I. MARKET ANALYSIS OF THE STOCK MARKET FOR BASIC DAY 02/27/2025

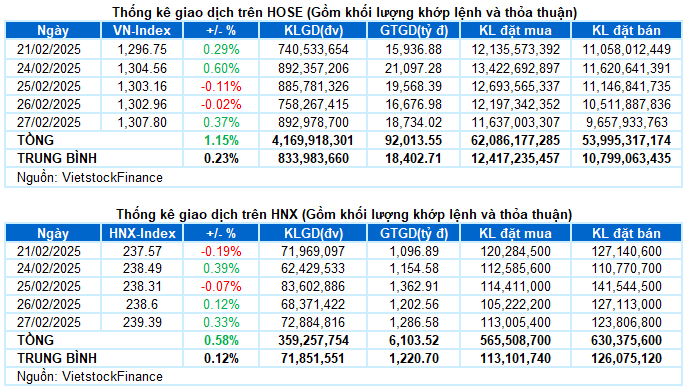

– The main indices increased in the trading session on February 27. VN-Index closed up 0.37%, to 1,307.8 points; HNX-Index increased by 0.33%, reaching 239.39 points.

– Matching volume on HOSE reached more than 846 million units, up 19.1% compared to the previous session; matching volume on HNX floor reached more than 70 million units, up 9.1%.

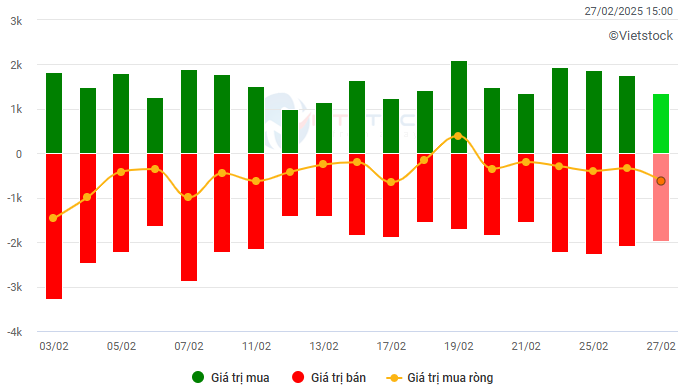

– Foreigners pushed up selling pressure on the HOSE floor with a value of nearly VND 600 billion and net sold nearly VND 18 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market fluctuated quite strongly in the trading session on February 27. VN-Index started with a positive green color thanks to the outstanding performance of a few pillar stocks in the early session, but selling pressure quickly increased in the remaining period, causing the index to weaken. The decline expanded significantly when the VN-Index lost more than 6 points at times, facing the risk of deeper correction in the early afternoon session. But from here, a strong demand suddenly returned and triggered an impressive reversal. If calculated from the lowest level in today’s session, the VN-Index recovered more than 11 points, closing at 1,307.8 points, up 0.37% compared to the previous session.

– The biggest contributors to today’s increase were VCB and HPG, which respectively brought in 2.3 and 1.1 points for the VN-Index. Meanwhile, VNM and BID were the two typical names on the opposite side, taking away nearly 1 point from the common index.

– VN30-Index closed up 0.22%, reaching 1,363.62 points. The basket width was balanced with 14 codes increasing, 13 codes decreasing, and 3 codes standing at the reference price. The stocks of HPG, VCB and SSB led with an increase of more than 1%, while VNM decreased by 1.4% was the most notable minus point. The remaining stocks in the basket fluctuated slightly around the reference price.

In terms of sector indices, the materials sector broke out strongly thanks to the brilliant performance of steel stocks, including HPG (+2.52%), TVN (+4.35%), VGS (+5.92%), TIS (+3.03%), HSG and NKG hitting the ceiling price. In addition, a few mining stocks also made a notable comeback, such as KSV, HGM, MSR, GDA, KCB, BMC,…

The real estate group was also a bright spot at the end of the session when the green color spread widely, with many codes attracting large demand such as DXG (+3.91%), DIG (+2.58%), VHM (+0.86%), TCH (+3.52%), PDR (+3.13%), NVL (+2.02%), CEO (+2.07%), NLG (+1.06%) and HDC (+2.67%).

