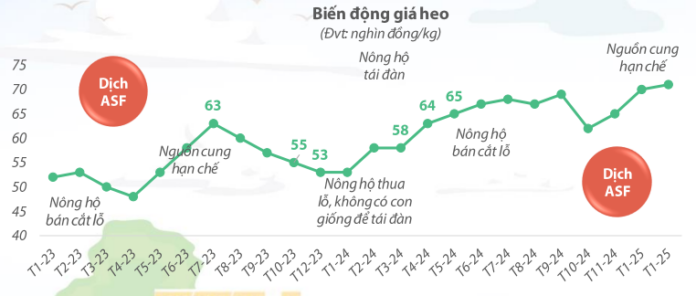

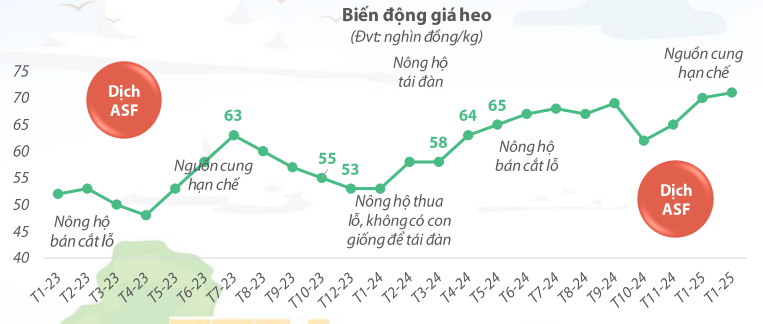

A preliminary overview of pork price movements in 2024 shows a significant surge from below 50,000 VND/kg at the beginning of the year to a peak of 68,200 VND/kg in mid-June. This upward trend subsequently plateaued, with prices dipping to just over 61,000 VND/kg in November before rebounding in December. In the final days of the year, pork prices rose daily, returning to the mid-year peak, with a staggering over 30% increase compared to the end of 2023.

Source: BAF

|

This dramatic price increase, coupled with a decrease in animal feed prices, contributed to substantial profits for businesses in the industry, with most companies experiencing multifold increases in profits.

Pork producers reap significant profits

|

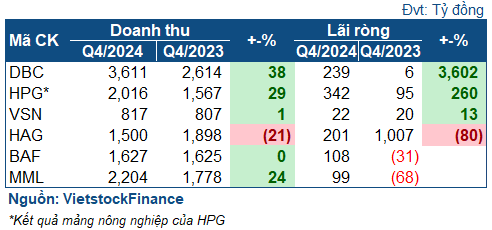

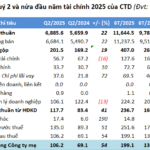

Q4 business results of pork producers

|

|

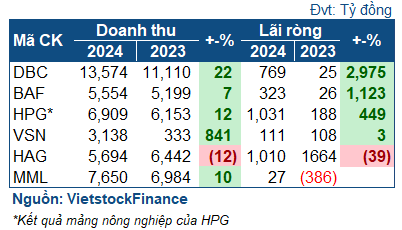

2024 business results of pork producers

|

Leading the pack in terms of growth was Dabaco (HOSE: DBC), with a net profit of 769 billion VND, nearly 31 times higher than the previous year. In Q4 alone, this leading producer earned 37 times more than the same period last year, amounting to 239 billion VND.

According to Dabaco, in Q4/2024, the prices of raw materials for domestic and imported animal feed remained stable, and animal diseases were under control. Additionally, farmers actively restocked their herds, leading to an increased demand for animal feed. However, this significant increase is also partly attributed to the low base effect from the same period last year.

| Business results of DBC |

The next notable performer was the vegetarian pork producer BAF, which recorded a record profit of 323 billion VND, 12 times higher than the previous year. While a significant contribution came from the sale of assets in Q1, Q4 also impressed with a turnaround from a loss of 31 billion VND to a profit of over 108 billion VND.

BAF’s profit surge can be attributed to increased sales volume and pork prices, along with their ability to source animal feed from their two vegetarian feed mills. The decrease in raw material prices for animal feed by 10-20% further bolstered their profits.

| Vegetarian pork producer achieves highest profit in history |

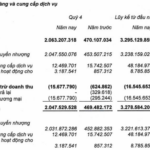

Hòa Phát (HOSE: HPG)’s agriculture segment also witnessed a multifold increase in profits, with over 1,000 billion VND in net profit for 2024, 12 times higher than the previous year. While the company did not provide detailed sales figures for each segment (as HPG produces both chicken eggs and beef), they attributed the success in pork production to exceeding their target for market-ready hogs.

Vissan (HOSE: VSN) did not experience as significant a surge in profits, but still managed a slight 2% increase to 111 billion VND in the past year, with a 13% increase in Q4, amounting to 22 billion VND. This was primarily due to the development of sales programs and cost-cutting measures.

MML (Masan Meatlife) reversed two consecutive years of losses, posting a profit of 27 billion VND (compared to a loss of over 385 billion VND the previous year). This turnaround was mainly due to a profit of 99 billion VND in Q4 (compared to a loss of 68 billion VND in the same period last year) and a restructuring of their farm segment to focus on direct-to-consumer sales. The company reported a 15.4% increase in revenue from fresh and processed meat and a 7.3% decrease in revenue from the farm segment.

Swimming against the tide, HAG, owned by “Bầu Đức,” reported a sharp decline in net profit for 2024, down 39% to just over 1,000 billion VND. This was mainly due to a 79% plunge in profit in Q4, as there was no longer a reversal of financial expenses through interest waivers. Nonetheless, this marks the third consecutive year of HAG’s net profit surpassing 1,000 billion VND, reducing their accumulated loss to 426 billion VND.

| Business results of HAG |

However, it was the fruit segment that primarily drove HAG‘s strong performance. In Q4, fruit sales surged by 81%, reaching over 1,300 billion VND. Meanwhile, the pork farming segment continued to shrink, generating only 159 billion VND in revenue for the quarter, a 66% decrease from the previous year.

Pork prices are expected to continue their upward trajectory in the first two quarters of the year.

The main factors contributing to the significant price increases in the past year include a downturn in the economy, which reduced overall demand, and the complex nature of the ASF (African Swine Fever) disease, which led to panic selling by farmers. Additionally, during a recent event, BAF‘s Vice President, Ngo Cao Cuong, attributed the price hikes to the devastation caused by Typhoon Yagi on pig farms, the implementation of the new Livestock Law from January 1, 2025, and the outbreak of foot-and-mouth disease in late 2024, which forced small-scale farmers to sell their pigs, impacting the supply.

Notably, ASF continues to ravage Vietnam, with new variants emerging. The country recorded nearly 1,600 new outbreaks, a 79% increase compared to the same period last year across 48 provinces and a staggering 2.5 times increase in 20 provinces. In recent times, even large pig farms have reported cases of (or suspected) ASF infections. According to BAF’s representative, this situation is likely to impact pork supply and drive up prices further.

Looking ahead, BAF’s representative anticipates that the impact of diseases and the new Livestock Law will continue to limit pork supply. Prices are expected to rise after the Tet holiday, approaching 73,000 VND/kg due to scarce supply. In Southern Vietnam, where there is an influence of smuggled pork from Cambodia, prices are even higher than in the North.

“This indicates a permanent scarcity, rather than a temporary one. Therefore, pork prices are expected to continue rising in the coming period” – quoted Ngo Cao Cuong. He predicts that the average pork price for the year will hover around 70,000 VND/kg, and the supply shortage in the first two quarters may push prices even higher.

– 10:00 24/02/2025

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.