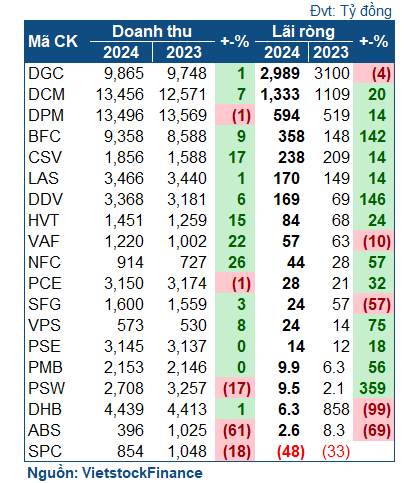

According to statistics from VietstockFinance, out of 19 enterprises in the chemical and fertilizer industry that announced their Q4 financial statements, 9 units reported profit growth, including 2 that turned losses into profits. The remaining 10 consisted of 7 companies with reduced profits and 3 that incurred losses.

|

Q4 business results of the fertilizer and chemical group

|

Two major fertilizer companies lag behind

Among the leading fertilizer enterprises, only BFC (Binh Dien Fertilizer) witnessed a significant profit increase, reaching VND 73 billion, double that of the same period last year. Together with the positive results from the previous quarters, BFC achieved a record profit in 2024 with VND 358 billion, 1.4 times higher than the previous year.

| Business situation of BFC |

Meanwhile, Ca Mau Fertilizer (HOSE: DCM) and Phu My Fertilizer (HOSE: DPM) both experienced declines in Q4. Specifically, DCM recorded a net profit of VND 282 billion, a decrease of 43%, while DPM‘s profit dropped to VND 36 billion, a 66% decline compared to the previous year.

DPM attributed the decrease in profit mainly to the significant drop in the selling prices of fertilizer products compared to the same period. This was likely a common issue for both companies, as DCM, despite achieving higher revenue, faced an even more substantial increase in cost of goods sold, resulting in a sharp decline in gross profit.

Nevertheless, the two major fertilizer companies performed well for the full year. On a cumulative 12-month basis, DCM earned a net profit of over VND 1,300 billion, a 20% increase, while DPM reached VND 594 billion, up by 14%. Both companies exceeded their after-tax profit targets for the year (by 17% and 13%, respectively).

In contrast, Duc Giang Chemical (HOSE: DGC) ended its eight-quarter streak of declining profits, earning VND 749 billion in net profit, a 4% increase. However, due to setbacks in the previous quarters, DGC‘s cumulative results for the year still showed a decline, with a net profit of nearly VND 3,000 billion, 4% lower than the previous year. Nonetheless, this was still a commendable outcome, as DGC nearly achieved its revenue target (97%) and surpassed its after-tax profit goal for 2024 approved by the Annual General Meeting of Shareholders. It is also worth noting that 2023 was the second-best year in terms of profit in the company’s operating history, and the 2024 results exceeded the pre-2022 period when DGC benefited from the global commodity boom.

| Duc Giang Chemical ends its streak of declining profits in Q4/2024 |

Divergence

The remaining enterprises in the industry displayed a notable divergence in performance. While some chemical companies shone, the fertilizer group, in general, showed signs of dullness.

In the chemical sector, HVT (Viet Tri Chemical) – a member of Vinachem – stood out with a net profit of VND 30 billion in Q4, double that of the same period. The main reason for this growth was the increase in selling prices of its main products compared to the previous year. The company reported that the selling prices of liquid caustic soda products rose by 8-25%, while those of chlorine-based products such as Javen, PAC liquid, and PAC powder increased by 15-34%. Additionally, the vigorous implementation of financial policies to reduce expenses also contributed to the profit increase.

Along with the outstanding performance in Q3, HVT‘s cumulative results for the year were impressive, with a net profit of VND 84 billion, a 24% increase.

| HVT‘s remarkable performance in Q3 and Q4/2024 |

CSV (Southern Basic Chemicals) continued its growth trajectory, achieving a net profit of VND 52 billion in Q4, an 8% increase over the same period. Similar to the other two members of the group, BFC and HVT, CSV‘s cumulative results were also relatively positive, with a net profit of VND 186 billion, a 16% increase.

