund certificates) while potentially yielding higher returns than bank deposits.

Statistics underscore this trend, as the asset flow of the four insurance-rooted trust companies significantly differs from the rest of the market. Dai-ichi Life allocates 82% of its entrusted assets to debt securities, followed by Manulife IM at 63%, Eastspring Investments at 60%, and Bao Viet Fund at 57%.

Similar cases include QLQ MB (MBCapital), which invests 76% in debt securities, 18% in equity securities, and 6% in deposit certificates and term deposits. Meanwhile, some trust companies prioritize equity investments, such as Dragon Capital at 59%, QLQ VCBF at 82%, VinaCapital at 97%, and Leadvisors Investments and Mirae Asset, which allocate 100% of entrusted assets to this category.

The market also observes trust companies seeking profits through investments in deposit certificates and term deposits, notably QLQ Thien Viet (TVAM), QLQ I.P.A (IPAAM), and QLQ Saigon (Saigon Capital).

*Data as of June 30, 2024 – Source: Author’s Compilation

|

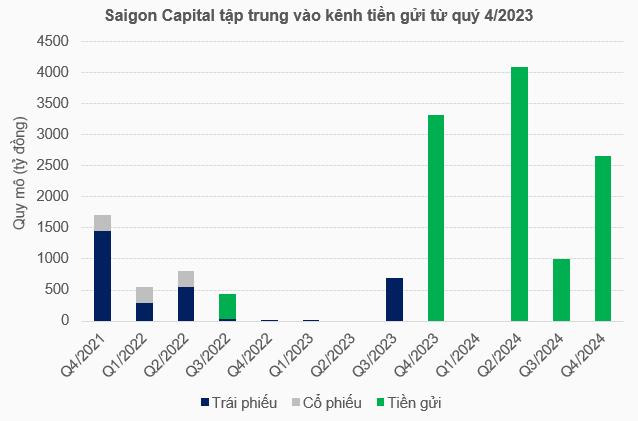

Saigon Capital, in particular, has a portfolio entirely comprised of deposits (term deposits and deposit certificates). This strategy was adopted by the company starting in Q4/2023, marking a shift from their previous focus on bonds and stocks. Saigon Capital’s entrusted portfolio scale has also been consistently dynamic, exhibiting substantial fluctuations from one quarter to the next.

Source: Author’s Compilation

|

A Key Strategy in Business

Overall, the substantial entrusted investments serve as a significant revenue stream for the trust companies, generating substantial management fees alongside related bonuses. In terms of structure, portfolio management revenue contributed approximately 47% of the industry’s total revenue in Q4/2023, the highest among all segments, despite a slight decline from 50% in Q4/2023.

Many companies rely heavily on this segment, with six firms having a revenue concentration of over 90%, four firms above 80%, and four firms above 70% in this area. Dai-ichi Life leads the industry with a concentration of 98.8%.

In Q4/2024, the industry’s portfolio management revenue reached nearly VND 452.3 billion, an increase of 8% compared to Q4/2023. Several companies witnessed robust growth in this segment, notably QLQ I.P.A (IPAAM) and QLQ Thanh Cong (TCAM)…

A Snapshot of the Fund Management Industry in Q4/2024: Who’s Leading the Pack?

– 12:00 25/02/2025

The Central Bank’s Aggressive Reduction of Funds Through Bill Channels

In the week following the Lunar New Year celebrations (03-10/02/2025), the State Bank of Vietnam (SBV) reduced the issuance of treasury bills while ramping up lending through the channel of pledging valuable papers.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.