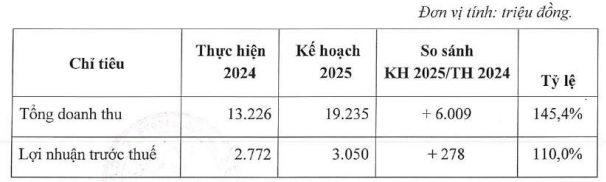

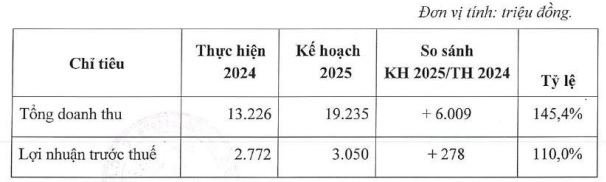

Specifically, BSC targets revenue of over 19 billion VND in 2025, a 45% increase from its 2024 performance. The company plans to achieve a pre-tax profit of more than 3 billion VND, a 10% rise.

|

BSC’s 2025 Plan

Source: BSC

|

This plan is set against a backdrop of declining 2024 results compared to the previous year. While revenue grew by 45% to over 11 billion VND, net profit fell by nearly 19% to around 2.2 billion VND. This was due to a decrease in financial activity revenue (lower interest rates and deposits), coupled with increased financial expenses attributed to provisioning for the Vinh Loc – Ben Thanh project.

| BSC’s Business Performance |

To meet its objectives, BSC intends to focus on optimizing the management of its occupied spaces and stalls in the markets. Additionally, the company will actively promote its range of services, including industrial cleaning, installation of solar power systems, operation and maintenance of solar panels, air conditioner maintenance, consulting, remodeling, construction, installation, and maintenance of surveillance camera systems.

Furthermore, BSC will continue its search for capable and experienced partners who align with the company’s vision. The company will also enhance its financial management, optimize cost structures, and utilize capital efficiently. Notably, BSC will extend support to the management of Vinh Loc Ben Thanh JSC to expedite the completion of the Vinh Loc Wedding Banquet and Conference Center project, aiming to commence business operations.

Regarding executive compensation, BSC proposes a total remuneration of 492 million VND/year for the members of the Board of Directors and the Supervisory Board. This includes 360 million VND/year for the Board of Directors, while the Supervisory Board will receive a slight increase to 132 million VND (up from 124 million VND in 2024). Currently, BSC’s leadership comprises 9 individuals, including 6 members on the Board of Directors (among them, Chairman Le Van Hung) and 3 members on the Supervisory Board.

For dividends, the company plans to pay out 10% for 2024, amounting to over 3.1 billion VND. A 5% dividend is projected for 2025.

Additionally, BSC intends to expand its business operations by adding two new lines: Packaging Services (excluding plant protection drugs) and Cargo Handling (excluding airport cargo).

The Annual General Meeting of Shareholders for 2025 is scheduled for 8:00 AM on March 21, 2025, at the Hoa Vien Tri Ky Restaurant on Hong Ha Street, Ward 9, Phu Nhuan District, Ho Chi Minh City.

BSC, formerly known as Ben Thanh Commercial Services Company, was established in 2003. The company’s primary areas of business include trading in household goods, food, timber, seafood, handicrafts; buying and selling machinery, equipment, spare parts, agricultural and industrial inputs, chemicals, construction materials; and providing transportation services.

Currently, BSC is part of the Benthanh Group ecosystem. Benthanh Group is the largest shareholder of BTT (Ben Thanh Trade and Service), which holds the rights to operate the Ben Thanh Market in Ho Chi Minh City.

Chau An

– 14:38 25/02/2025

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

The Companies Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The Ultimate Guide to Writing Compelling Copy for the Web: “Unveiling the Giant: How the Owner of Vietnam’s Largest Rare Earth Mine Reached New Heights with a Record-Breaking Profit, Surpassing Industry Giants”

The company’s net profit attributable to the parent company’s shareholders soared to VND 422 billion in Q4 2024, a staggering 9.5 times increase compared to the same period last year.