On the contrary, the telecommunications and information technology groups, after a brief recovery, returned to red in today’s session. Many large-cap stocks in the industry such as VGI, FOX, YEG, ELC, FPT and CMG corrected again.

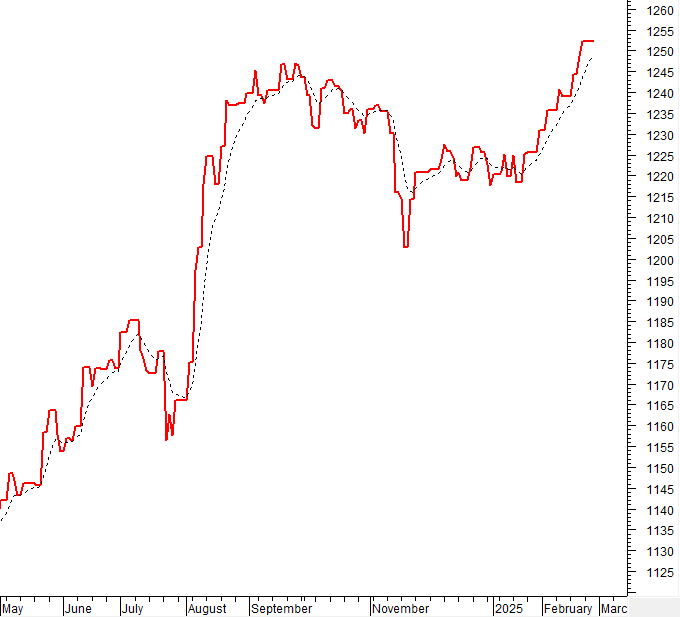

VN-Index returned to an increase with the appearance of a Hammer candlestick pattern. This reflects the optimism of investors in the context that the index has broken through the old peak of October 2024 (equivalent to the region of 1,290-1,305 points). If in the next sessions, the index continues to hold above this threshold along with the trading volume maintained at a high level, the uptrend will be consolidated. Currently, the MACD indicator continues to rise after giving a buy signal. If this state is maintained in the coming time, the short-term outlook will remain optimistic.

II. ANALYSIS OF TRENDS AND PRICE FLUCTUATIONS

VN-Index – Hammer candlestick pattern appears

VN-Index returned to an increase with the appearance of a Hammer candlestick pattern. This reflects the optimism of investors as the index has broken through the old peak of October 2024 (equivalent to the 1,290-1,305 point region). If in the next sessions, the index continues to hold above this threshold along with the trading volume maintained at a high level, the uptrend will be consolidated.

Currently, the MACD indicator continues to rise after giving a buy signal. If this state is maintained in the coming time, the short-term outlook will remain optimistic.

HNX-Index – Testing the old peak of August 2024

HNX-Index maintained its upward momentum with trading volume maintained above the 20-day average, indicating a positive shift in participating cash flow. In addition, the index is testing the old peak of August (equivalent to the region of 238-242 points). If in the near future, the index breaks out of this region, the situation will be even brighter.

Currently, the MACD indicator is maintaining a buy signal and is above the 0 threshold. If the indicator continues to hold above this threshold, the short-term outlook will remain optimistic.

Analysis of Cash Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index cuts above the EMA 20 day. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreigners continued to net sell in the trading session on February 27, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS ON 02/27/2025

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 16:58 02/27/2025

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

The Market Tug-of-War

The VN-Index declined, sustaining a tug-of-war stance as the High Wave Candle pattern emerged. This reflects investors’ cautious sentiment as the index retests the old peak from October 2024 (1,290-1,305 points territory). Unless the index breaks out of this range soon, a resumption of the downward trend is highly likely. Notably, the Stochastic Oscillator is venturing deep into overbought territory, suggesting a sell signal in the upcoming sessions. Should this materialize, the risks of a market correction intensify.

The Market Tug-of-War: Vietstock Weekly Analysis 03-07/03/2025

The VN-Index continued its impressive upward trajectory, closely hugging the upper band of the Bollinger Bands. Accompanying this rise was a trading volume above the 20-week average, indicative of strong participation and a healthy flow of capital into the market. However, the index’s persistent volatility last week revealed that the 1,300-point mark is a significant resistance level. For the VN-Index to sustain its bullish momentum, breaking through this threshold in the coming period is essential.