Name Change to OCBS, Headquarters Relocation to Ho Chi Minh City

According to the published board meeting documents, the VISecurities Board of Directors will propose to the Annual General Meeting of Shareholders to approve changes to the company’s name, branches, and head office location.

If approved, the company will adopt the new name OCBS Securities Joint Stock Company, abbreviated as OCBS. The head office address will also be relocated from the North to the South, specifically from the 3rd floor, 59 Quang Trung, Nguyen Du Ward, Hai Ba Trung District, Hanoi to the 26th floor, The HallMark Building, 15 Tran Bach Dang Street, Thu Thiem Ward, Thu Duc City, Ho Chi Minh City.

On the other hand, the branch office will move from the South to the North, specifically from the 2nd floor, 194 Nguyen Cong Tru Street, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City to the 8th floor, 265 Cau Giay Street, Dich Vong Ward, Cau Giay District, Hanoi. Accordingly, the name will also change to OCBS Securities Joint Stock Company – Hanoi Branch.

Highest Expected Financial Results in 16 Years

Looking ahead to 2025, VISecurities forecasts that the Vietnamese stock market will continue its positive growth trajectory, with high expectations for breakthroughs in both scale and quality. One of the important goals for 2025 is to upgrade the market from a Frontier to an Emerging Market, thereby attracting foreign capital and enhancing the country’s financial stature.

However, the market still faces risks from global economic fluctuations and changes in the monetary policies of major economies, especially the United States.

According to the company, with a stable policy foundation and market reforms, the outlook for the Vietnamese stock market in 2025 is favorable, promising to bring numerous opportunities for investors in the context of deep economic transformation and international integration.

For its part, the company assesses 2025 as a pivotal year marking a transformation with the following key tasks: (1) increasing capital; (2) developing a strategy to become a leading investment banking model securities company in Vietnam; (3) changing the company’s name and brand identity, positioning and establishing the brand of an investment banking model securities company; and (4) formulating appropriate policies and products.

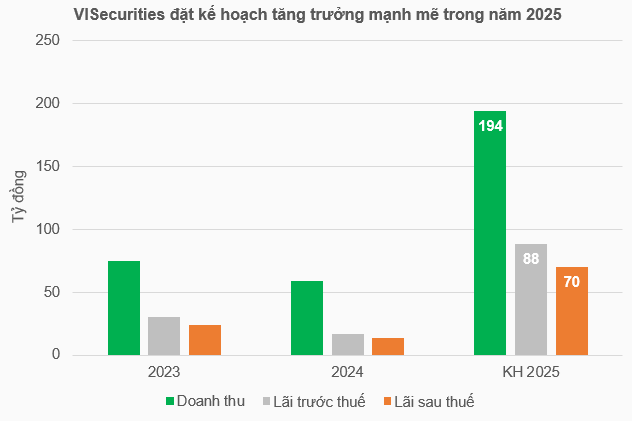

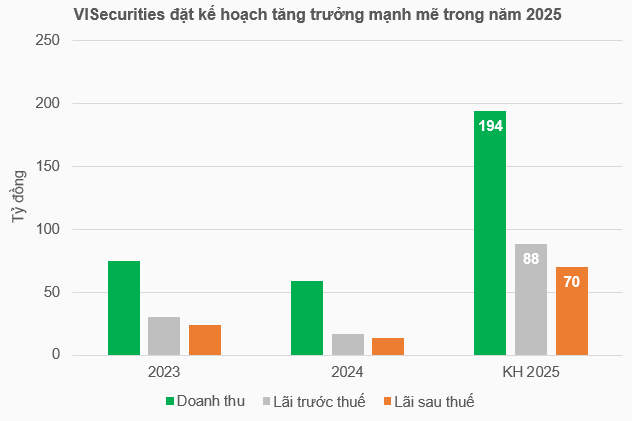

VISecurities sets ambitious business targets for 2025, with a revenue goal of VND 194 billion, 3.3 times higher than the 2024 performance. Of this, revenue from securities services contributes the most with VND 88 billion, followed by investment banking at VND 56 billion and investment and capital trading at VND 50 billion.

Finally, the company expects to achieve VND 88 billion in pre-tax profit and VND 70 billion in after-tax profit, more than five times the 2024 figures.

According to VietstockFinance, the figures set by the company are very high compared to historical performance, second only to 2009, which saw VND 203 billion in revenue and VND 97 billion in pre-tax and after-tax profits.

Source: VietstockFinance

|

Back to the Capital Increase Plan

In 2024, VISecurities implemented a plan to increase its charter capital to VND 600 billion. However, the company stated that due to unfavorable market conditions and changes in capital needs, the Board of Directors proposes to the Annual General Meeting of Shareholders to approve the discontinuation of this offering and the adoption of a new capital increase plan.

Under the new plan, the company intends to issue a maximum of 90 million shares (a 1:3 ratio) to increase its capital to VND 1,200 billion. With the expected proceeds of VND 900 billion, the company plans to allocate VND 475 billion to supplement capital for margin lending and pre-sale cash lending activities, VND 400 billion for investment and securities proprietary trading activities, and VND 25 billion for investing in office assets (head office, branches), developing infrastructure and technology services (hardware and software purchases, and other costs to implement and operate the entire technology activities).

Additionally, at the upcoming 2025 Annual General Meeting of Shareholders, the Board of Directors will also propose the approval of several other important matters, such as increasing the number of legal representatives from 1 (the Chairman) to 2 (the Chairman and the General Director), and electing an additional member to the Board of Directors and the Supervisory Board for the term 2024 – 2029.

– 15:13 24/02/2025

The Cash-Rich Warren Buffett: Unraveling the Oracle’s Latest Moves

The Oracle of Omaha’s recent silence on his defensive strategy has only added to the intrigue surrounding the investment legend.

A Nuanced Look at Tariff Policies and Their Market Impact

The US trade policies and their tariffs could have a significant impact on global commerce. This move will undoubtedly affect Vietnam’s exports, a key driver of its economy. While the stock market may experience indirect and limited effects, it is not a primary driver of market trends and thus will not be significantly influenced.

Unlocking Project and Land Conundrums: A Post-Inspection Conclusion for Three Provinces

The resolution proposes special mechanisms and policies to address challenges and obstacles faced by projects and land issues in inspection and audit conclusions, as well as court rulings in Ho Chi Minh City, Da Nang, and Khanh Hoa Province.

The Oracle of Omaha: Unlocking Secrets to Success in Warren Buffett’s Letter to Shareholders

The legendary investor, Warren Buffett, has once again shared his insightful perspectives on a range of topics in his highly anticipated annual letter. From the US fiscal situation, advice for the Trump administration, to his proud 60-year journey at Berkshire Hathaway, Buffett offers a wealth of wisdom and experience in his latest correspondence.