Another Vinachem member, NFC (Ninh Binh Phosphate Fertilizer), saw a remarkable 91% surge in profit, reaching VND 11 billion. However, the primary driver of NFC‘s growth was the significant drop in financial expenses due to reduced interest expenses and financial lease costs. On a cumulative basis for the year, NFC earned a net profit of VND 44 billion, a 57% increase over the previous year.

In contrast, the fertilizer group’s performance in Q4 was generally lackluster. LAS witnessed a 69% drop in profit to VND 17 billion, mainly due to the shortage of raw materials (apatite ore) leading to increased purchase costs and, consequently, higher cost of goods sold. SFG (Southern Fertilizer) experienced a 63% decline in profit, amounting to VND 4.4 billion, mainly due to a more substantial increase in cost of goods sold compared to revenue growth.

DDV reported a slight decrease in profit of 6%, amounting to VND 59 billion. Meanwhile, Ha Bac Nitrogen Fertilizer (UPCoM: DHB) saw a 96% plunge in profit to VND 67 billion. However, the main reason for this decline was the exceptionally high profit in Q4 of the previous year due to the restructuring of a massive loan from the Vietnam Development Bank (VDB).

When considering the cumulative results, the picture varied among these enterprises. LAS recorded a 14% increase in profit to VND 170 billion, the highest in eight years. DDV earned a net profit of VND 169 billion, 2.6 times higher than the previous year. In contrast, SFG continued its downward trend, with a 57% decrease in profit to VND 24 billion.

As for DHB, the cumulative results were not impressive due to an unexpected loss in Q2. The company’s net profit for the year stood at only VND 6.3 billion, a 99% drop from the previous year.

|

Business results of the fertilizer and chemical group in 2024

|

Expectations for fertilizer price increases in 2025

According to SSI Research, the demand for cultivation is expected to increase slightly in 2025. Additionally, the La Nina cycle is predicted to bring higher rainfall, which could support agricultural activities and boost fertilizer demand.

The export policies of China and Russia, the leading producers of low-cost urea in the world, are forecasted to diverge in 2025. Their export policies will significantly impact the selling prices in other countries. In the first half of 2024, China restricted urea exports, causing urea prices in Vietnam to rise. Although China relaxed its export controls in the latter half, the volume of exports did not increase significantly. On the other hand, Russia extended the quota for nitrogen fertilizer exports (mainly urea) to 11.2 million tons for the period from December 2024 to May 2025 (compared to 9.8 million tons for December 2023 – May 2024). However, as Vietnam primarily imports urea from neighboring countries (China, Indonesia, and Brunei), this may not significantly affect urea prices in Vietnam.

Additionally, transportation costs are projected to increase, adding to the selling prices of fertilizers. Considering these factors, SSI believes that domestic urea prices will witness a slight increase in 2025.

Another factor to consider is the change in VAT policy for fertilizers, which will shift from “VAT exempt” to “5% VAT applicable,” effective from July 2025. In theory, this will lead to higher prices for farmers. However, domestic companies (such as DCM and DPM) have stated that they may opt to reduce selling prices before adding VAT to support farmers and alleviate competitive pressure.

Nonetheless, the critical aspect is that domestic fertilizers will become more competitive in pricing, thereby supporting consumption growth and benefiting local businesses.

– 19:00 25/02/2025

Unlocking Digital Growth: HDBank’s Investor Conference for a Profit Target of Over VND 20,000 Billion

On February 18, 2025, HDBank (HOSE: HDB), Ho Chi Minh City Development Joint Stock Commercial Bank successfully hosted an Investor Conference to present its 2024 business results and 2025 outlook.

The Forex Fluctuation Conundrum: How it Led to a 15% Profit Plunge for Petrolimex in Q4

Petrolimex (Vietnam National Petroleum Group, HOSE: PLX) experienced a significant decline in profits in Q4 due to volatile exchange rates. Despite this challenge, the Group achieved growth in its cumulative results, surpassing the plans approved by the 2024 General Meeting of Shareholders.